Investors suffer heavy losses in popular Turkey carry trade

Last month's sudden plunge in the Turkish lira inflicted hundreds of millions of dollars of losses on hedge funds and bank trading desks, traders say, after the sudden detention of president Recep Tayyip Erdogan’s main political rival sent shockwaves through local markets.

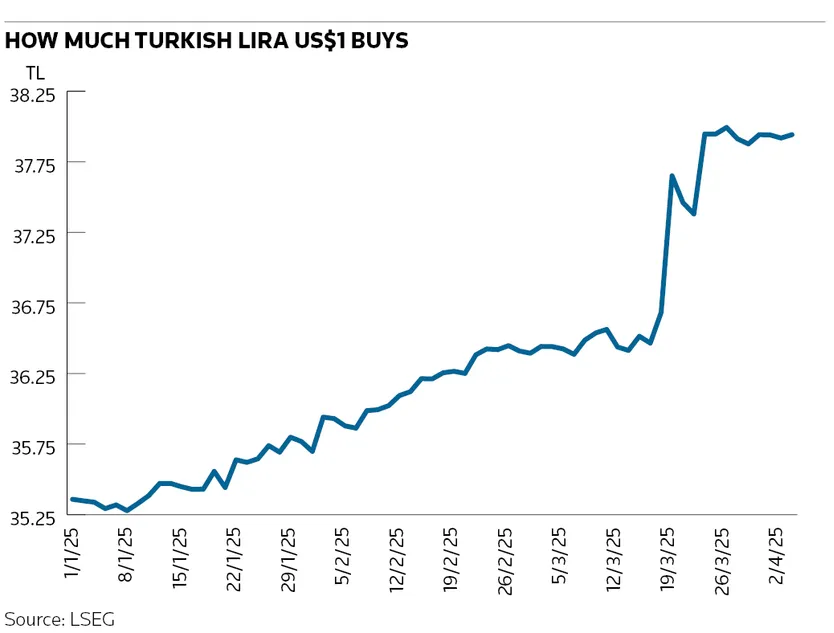

The lira collapsed 10% in just 30 minutes on March 19 to reach an all-time low against the US dollar following the arrest of Istanbul mayor Ekrem Imamoglu on charges of corruption and aiding a terrorist group as part of an ongoing crackdown on Erdogan’s opposition figures.

Turkey's central bank intervened to steady the currency but not before its freefall had upended what had become one of the most popular foreign exchange carry trades in financial markets. JP Morgan estimates roughly US$35bn of lira carry trades were in place as of March 19, implying paper losses potentially running into billions of dollars for investors and trading desks.

"The majority of investors are short US dollars and long the lira because of the carry trade so this 10% move in the lira will have caused a lot of pain," said Oliver Jerome, head of FX, Europe, at Deutsche Bank.

"The reason why this 10% move is interesting is not necessarily because of the violence of the move but because the majority of investors are positioned one way on Turkey – they’ve been hunting for yield in a previously quite stable world and there was only a very narrow window on March 19 to get out of that position, which took everyone by surprise.”

Carry trades are a popular investment strategy in FX markets in which investors borrow cheaply in a low-yielding currency to buy a higher-yielding currency, allowing them to profit from the interest rate differentials between the two markets.

Although lucrative during periods of calm, carry trades can quickly come unstuck when volatility rises rapidly. Such was the case last August when a surge in volatility across global markets saw investors unwinding their yen carry trades, which had grown to around ¥40trn, or US$250bn, according to estimates from the Bank for International Settlements.

The lira carry trade had been a favourite among investors since early 2024, according to research from BNP Paribas, thanks to the difference between the US dollar’s 4.3% overnight lending rate and the Turkish lira’s 44% rate.

Those high implied yields had broadened the appeal of the trade outside the traditional emerging market investor set to more generalist macro hedge funds, bankers say. In a report last July, ING said holding the lira over the previous month would have generated a 4% total return.

“This year, Turkey had been investors' favourite carry trade,” said Chris Turner, global head of markets and regional head of research for UK and Central and Eastern Europe at ING. “The lira provided one of the last vestiges of global carry trade opportunity for investors, but the volatility that we saw last month quickly unwound that sentiment.”

Turkish dismay

Turner estimates up to US$20bn of foreign money invested in the carry trade left the lira after the currency slumped. For those holding long lira positions, more than four months of returns were wiped out in 24 hours, according to analysis by Marek Raczko, FX and emerging markets rates strategist at Barclays.

“[Until this point] it was one of the most profitable trades and that meant that all of the [hedge fund] pods [had] it on," said a senior fixed-income trader at a major bank. "There were definitely some smaller pods that had real problems on this."

It’s not just investors who appear to have been hit by the sudden move. Some bank dealing desks also held lira positions before March 19 and suffered losses, said the senior fixed-income trader.

“I don’t know whether [these losses are] big enough to have hit people’s earnings but there could have been a … [reasonable loss] on a trading desk somewhere,” he said.