Third of Musk’s Tesla shares tied up in margin loans

About a third of Elon Musk’s stake in Tesla remains tied up in margin loans, regulatory filings show, underscoring how the world’s richest man continues to lean on his nearly US$250bn worth of shares in the electric carmaker as a source of cash.

Tesla’s latest proxy statement filed with the Securities and Exchange Commission showed Musk had pledged as collateral roughly 236m of the 715m Tesla shares he beneficially owns as of August 29 "to secure certain personal indebtedness”. That is slightly lower than the 238.4m shares the Tesla chief executive had pledged at the end of March 2024, according to the company’s previous proxy statement.

Tesla didn't respond to a request for comment.

Borrowing money secured against equity holdings is a common way for wealthy individuals to free up cash without selling down their stake in a company. Musk is perhaps the most prominent example of this method due to his public profile and openness to using margin loans as a source of funding.

In 2022, Musk agreed a record US$12.5bn margin loan backed by Tesla shares as part of a mammoth financing package to secure his takeover of social media company Twitter, now known as X. He later dropped those plans after persuading other investors to join him in stumping up cash for the acquisition.

Bloomberg reported later the same year that bankers were considering reviving the margin loan idea after struggling to sell the US$13bn in leveraged loans they had underwritten backing the acquisition to outside investors. Those plans didn't appear to gain traction, though, and banks were eventually able to offload the Twitter debt earlier this year.

Limiting loans

Nevertheless, Tesla’s board has taken action since that time to limit how much Musk and the company's directors can use Tesla shares as a piggybank for other activities. The board said in its 2023 proxy statement that it had amended its policy so that Tesla’s chief executive cannot borrow more than US$3.5bn against Tesla shares. Previously, the company had capped the size of margin loans for its chief executive at 25% of the total value of shares pledged – a policy that the board has maintained alongside the US$3.5bn cap.

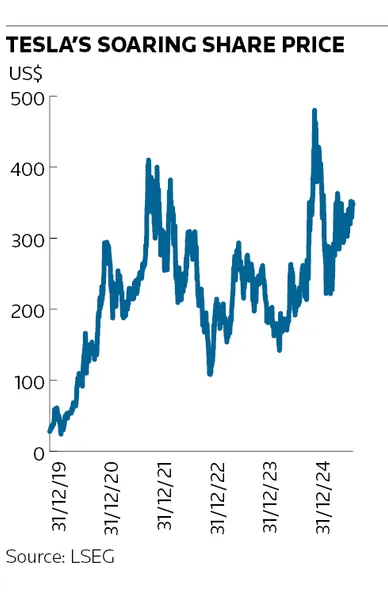

Tesla's soaring stock price combined with Musk's massive stake in the company meant the 25% cap alone would not have prevented him from taking out huge debt secured against his shares. Pledging all his Tesla shares as collateral, for instance, would have allowed Musk to borrow as much as US$62bn under the old policy based on the carmaker's current stock price.

In reality, the US$3.5bn limit means the terms on Musk’s margin loans should be extremely conservative. The 236m Tesla shares Musk has pledged as collateral are worth about US$82bn. Even if he is borrowing the full US$3.5bn that Tesla's policy allows, the loan is still worth only about 4% of his pledged shares – well below the loan-to-value ratio of 20% that bankers were set to impose on the cancelled Twitter margin loan in 2022.

Healthy cushion

That gives Musk’s banks an enormous cushion on the loans they’ve made. In turn, that cushion should soothe any concerns that a sudden slump in Tesla’s stock price could trigger margin calls for Musk – or that his borrowing arrangements could cause any wider fallout for Tesla shareholders.

Musk has used his Tesla shares in margin loans for several years. A December 2020 filing revealed Musk owed US$515m under various loan agreements with Morgan Stanley, Goldman Sachs and Bank of America. A mid-2021 filing showed Musk had pledged 36% of the 244m shares he owned at the time.

Elon’s brother Kimbal Musk, a Tesla director and board member, has also used margin loans. The company's latest filing shows Kimbal Musk had pledged all his roughly 1.5m Tesla shares as “collateral to secure certain personal indebtedness” as of August 29.

Tesla's board has also reduced the cap on the size of margin loans company directors can take from 25% to 15% of the total value of shares pledged, according to Tesla's 2023 proxy filing. Kimbal Musk's shares were worth about US$509m as of Wednesday's close, meaning he could borrow no more than US$76m against them at current market levels.