American exceptionalism and the IPO class of 2025

Animal spirits are back. Nowhere more so than in the US, the epicentre of the AI boom and where last week saw the successful US$7.2bn IPO of Medline.

Stock markets have seen a strong second-half performance, setting a positive backdrop for companies wanting to go public in 2026. But how did the US IPO market perform this year, and how could that impact this outlook?

There are certainly reasons to be positive about IPO activity in the US in 2026. Global M&A activity in dollar terms boomed in 2025 with the US accounting for half, illustrating the returning risk appetite of boardrooms and investors. Fundraising in the private markets in the US in 2025 has also been red hot.

The potential list of US IPOs in 2026 includes megacaps of a kind never seen before. Private companies are tightly held, and valuation rounds can include preferential rights such as anti-dilution terms, but no one can doubt the excitement around IPOs of the “fantastic five”: SpaceX, OpenAI, Anthropic, Databricks and Stripe.

SpaceX has ambitions to become the first company to IPO with a market capitalisation of more than US$1trn, while OpenAI and Anthropic have recently raised money at private valuations of US$500bn and US$350bn, respectively.

Will all make it to market in 2026? Almost certainly not. And some might not make it to market at all. More to the point, these companies are so industry-defining that the success of any IPO may have a limited halo effect on the broader IPO market.

Up or not?

Historically, when it comes to investor appetite for IPOs, the performance of recent deals has been more important than the level of stock markets. Did investors make money on new listings and, if so, on what types of IPOs? For example, public markets investors are often cautious about IPOs of private equity-backed firms, given some recent blow-ups post-IPO.

In that context, the medium-term performance of Medline will be crucial. Its IPO, the largest ever from a PE-backed company, raised US$7.2bn (after the 34.4m-share greenshoe was exercised) and still the shares ended the first day of trading up 41%.

But will they stay there or will they perform like the shares of Verisure? It listed on Nasdaq Stockholm in October in a €3.59bn deal that was the previous largest PE disposal via a listing.

Verisure stock closed up 20.8% on its debut – and then went even higher. However, its shares are currently just 4.6% above their IPO pricing. The stock fell at the end of November when the company’s third-quarter numbers suggested it was underdelivering relative to elevated expectations.

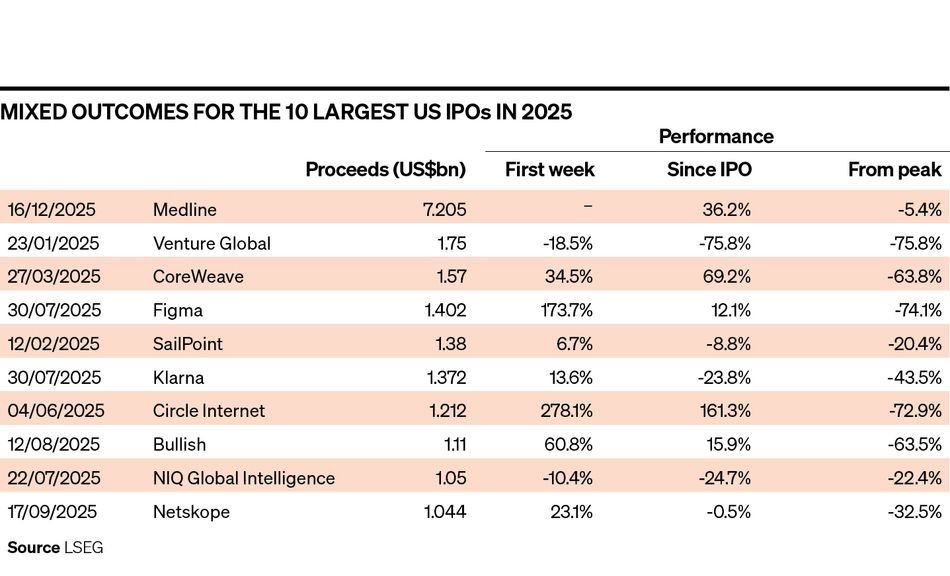

Indeed, the performance of the IPO class of 2025 is mixed. Before the Medline deal, the median share price of the top 10 US IPOs of 2025 was down 5% since IPO – and 44% from the peak. Too often, a first-day or first-week pop has been followed by share prices trending back down towards (and sometimes below) the IPO price.

Until the Medline deal, the largest US IPO of 2025 was energy upstart Venture Global's US$1.75bn listing. The brash management team sought an initial valuation of US$110bn but had to settle for US$60bn. Since then, the share price has declined by 75%, giving it a market capitalisation of less than US$15bn. Business disputes and accusations of misleading statements in IPO filings add a company-specific element.

Even the tech companies that made up the rest of the top 10 IPOs this year in the US (before Medline) have mostly struggled to tread water.

The best performer was AI data centre firm CoreWeave, which is still double its IPO price, despite halving from its high. Stablecoin firm Circle and design software maker Figma are also up from their IPO pricing even if they have spent the last six months giving up most of their huge post-IPO share price pop. Klarna, a fintech pushing its AI adoption story, listed in the US in September, and its share price has also drifted lower. Many other IPOs declined almost immediately.

Not much of this provides great marketing material to encourage companies to list (or investors to buy), especially when contrasted with the sharp increase in the Nasdaq Composite Index.

Cautionary tale

The reasons for these share price performances are timeless but a cautionary tale for IPO bankers salivating about the 2026 pipeline. Sky-high valuations come down quickly when financial results post-IPO are good, but not good enough. The supply-demand mechanics tend to override fundamentals when limited free-floats combine with a strong narrative and retail investor demand, but then unwind naturally over time, especially when the end of lockup periods allows more insider selling.

The aftermarket performance of the IPO class of 2025 suggests public market investors will once again want sizeable IPO discounts for future listings. Achieving a first-day share price pop is one thing. Sustaining the resulting valuation is another thing entirely.

Rupak Ghose is a corporate adviser and former financials research analyst. Read his Substack blog here.