Turning tables: Morgan Stanley tops US IG leaderboard

Wall Street dealmakers could be forgiven for thinking they were reading some regrettable AI hallucination when, on October 30, they looked at the US high-grade corporate bond league table and saw Morgan Stanley at the top, not JP Morgan.

While the two midtown Manhattan-based financial institutions have a lot in common (including blood-related co-founders), JP Morgan, backed by its fortress balance sheet, is the one that is the perennial leader atop the most important US credit league tables.

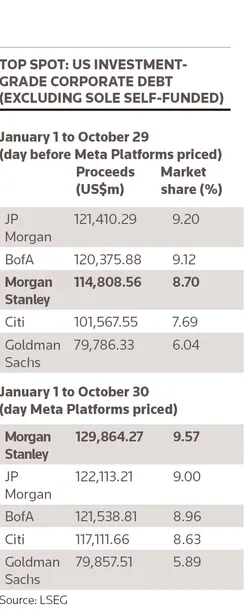

Yet in the space of about two weeks, Morgan Stanley climbed from fourth on the 2025 US Investment Grade Corporate Debt league table (excluding sole self-funded deals), with a 6.52% market share, to number one, with a 9.57% share, according to LSEG data. Over the same period, JP Morgan went from first (9.57%) to second (9%).

“You have to go back to before Glass-Steagall was repealed in 1999 to find a [US investment-grade bond] league table where Morgan Stanley was at the top,” said Teddy Hodgson, global co-head of investment-grade fixed income capital markets at Morgan Stanley.

While bankers often say they almost never look at league tables, at least a couple of smirking dealmakers at rivals of the two firms told IFR last week that Morgan Stanley's rapid ascent – above the House of Jamie Dimon, no less – was the talk of Wall Street.

Just as impressive is the fact that Morgan Stanley’s rise essentially comes from two very big and rather complex trades that earned it some US$42bn of league table credit.

On October 16, the firm was the sole lead on US$27bn of senior secured notes – the biggest single-tranche bond ever – for Blue Owl Capital, funding an AI infrastructure joint venture with Meta Platforms. That deal moved Morgan Stanley up one place to third on the year-to-date league table, behind JP Morgan and Bank of America.

Then, on October 30, Morgan Stanley and Citigroup equally shared league table credit on Meta’s US$30bn offering, the biggest corporate bond offering of the year and tied for fifth biggest of all time. The US$15bn from that deal put the bank at the top of the table, where it still stands as of November 6.

There are of course several weeks left in the calendar year. JP Morgan, which trails Morgan Stanley by about US$6bn as of Thursday, has time to close the gap.

That would restore some normality in what has been one of the busiest investment-grade bond markets on record. JP Morgan has been top of the high-grade table for all but two of the last 15 years, LSEG data show.