Derivatives-based ETFs are Wall Street’s hottest investment

Banks and asset managers are seizing on the defining investment trend of the past decade – the rise of exchange-traded funds – to bring complex derivatives strategies to the masses.

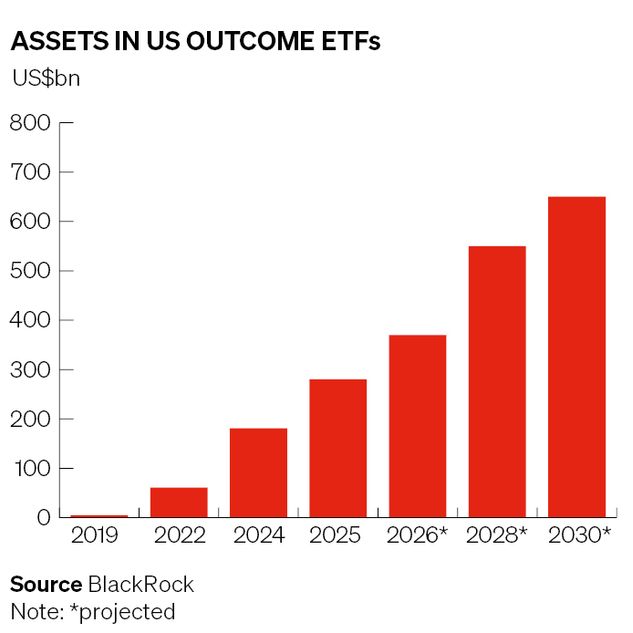

Assets in US "outcome" ETFs, which layer derivatives on top of well-known benchmarks like the S&P 500 to achieve a targeted return profile, have more than quadrupled since 2022 to US$280bn, according to BlackRock. Many believe this is just the beginning of a broader proliferation of derivatives-based ETFs, which BlackRock says are on track to swell to US$650bn in assets by 2030.

Finance veterans view ETFs as the ideal vehicle for providing the retail market with access to derivatives-linked investment strategies that were once the preserve of large institutions and high-net-worth individuals.

The prospect of unlocking a whole new audience for these products is stoking excitement among asset managers and banks as they jostle to position themselves as beneficiaries of this rapid expansion.

“There’s been unprecedented growth [in derivatives-based ETFs] and a massive shift from passive to more active and more complex strategies,” said Jessica Janowitz, head of US equity derivatives sales at Goldman Sachs. “This evolution is transforming how investors access various market segments and, quite frankly, how asset managers develop products.”

Active surge

Derivatives first came to prominence in the ETF world in passive index-tracking products. Their main uses were to provide exposure to hard-to-reach markets like Chinese equities, or to lower the cost of tracking more mainstream markets, like the US, compared with buying the underlying stocks directly.

The recent surge in derivatives-based products comes from a different source: active ETFs that provide investors with more tailored returns. This is part of a broader shift in the ETF ecosystem. The passive funds that fuelled the explosive growth of ETFs over the past decade are still the dominant force, but active products are gaining ground.

Assets in US active ETFs have quadrupled since 2022 to US$1.5trn, according to Morningstar Direct, following three years of record inflows. Nearly 1,000 US active ETFs were launched in 2025 – more than the number of passive ETF launches from the past six years combined. That heady growth means there are now more ETFs than single stocks in the US – and more than half use derivatives in some shape or form, analysts say.

Overall, it shows how ETFs are becoming a gateway for everyday investors to tap the kind of complex strategies that more sophisticated money managers have deployed for years, either to juice returns on their stock portfolios or to insulate themselves from downturns.

“The use of derivatives within ETFs has lots of precedents. What we’ve seen more recently is this very fast expansion in active ETFs that opens up the potential use cases for options and other derivatives within the ETF wrapper,” said Matt Legg, global head of ETF and delta one sales at JP Morgan.

“It's always been much more difficult for retail investors to access leverage, yield enhancement products or downside protection compared to institutional investors. We see a significant role for ETFs as a vehicle bringing these types of return streams to a broader suite of investors.”

Trading alignment

Many firms are intensifying their efforts in this space. In December, Goldman announced an agreement to acquire active ETF specialist Innovator Capital Management in a deal that will add US$28bn in assets to its asset management unit.

Janowitz said ETFs also align well with several of Goldman’s core markets businesses including risk intermediation, its flow and structured derivatives franchises, clearing services and balance-sheet provision. “ETFs broadly remain a strategic priority for Goldman Sachs,” she said.

Several breeds of derivatives-based ETFs have emerged. Income products have grown at the fastest clip, according to JP Morgan. These deploy well-known strategies such as selling call options to generate income in return for capping the upside of a stock portfolio.

“Buffer” products have proved popular too. These use options to provide some level of protection against a selloff in stock markets, which is usually paid for by capping an investor’s potential upside. ETFs offering leveraged exposure to popular stocks or benchmarks have also been a hit among retail investors eager to ramp up bets on technology companies and the AI craze.

“ETFs can bring strategies to clients that couldn’t access them before, either because they couldn’t trade derivatives or because it’s been too operationally complex for them to do so," said Laura Elliott, head of EMEA iShares product structuring and solutions at BlackRock.

“Clients love the simplicity and enhanced transparency of an ETF and we believe it can really bring a lot of cash off the sidelines [and into these markets]."

Call me

The latest frontier in derivatives-based ETFs involves copying a wildly popular product from the structured notes market: the autocallable. These notes became a staple of private banks and other retail investors during the ultra-low interest rate years of the 2010s. A typical autocallable delivers a chunky payout if a stock index reaches a certain level in a year’s time at which point it redeems – or autocalls.

The US structured notes market has quadrupled over the past decade to about US$200bn, Citigroup said citing structured product data provider SRP. Autocallables and issuer callable notes account for about two-thirds of that, showing the scale of demand.

“The market for autocallable ETFs is still small, but if you look at that demand for notes, as well as the amount of regulatory filings and client interest we're seeing, then there’s definitely huge growth to come,” said Sebastian Lutz, head of advisory solutions for financial intermediaries at Citigroup.

Thibaut Delahaye, global head of equity derivatives at UBS, said the Swiss bank plans to issue an ETF referencing an index of rolling autocallables in Europe in the second half of 2026 that will be distributed through its own wealth manager as well as external managers. It is also developing a US autocallable ETF in partnership with an external ETF issuer.

“Our main priority, where we believe we have an edge, is in developing autocallable ETFs and more sophisticated products. This is a market that didn’t really exist two years ago – it’s still quite recent and burgeoning,” said Delahaye.

Only upside?

So far at least, bankers and asset managers only see upside in this marriage between ETFs and derivatives. Rather than cannibalising banks’ structured notes businesses, Delahaye said it should “grow the overall pie” by broadening the client base of these products.

From a trading perspective, ETF flows are a good addition to the wider market, according to Travis Chmelka, head of Americas flow derivatives trading at Goldman.

“The flow derivatives business has always had clients trading options to hedge, generate income, express views and add leverage,” he said. “We feel uniquely positioned to continue providing liquidity and capital provision to help facilitate all sides of this growing ecosystem.”

It’s not just in the US that industry insiders are bullish on the market’s prospects. Active ETFs are also gaining momentum in Europe, albeit from a smaller base. There are about US$10bn of assets in outcome ETFs in the region, according to BlackRock. The asset manager launched some European income products in 2024 and is now making a push on buffer ETFs as well.

“Buffer products that offer some predictability of returns through providing a level of protection are really resonating with clients,” said Elliott, who highlighted the retirement market as an important area. “We expect to see a lot of growth in that space.”