No prop, no problem: bank trading revenues hit record high

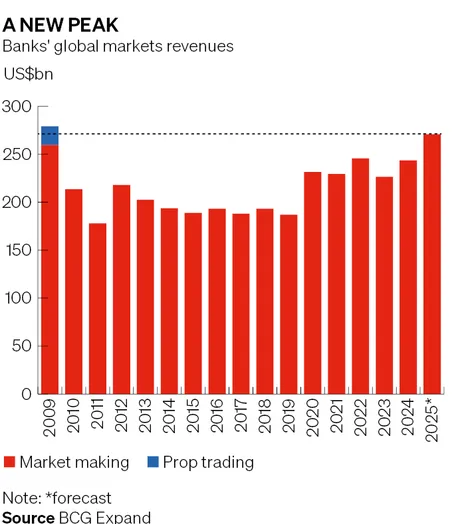

Global banks’ trading divisions will report their largest ever revenue haul in 2025, surpassing their previous 2009 record after stripping out proprietary trading activities that these firms have long since jettisoned.

Banks generated US$271bn of global markets revenues last year, according to forecasts from strategic benchmarking firm BCG Expand. That’s US$11bn above their 2009 total when looking at comparable client-focused, marketmaking revenues (which excludes banks’ now redundant prop trading units).

The milestone underlines how far trading divisions have come in recent years after struggling with mediocre returns in the low volatility era leading up to the outbreak of the pandemic in early 2020.

Markets units, alongside their colleagues in investment banking, have enjoyed a new lease on life since then as a deluge of trading and dealmaking activity has transformed them into the driving force behind rising profits across the banking industry.

“2025 was a tremendous year for global markets revenues in this new world where banks no longer engage in prop trading,” said Amrit Shahani, partner at BCG Expand. “Global markets and investment banking have shifted from weighing on banks’ returns in the decade from 2010 to 2019 to becoming a major driver of group profitability.”

More to come

Another strong batch of quarterly earnings from US investment banks have only served to reinforce this message. The big five US banks generated US$134bn of markets revenues between them last year, 16% above 2024’s already lofty levels.

JP Morgan, the largest bank in sales and trading, reported a record US$35.8bn revenue haul from its markets operation for 2025 and signalled there’s more to come. “We're going to grow that business,” said Jamie Dimon, the bank’s longstanding chief executive, on an earnings call. “We're quite good at it. It's critical to the capital markets of the world, and the capital markets of the world are going to grow dramatically over the next 20 years.”

Equities trading has been a particular area of strength, while derivatives desks continued to thrive in 2025’s uncertain environment. There was also growing demand for leverage from clients such as hedge funds, fuelling an expansion in banks’ prime brokerage units.

Goldman Sachs, the largest bank in equities trading, broke its own record set the previous year by growing revenues 23% to US$16.5bn – thanks in part to its best ever results in equities financing.

“We have a demonstrated ability to deliver strong results in a broad array of market environments,” David Solomon, Goldman’s chief executive, said on an earnings call. “This reflects the breadth and diversification of these businesses which have been bolstered by our share gains. We see even more opportunities to further strengthen our franchise.”

High watermark

Surpassing 2009’s high watermark in global markets represents a significant achievement for investment banks. For years that record seemed unassailable – a one-off trading bonanza that erupted as markets recovered from the great financial crisis and central banks unleashed unprecedented monetary stimulus.

It also proved the last hurrah for banks’ prop trading desks, which BCG Expand said raked in about US$20bn that year, before a US regulatory crackdown pushed these activities to other parts of the financial system.

Banks' trading businesses sputtered over the following decade as central bank stimulus turned into a headwind that sapped volatility from financial markets and depressed client volumes. That, combined with regulators’ post-crisis capital rules, proved deadly for markets revenues, prompting many banks to beat a retreat.

Relief eventually came from an unexpected source. The outbreak of Covid-19 in early 2020 lit a fire under global markets, triggering a wave of client activity. It also set in motion a series of events that rekindled an inflationary impulse that had been absent from Western economies for over a decade.

Banks’ trading desks have flourished ever since as volatility has returned. More recently, dealmaking activity has also picked up after investment banking fees hit their lowest level in over a decade in 2023. BCG Expand projects investment banking fees reached US$97bn in 2025, 37% higher than that recent low and their third best year on record.

This renaissance of the investment bank has given a meaningful shot in the arm to the returns of banks' broader operations. Goldman reported a 15% return on equity last year, up from 10% in 2019, driven by the performance of its global banking and markets division.

“The combination of growing revenues, a laser-like focus on costs, and capital optimisation have driven this comeback for investment banks in their trading and dealmaking activities,” said Shahani. “We expect them to continue to outperform over the next five years and provide a strong impetus for growth for broader banking group revenues globally.”

Bank executives share this optimism. Many point to a healthy deal pipeline, which should further stoke activity in banks' trading businesses.

"As a student of these businesses for decades ... I would bet you that 2021 is not the ceiling," said Solomon, referring to the record year for dealmaking fees. "The world is set up at the moment to be incredibly constructive in 2026 for M&A and capital markets activity."