UBS bags hefty trading gain in Europe’s sleepiest bond markets

A small band of UBS traders are making waves in Europe’s famously sedate SSA and covered bond markets after scoring a major windfall last year.

UBS more than doubled its revenues in SSAs and covered bonds to more than US$80m in 2025, according to sources familiar with the matter. That bumper haul catapulted it past other banks with more established operations focused on trading and underwriting these low-risk securities to make UBS one of the largest banks in this space by revenue.

The Swiss bank has hired bankers to rebuild its presence in the SSA market in recent years, reversing a 2012 retreat from the historically low-margin business of handling bonds issued by sovereigns, supranationals and government-linked agencies. Banks tend to trade covered bonds, an ultrasafe form of financial debt, from the same desk.

But the speed of UBS's revenue gains has raised eyebrows among bankers in this tight-knit community – and caught the eye of hedge funds looking to replicate its success.

Sources said the bulk of UBS’s revenues came from a small trading team led by former Citigroup trader Jonas Klink. He joined UBS in 2023 to spearhead a push in these niche markets. His LinkedIn profile said he previously led covereds, SSAs and rates illiquids trading at Citi.

“He’s a very good trader,” one source said. “[He] knows what he’s doing.”

A UBS spokesperson declined to comment.

Trading opportunities

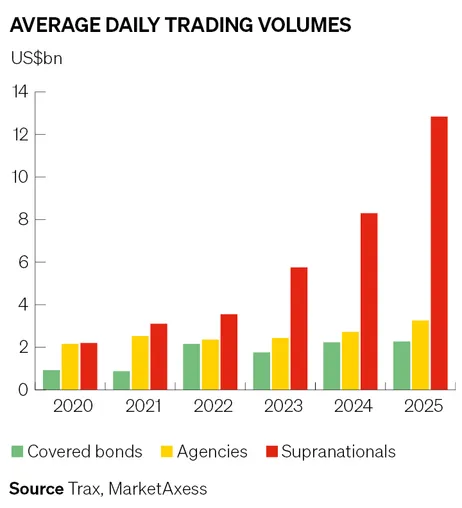

Europe’s SSA and covered bond markets aren't exactly renowned for high-stakes risk-taking and big trading profits. Average daily trading volumes in covered bond markets were about US$2.3bn last year – less than 1% of daily activity in government bonds, according to MarketAxess's Trax data service, which captures about 85% of the European credit market.

Volumes in supranational and agency debt increased 46% to US$16.1bn a day in 2025, Trax data show, although that's still a drop in the ocean compared with the US$245bn of government bond transactions changing hands on a daily basis.

But these backwaters have attracted greater attention lately from both multi-strategy hedge funds and banks eager to uncover the next trading opportunity. Last year, Bobby Previti joined Steve Cohen's Point72 hedge fund from Bank of America, where he previously led SSAs and covered bonds trading, according to his LinkedIn profile.

Sources said Klink has also become a hedge fund hiring target following his success last year. “SSA traders are very well bid” right now, said one trader.

Business rebuild

UBS’s stellar trading performance stands out in part because of the smaller presence it has historically held in these markets compared to many rivals. The Swiss lender scythed back its bond trading division in a high-profile 2012 restructuring that saw fixed income trading revenues more than halve over the following decade.

A notable part of that retreat involved a significant reduction in its operations trading low-margin products linked to interest rates such as government bonds. That included shuttering its SSA business altogether.

The Swiss bank has, however, been steadily rebuilding its SSA desk in recent years. It moved Chris Idialu-Ikato internally from emerging markets credit trading to SSAs and covered bonds around the time that Klink joined in 2023 to lead its trading expansion.

Last year UBS began hiring debt capital markets bankers to win more SSA underwriting businesses. They included Jake Webster, a senior deal originator from Morgan Stanley, and Raman Gangahar, who previously worked at Bank of America and Deutsche Bank.

"We’re not going to go back to a place where we’re all things to all people as we have been in the past, so it will be a smaller business but the intention is certainly to grow it from where we are now,” Barry Donlon, global head of DCM at UBS, told IFR last year.

Traditionally, the biggest banks in SSA and covered bond trading also tend be among the most prominent underwriters. LSEG data suggest UBS has made some progress in SSA underwriting, albeit from a low base.

In euro-denominated debt, UBS was ranked 15th last year by deal volume for supranational bonds and 20th for agency bonds, having not figured in the top 20 for either category in the previous two years. It also ranked fourth in covered bonds across all currencies, up from sixth in 2023.