Trading titans diverge, as Jane Street’s prop push pays off

Nonbank trading firms have historically been bucketed together as high-frequency trading firms. But the industry has evolved since the “flash boys” era and nowhere is the divergence in business models greater than between the two goliaths of the industry, Citadel Securities and Jane Street. Recent results have also diverged.

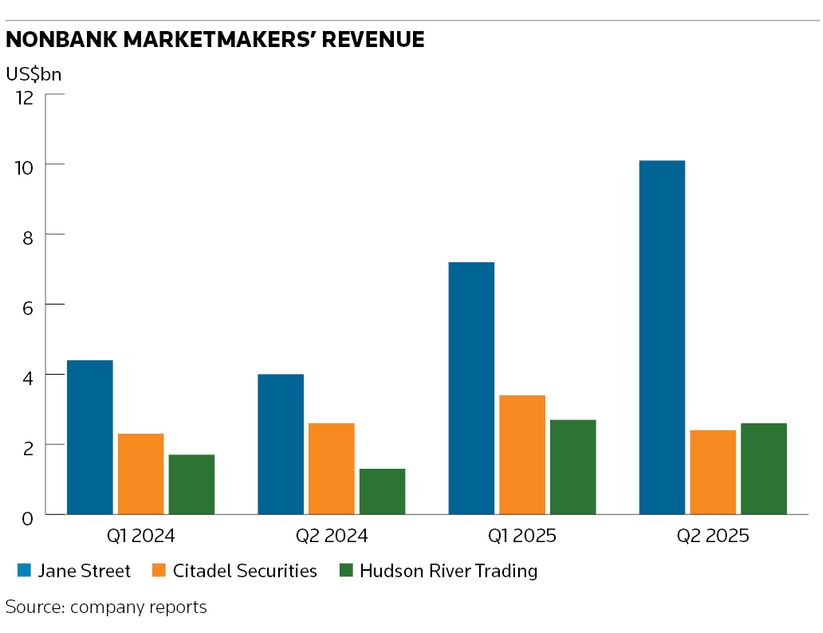

Earlier this week, second-quarter results were reported for Citadel Securities, Jane Street and another goliath of the industry, Hudson River Trading.

Jane Street’s Q2 revenues of US$10.1bn were up more than 150% year on year and 40% quarter on quarter. That put them as the top dog of Wall Street trading firms – even beating the Q2 revenues from the respective markets businesses of JP Morgan (US$8.9bn) and Goldman Sachs (US$7.8bn).

That was a sharp contrast with Citadel Securities' Q2 performance: it brought in revenues of US$2.4bn, a decline of 8% year on year and down 29% sequentially. This was much worse than the big five US investment banks (up 17% year on year and down 8% sequentially) and HRT, which generated Q2 revenues of US$2.6bn – up 103% year on year but down 4% sequentially.

It also contrasted with the first quarter when Jane Street, Citadel Securities and HRT saw respective year-on-year revenue growth of 64%, 47% and 65%, well ahead of the average of 16% for the big five US investment banks’ markets revenues.

The difference was even more stark when it came to Q2 profitability. Jane Street’s Q2 operating profit of US$6.9bn was almost three times the year-earlier period and more than 50% up on the previous quarter. In contrast, Citadel Securities’ profit halved quarter on quarter, while HRT was up only marginally.

Wide gulf

As they are private companies, with sparse financial disclosure, it is impossible to access the numbers that demonstrate exactly why the gulf between Jane Street and Citadel Securities was so wide the last quarter. But there are four main areas in which these two businesses are very different: technology, time horizons, trading strategies and proprietary bets.

Let’s start with technology. Both firms are famous for being full of genius maths geeks and also investing heavily in cutting-edge technology. But there is a subtle difference. At Jane Street, which is devoted to the OCaml programming language and has benefited from consistency and a unified development environment, technologists support the markets functions across trading, research and risk management. On the other hand, Citadel Securities is a technology-first company (as is HRT, which is led by techies).

Second is time horizons. The classic model of HFTs was latency arbitrage between different exchanges and trading venues. Citadel Securities has always had some focus on speed. Its core business is US equity retail wholesaling flow from online brokers, a market it dominates. It has diversified by becoming a liquidity provider to the buyside in fixed income and currencies through platforms such as Bloomberg.

In this latter role, it is increasingly willing to hold some positions and provide block-size liquidity (helped by an equity base of US$13.2bn at the end of Q2). But the core of its business model, given its focus on cash equities and listed equity options, remains ultra-short time horizons of milliseconds to seconds and being in the flow business rather than taking inventory risk.

Jane Street also has huge flow – it conducts around a 10th of all volumes in US stocks and listed stock options, as well as leading flows in ETFs – but for the firm overall, its time horizons are typically much longer, partly as a function of its core ETF markets where it seeks to capture mispricings that can last minutes or even hours. It has built up a formidable equity base that is many times larger than that of Citadel Securities.

In a similar vein, HRT says its average holding time for positions is five minutes and it held 25% of its positions overnight. A recent Business Insider article said HRT generated billions of dollars in profits from hedge fund-style trading strategies that require greater risk and longer holding periods than its original high-frequency trading business.

Interconnected to this is a third important factor: trading strategies. Citadel Securities is a classic electronic marketmaker looking to make money from the bid-ask spread in equity markets and other high-frequency markets like US Treasuries and foreign exchange. Jane Street’s roots lie in ETF arbitrage, and it has become a huge relative value trader across many asset classes.

The final significant differentiator is proprietary bets. As IFR said earlier this year (Trading firms ride prop and marketmaking to new heights), it is likely that out of the nonbanker marketmakers, Jane Street is more heavily skewed towards proprietary trading while Citadel Securities is the opposite.

There is a heated debate around whether Jane Street’s trading strategies in the Indian options market were a form of arbitrage or market manipulation (Jane Street says it was the former; Indian regulators allege the latter). Either way, the trading strategies were super aggressive (the firm was behind 25% of the volume in stocks for short bursts of trading), heavily directional and showing huge risk appetite for punting.

Directional bets

The second quarter saw volatility drop after the early April tariff turmoil while markets moved up strongly. And that gives us the likely explanation for Jane Street’s outperformance.

Just as Goldman does well in volatile markets and when hedge funds are booming, and Citigroup is dependent on its corporate treasury FX trading business, the leading nonbank marketmakers have different business models that perform differently in different conditions.

In Q2, Jane Street’s directional bets paid off and its greater reliance on proprietary trading proved decisive.

Rupak Ghose is a former financials research analyst