Traders start buying euros as US dollar loses its lustre

A sombre outlook for the US economy is encouraging investors to ditch bets on the US dollar, one of the most prominent consensus trades since Donald Trump’s reelection as US president in November, while tentatively embracing the euro amid a brightening growth picture across the Atlantic.

A broad-based gauge of foreign exchange market positioning shows investors are slightly bearish on the US dollar for the first time since October, according to BNP Paribas, as uncertainty over tariffs starts to dent growth expectations for the world's largest economy.

Bank of America strategists said bullish greenback bets have been cut by about 40% this year, with investors selling all the US dollars that were bought in the fourth quarter around the time of Trump's election win.

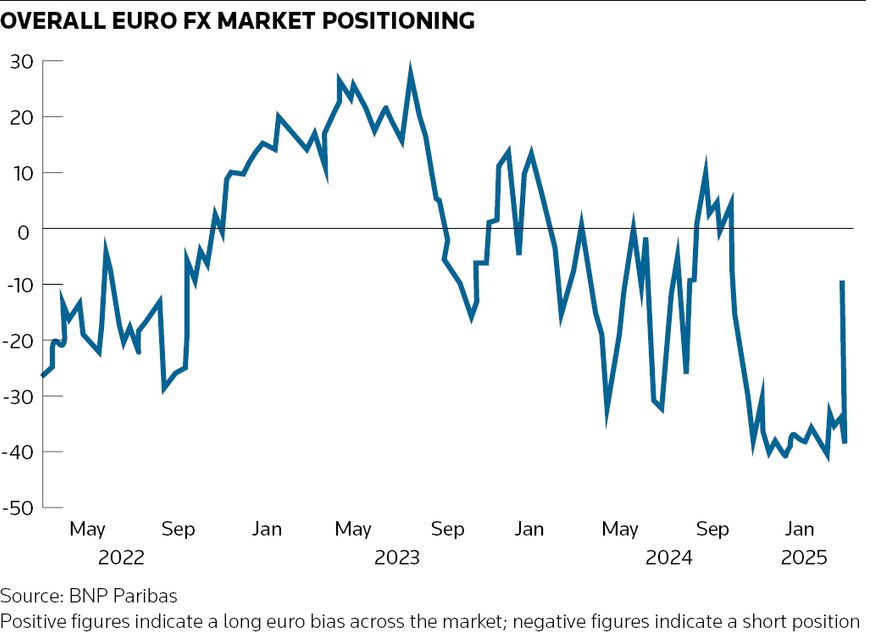

That comes as investors have begun unwinding negative euro wagers in anticipation of a reversal in fortunes for the beaten-down single currency following Germany's shock announcement that it plans to increase spending by almost €1trn in the coming years. The news from Germany has driven the sharpest jump ever in euro positioning in BofA's client survey on rates and FX market sentiment, the bank said on Friday.

“We’ve seen a huge unwinding of these long dollar positions,” said Francesco Pesole, FX strategist at ING. “Sentiment within the FX market has definitely shifted from the long dollar trade, which was previously justified by the notion of the US remaining relatively strong compared to the rest of the world, to Europe."

Betting on a stronger US dollar had been a favourite "Trump trade" given expectations of looser regulations and fiscal policy. Citigroup said hedge funds bought US dollars from the bank for 19 consecutive trading days from October 2 in the run-up to Trump's victory on November 5, the most consistent period of hedge funds buying US dollars the bank has ever seen.

The US Dollar Index hit its highest point in more than two years in mid-January but has since slid nearly 6% to levels last seen around election day. That slump has coincided with mounting concerns among investors about the effect of Trump's tariff plans on the US economy and a sharp downturn in US stock markets.

Goldman Sachs recently lowered its US growth projections for 2025 from 2.4% at the beginning of the year to 1.7% following another round of tariff policy whipsawing from the president. That included Trump threatening 50% tariffs on Canadian steel and aluminium – only to walk that back a matter of hours later – and escalating trade tensions with the European Union.

“The market has bought hook, line and sinker into the idea that all of this tariff talk and the sheer pace of policy change coming from the US is going to hurt economic growth,” said Kit Juckes, chief global FX strategist at Societe Generale. “The market is seeing all this news and is interpreting it as something that is going to significantly change [the] growth trajectory for the US given volatile policymaking.”

MEGA

Those growth expectations contrast sharply with improving investor sentiment on Europe following German chancellor-elect Friedrich Merz declaring Europe would do “whatever it takes” to beef up its defence and infrastructure spending. The potential €1trn in increased fiscal stimulus over the coming years should lead to “significantly more growth”, according to economists at Morgan Stanley, who projected it would increase German GDP by 70bp in 2026.

The single currency has rallied in response to this newfound optimism. After flirting with parity against the US dollar earlier this year, the euro is now up 6.5% since its mid-January low to about US$1.09.

BNPP's broad-based FX market gauge suggests investors have been unwinding their negative euro bets and that options traders are now long the currency. Despite this bounce, analysts say investors haven't yet reached peak euro exposure as they wait and see whether Germany's new government can secure parliamentary approval for its spending plans.

“Some investors are still reticent to fully shift their exposure into euros until this defence story is confirmed … [but] things can shift pretty quickly into peak long euro positioning," said Dominic Bunning, head of G10 FX strategy at Nomura. “We’re nowhere near close to seeing a peak long euro position in the market yet. There's still a lot of room for this to run and so I wouldn’t be surprised to still see a long euro position playing out through the middle of the year.”

Tariff risks

The biggest risk to a euro revival is an intensifying trade war with the US. Trump has threatened to impose a 200% tariff on EU alcohol imports after the EU retaliated with tariffs on US$26bn of US goods in response to Trump's 25% tax on steel and aluminium imports.

JP Morgan research estimates that tariffs greater than 25% across EU products could more than offset the fiscal boost that increased defence spending is expected to have on the euro. But Juckes isn’t convinced such tariffs will stick around long enough to do any long-term damage to Europe’s growth prospects.

"Tariffs on Europe could further refocus European minds on European growth and further incentivise Europe to stand on its own two feet separate from the US,” he said.