Retail investors pile into European credit markets

There's a new bulk buyer in town for European corporate bonds: retail investors.

Asset managers have been scooping up short-dated bonds in record volumes this year to cater to soaring demand from European retail investors for higher-yielding alternatives to regular savings accounts.

Allianz Global Investors and Amundi are among those raising billions of euros in recent months, packaging corporate bonds into so-called hold-to-maturity funds, sold to investors across Europe – especially in Italy.

That buying has created a powerful tailwind for European credit, providing a constant source of demand when the European Central Bank is reducing its support for these markets.

"The biggest sector change this year has been the hold-to-maturity funds that have been raised on the Continent," said Finbar Cooke, co-head of European credit trading at Barclays.

"It's a sizeable percentage of our secondary volumes that didn't exist one year ago," he said. "So that's been very positive for our market."

The promise of higher returns has lured many investors back to European bond markets following a decade of ultra-low yields. Around 80% of European investment-grade bonds yielded below zero at the end of 2021, according to Amundi, following years of unprecedented central bank stimulus aimed at juicing lacklustre growth and inflation in the euro area.

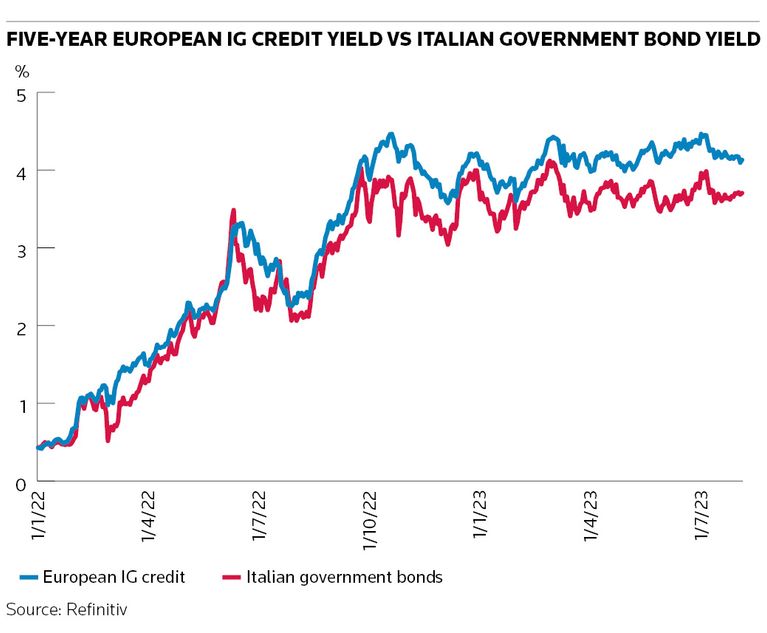

But that extraordinary investment backdrop has changed beyond recognition in the past year as the ECB has raised interest rates rapidly in an effort to subdue stubbornly high inflation. Corporate bonds now yield an average of about 4.2%, according to the ICE BofA euro corporate index – a level not seen since the height of the eurozone sovereign debt crisis nearly 12 years ago.

That has prompted a generation of investors, who in many cases had overlooked European fixed income wherever possible, to reconsider their options. Euro area pension funds bought €15bn of bonds in the first quarter and sold €5bn of stocks, ECB data show, in just one example of money flowing back into credit markets. Retail investors, frustrated with the paltry interest rates on their bank savings accounts, have also looked to get involved.

"The levels of yield are quite attractive from a long-term point of view after a long period in which yields were negative," said Cosimo Marasciulo, head of absolute return at Amundi, who said his firm is seeing "quite significant interest" from retail investors.

Italy, a market with a long history of retail fixed-income investing, has been the main source of this flow, thanks in part to the country's large savings stockpile. Italian households had €1.25trn of deposits at the end of June, according to the ECB. Corporate bond yields rising at a faster rate than those on equivalent Italian government debt has also been fuelling this trend, offering investors an additional 50bp in yield.

Bond bonanza

Fund managers also report increased retail demand in other countries where corporate debt yields more than local government bonds – including France, Belgium, Germany, and Spain.

In Germany, where households are sitting on €2.7trn in deposits, investors can pick up an extra 150bp over German bonds. "Therefore, German investors are perhaps even more incentivised to engage in this trend compared to Italian investors," said the head of credit research at a European bank.

Most retail investors can't easily buy corporate bonds directly and rely on asset managers to provide access to these markets. Hold-to-maturity funds, also known as target maturity funds, have become an increasingly popular way to put money to work. While these vehicles have different formats, they typically offer a set annual coupon through investing in a diversified portfolio of corporate bonds. The advantage over traditional open-ended funds is that investors don't have to worry so much about the mark-to-market price of the portfolio, fund managers say, and can instead focus on the yield and coupon they receive.

Funds typically range from 18 months to five years in maturity, said fund managers, with some portfolios focused solely on investment-grade credit while others hold up to 70% in high-yield securities to produce yields between 4.5% and 7%. Higher-yielding products also bring greater risk for investors in the form of potential defaults in the underlying portfolio, which has prompted some fund managers to avoid autos and other cyclical credits that tend not to perform well during an economic slowdown.

Vincent Marioni, chief investment officer for credit at Allianz, said: "Our goal as an asset manager is to avoid default, but you cannot guarantee such events not happening over a five-year time period," highlighting the unexpected events of the past five years such as the pandemic and war in Ukraine.

The growing involvement from retail investors has been a stabilising force for the European fixed-income market when the largest buyer in these markets – the ECB – is scaling back its presence. The ECB still holds €336bn in euro corporate bonds, accumulated through various stimulus rounds since 2016. But since March, it has only been reinvesting part of the principal from these bonds as they mature – a move that has reduced its holdings by about 3% from their peak in November. The ECB has also started slowly shrinking its stockpile of €2.5trn in public sector securities.

"Central banks have been less present in the market both on the sovereign side and within the credit market, so it's been very important to find another source of buyers," said Marasciulo.

How long retail investors remain large players in European credit may ultimately be determined by how sticky inflation proves to be and where rates eventually settle – particularly as the yields on these funds aren't that much higher than those available from less risky investments like money-market funds, said Marioni.

"To me, the risk of demand weakening for the hold-to-maturity strategy could come from terminal rates being much higher than they are now," he said.