Most economies experienced rapidly increasing budget deficits in 2009 due to financial sector support measures and the onset of the global recession. Deficits are expected to continue to grow in 2010 as countries tackle historically high and deteriorating public finances. But what form is this issuance taking, and how are sovereigns ensuring they do not saturate the market and undermine their fundraising efforts in future years? Hardeep Dhillon reports.

Governments across the world are continuing to borrow substantially in the bond markets, with 2010 forecast to be another record year of supply. Estimates for issuance in Europe could hit the €1trn mark, a roughly €60bn increase on last year’s levels of €937bn. In the US it is expected to raise record debt sales to cover its US$1.4trn deficit. The UK will issue £187.3bn of Gilts for fiscal year 2010/11.

Standard & Poor’s (S&P) is projecting significant estimated general government deficits in some cases, such as 12.9% of gross domestic product in the UK, 11.7% in Ireland, 10.1% in Greece and 8.6% in France. “Revenues are contracting due to a slowdown in economic activity, expenditure is increasing to fund rising unemployment and stimulus packages, which are all adding to overall deficits and resulting in higher net borrowing requirements this year, said Kai Stukenbrock, credit analyst at S&P.

Borrowing for the next two to three years is expected to remain at elevated levels and then to gradually decline as efforts are made to manage deficit levels. “Deficits will not be able to be cut overnight and it will take several years before we get anywhere near the levels seen in the mid-2000s,” he added.

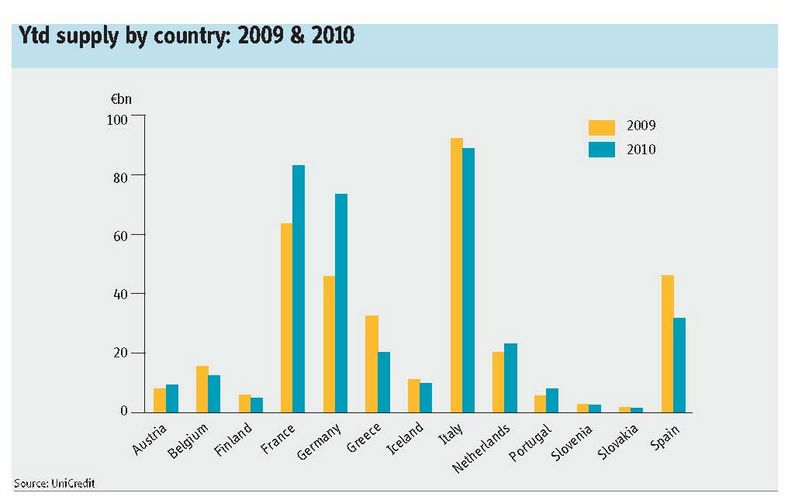

European governments issued €370bn of bonds by April 16, a weekly average of roughly €22bn, compared to €350bn in the same period last year. “Despite issuance being at historical highs, appetite for bonds is strong and there is no sign yet of any fatigue in terms of digestion. It is true that riskier sovereigns are paying high premiums for successful placement, but demand remains rather healthy for these issuers also,” said Chiara Cremonesi, fixed income strategist at UniCredit.

The unwind of quantitative easing this year in the US and UK might make it feel like more debt is being issued, with those governments not buying back the bulk of issuance they did in 2009. Although the market will need to take down a larger amount of bonds, demand to soak up the paper remains buoyant, partly due to an offsetting fall in issuance in other asset classes, such as covered bonds and government-guaranteed bank debt, said Noel Williams, director of syndication, RBC Capital Markets.

Debt management agencies are using a wider array of funding sources and becoming more innovative in the way they package and sell their debt, due to their larger issuance requirements. “As the market and financing needs grow, sovereigns are having to offer more diverse products and tap different types of investors,” said Grant Lewis, head of economic research at Daiwa Capital Markets Europe.

More funding could be conducted via syndication, particularly for longer dated bonds or higher volumes. “Syndicated taps of long bonds have been seen in the UK and I expect other countries to follow suit,” sid Huw Worthington, fixed-income strategist at Barclays Capital.

It is not just a seller’s market but a buyers’ one too. Many sovereigns are increasingly willing to satisfy investors’ demand for specific instruments. Finland launched a £500m sterling floater in March, while Belgium increased overall supply under its euro medium term note programme by 50% this year to €4.5bn, up from €3bn in 2009.

Duration patterns

Much of the financing last year was in short-dated format, predominantly bill issuance and two- to three-year bonds, putting pressure on funding profiles as debt rollover ratios spiked. The main trend in 2010 is an extension in the duration of debt, in particular, maturities of 15 years and over, which represent roughly 15% of total issuance this year, compared to 10% in 2009, according to Barclays Capital.

