US dollar weakness makes EM local debt great again

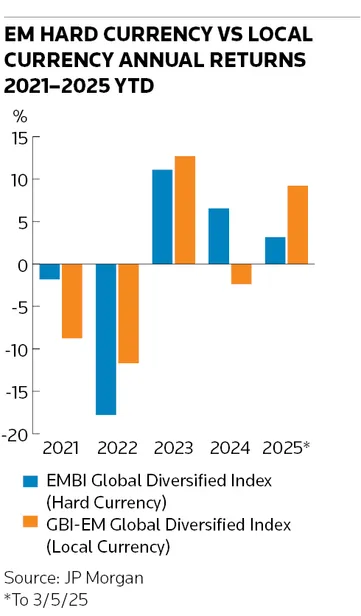

Local currency emerging market bonds are delivering huge gains this year thanks to a weakening US dollar and improving fundamentals in developing countries.

By the close of June 3, EM local debt had delivered a total return of 9.69% year to date, according to the JP Morgan EM local GBI Index – far surpassing any high-yielding fixed-income asset class, including EM hard currency debt. That compares to a significant underperformance of EM local debt between 2010 and 2024 when average annualised returns were just 1%, according to Neuberger Berman.

“It’s an interesting situation,” said Vera Kartseva, portfolio manager and strategist at Neuberger Berman. “Usually, local currency bonds are seen as the riskiest asset class correlating with equities. But right now, we see an inverse correlation because of the change in the dynamic of the dollar.”

In the past three years, the US dollar has appreciated, making it a difficult environment for EM local debt and causing outflows in the asset class. “But now, we have an overvaluation of the dollar with a catalyst for weakness, emanating from US policy, making it a favourable environment for local EM bonds,” said Kartseva.

Performance of EM local debt is often driven by the US dollar, explaining up to 70% of the performance of the asset class, according to Kartseva. “The overall dollar weakness plays a big role in global portfolios,” she said, adding that Neuberger Berman is “preferring local to hard EM debt” in its portfolios.

Other EM asset managers are also adding to their local debt positions. “We’ve been adding to our exposure to EM currencies since the uncertainty on trade and the U-turns from the White House,” said Alexis de Mones, portfolio manager at Ashmore. “There is a radical change in funding conditions for EM sovereigns and an increasing interest for local currency products.”

Strong fundamentals

It is not just a weaker US dollar but strong fundamentals in emerging and frontier markets such as lower oil prices, which will help boost growth in these economies.

“While the weaker dollar is certainly helping, we're seeing contributions from bond price appreciation in many countries, as the market begins to factor in lower oil prices and the implications of stronger EMFX on central banks' reaction functions,” said Joseph Cuthbertson, EM sovereign research analyst at PineBridge Investments.

Frontier markets are also benefiting from increased demand. The likes of Argentina, Egypt and Nigeria have attracted “significant inflows” in 2025, according to Raoul Luttik, senior portfolio manager at Neuberger Berman.

“The opportunity set in EM frontier local has increased as fundamentals across several countries have improved, and we're seeing credible reform efforts in Nigeria, as well as disinflation and attractive currency valuations and carry in Egypt,” said Cuthbertson. Meanwhile, Argentina has pushed through deregulation laws and reduced its fiscal deficit.

As well as the Egyptian pound and Nigerian naira, PineBridge is keen on the Uzbek som and South African rand “where we think any upcoming changes to lower the inflation target would be positive for the currency", said Cuthbertson.

Uzbekistan particularly stands out “given reform momentum and improving credit fundamentals”, he said.

Less correlated

Frontier markets are not typically included in benchmarks or ETFs, meaning they are less correlated to global macroeconomic volatility but rather respond to each country’s own macroeconomic changes.

“In the frontier space, we look for a combination of a credible path for fiscal and monetary policies, combined with an undervalued exchange rate and attractive carry,” said Cuthbertson. “We pay close attention to the amount of offshore positioning in each domestic market, looking for underowned markets and opportunities.”

The taper tantrum of 2013 – when Treasury yields surged after the Federal Reserve announced it would start to taper quantitative easing – was the last time there was a direct correlation between FX and interest rate volatility in EM, according to de Mones. “Since then, any selloff in global core bonds, including Treasuries, has not led to a more-than-proportional selloff in EM bonds,” he said.

“Many EM countries have been doing well from a fundamental point of view since the taper tantrum years,” said Luttik, referring to the reduction in external imbalances and tighter monetary policies to bring inflation back to target. “Attractive valuations and low foreign participation add to the favourable outlook for local bonds,” he said.

Can the outperformance of local EM bonds continue? “It’s early days,” said Kartseva. “Flow-wise we still have year-to-date outflows in the asset class. But we have started seeing inflows in the past couple of weeks [and] this trend has all the ingredients to continue.”

The fact the local GBI EM index has become more skewed towards Asia in recent years following the inclusion of India and China, and as the weight of more volatile countries like Brazil, South Africa and Turkey has shrunk, makes the index's “risk/return profile more stable”, said Luttik.