“A variety of issuers have launched long-term bonds and sovereigns will want to continue to extend their portfolio duration during the course of the year,” said Worthington. “What is underpinning this trend is that many countries will be keen to extend their curves not just by a couple of months but by a number of years to limit rollover risk,” added Commerzbank’s Schnautz.

France has issued the longest tenor this year, a new 50-year benchmark in March, the second ever 50-year bond from the eurozone. The 30-year maturity is proving popular, with Belgium having sold a new 30-year benchmark in mid-April, the Netherlands looking to launch a deal in the second quarter and expectations that Portugal and possibly Ireland will follow suit. Most countries issued new benchmarks in the 10-year sector at the start of the year and Portugal is expected to launch its second deal this quarter.

Many European sovereigns have issued in the US dollar market in the last 18 months, taking advantage of the favourable cross currency basis swap. “This has been the case for the last couple of years and we will continue to see European sovereigns issuing in dollars as a cost effective way of raising funds as long as that funding arbitrage window remains open,” said Williams at RBC Capital Markets.

Eurozone debt agencies have tapped the market for about US$5.25bn this year, according to Commerzbank. Belgium has been active twice. Italy issued in January and should continue to issue US dollar bonds under its global bond programme. In March Portugal tapped the dollar market for the first time since 1999 when it sold a US$1.25bn bond.

Spain has pencilled in up to €6bn of foreign exchange issuance in 2010, Greece will roadshow a dollar-denominated bond in late April and the Finnish debt agency has announced a new five-year transaction. Ireland has US$500m maturing in July, which could well be rolled over or even increased in size. The Netherlands is also open to issuing in the dollar market, an option the sovereign has never considered before.

Similar market conditions to Germany’s second-ever US$ bond issued in September 2009 could prompt another return to the market by Germany, said Schnautz. France is yet to issue in dollars but the positive experiences gained by French agency SFEF launching dollar debt last year could help pave the way for France’s first ever dollar bond.

“A lot of the major agencies have issued dollar debt and it makes sense for the sovereigns to do the same and extend issuance profiles in other currencies, even the yen and sterling markets. Levels are good, the arbitrage works, selling into a different investor base, this all makes issuing in foreign currencies more attractive,’ said BarCap’s Worthington.

Thinking outside the box

Non-conventional issuance, such as inflation-linked debt is also witnessing a sharp increase in activity. The bulk of the increase emanates from France, which has already issued a new OATi July 2019 benchmark linked to French inflation, and also 0Germany, which announced it would issue €3-4bn of linkers each quarter, in comparison to around €6bn for the whole of 2009. Germany has already tapped five- and 10-year linkers this year and is expected to launch a new 30-year transaction. Finally, Italy has just issued a new 10-year linker, the BTPei September 2021.

The rise in linkers is not based on expectations of higher inflation –bankers expect subdued inflation forecasts in the coming months. It is actually about diversification needs. “Sovereigns are facing another year of huge supply, and so their primary objective is to diversify their sources of funding by offering different products to attract different pockets of investor demand. This trend also accounts for the increase in floating-rate instruments and foreign currency denominated benchmarks,” said UniCredit’s Cremonesi.

Bankers said that though the appetite for government debt remains very strong, there is a greater degree of differentiation by investors, who have become more discerning about which debt they want to hold. Greece is the most obvious example, but this has also affected Portugal, Ireland, Ireland and Spain to varying extents. And other countries could also be susceptible if their fiscal plans do not satisfy the market or if they are unable to bring down their deficit levels.

One fundamental issue for the market is governments running deficits going into a crisis and when a crisis hits being forced to run even larger budget deficits. One overarching lesson to take from the current crisis is that countries will now be encouraged to run balanced budgets or surpluses rather than deficits during the good times, argues Lewis at Daiwa Capital Markets Europe.

“Germany is committed to running an effectively balanced budget from 2016 onwards and, having been a reluctant participant in bailing out Greece, is likely to push for a strengthening of the fiscal framework in the euro area to force countries to run much tighter deficit positions during good times,” he said. “Ironically, if this proves successful, a commitment to balanced budget means that eventually you end up with complaints about lack of issuance, as we had at the start of the last decade in many countries like the UK, US, Sweden and Australia. Of course, we are currently a long way from there.”

Stukenbrock at S&P believes that governments should consider where they stand on issues like the cyclical position of the economy and sustainability of its growth model when analysing their fiscal positions, “For instance, Spain may have needed more surpluses on the fiscal side when its economy was growing because as soon as boom ended the downturn was much more pronounced than many had expected,” he said. “The tendency in Germany is for fiscal consolidation and low deficits and the fact that Germany had a balanced budget in the years preceding the current crisis gave them some breathing space.”