Liquidity and consistency: Falling volumes and low volatility made for a tough equity derivatives backdrop in 2012, forcing many players back onto the sidelines. For its unfaltering commitment through some of the toughest times, and unrivalled innovation as it reaped the rewards of that constant focus, Societe Generale is IFR’s Equity Derivatives House of the Year.

To see the full digital edition of the IFR Review of the Year, please <a href="http://edition.pagesuite-professional.co.uk//launch.aspx?eid=24f9e7f4-9d79-4e69-a475-1a3b43fb8580" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">click here</a>.

In a market where players all-too quickly come and go, Societe Generale has proved to be the rare exception, resolutely placing the equity derivatives business at the heart of its investment banking operations come rain or shine.

The strategy is one that some rivals questioned given the tough market backdrop of the last four years, but the French bank has proved it can deliver impressive results, innovative client solutions, and unparalleled liquidity provision even under the harshest conditions.

And 2012 was a year as tough as any. Low-level volatility coupled with high levels of uncertainty saw listed volumes 20% down year-on-year and many over-the-counter products suffered heftier declines as forthcoming derivatives regulations began to pile pressure on bilateral transactions.

Against that backdrop, the divide between those houses with long-term commitment and those that had just come along for the ride in hope of better times ahead became more pronounced than ever.

“It has been a year of recovery and rebounds and we’re proud to have exactly the right business mix,” said Christophe Mianne, deputy CEO of SG Corporate and Investment Bank. “We have the right products to be able to show to the board that we are consistently profitable.”

The business posted a return-on-equity in the mid-30s, and while total equity revenues were 13% down for the first nine months of the year at €1.7bn, a solid third quarter saw the business post a 22% gain over the same three months in 2011.

For shareholders and clients, the results validate the bank’s decision to stand by its contra-cyclical business model though 2011 despite escalating counterparty concerns that engulfed French banks as they lost access to dollar funding in mid-2011when credit default swap levels surged above 400bp.

“2012 has been a turnaround year for us – it’s been make or break in terms of the business model,” said David Escoffier, head of global equity flow at SG. “It is reminiscent of 2003 or 2004 when we decided to be very counter-cyclical.”

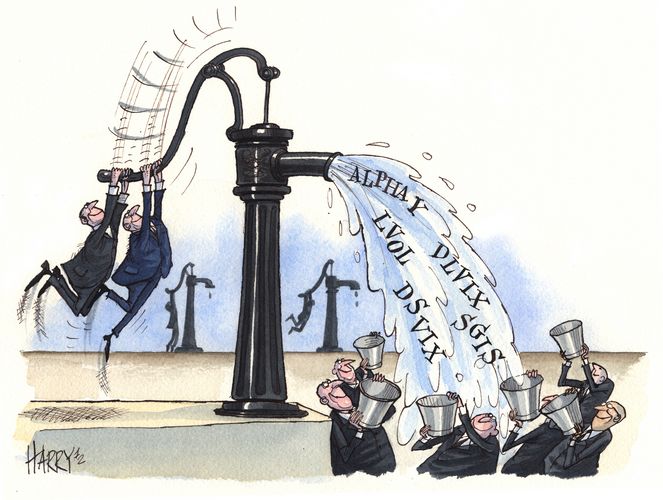

Liquidity provider

With its CDS back below 200bp, and many competitors forced to reassess their business models amid industry-wide ratings downgrades, SG was able to focus its attention on what mattered most in 2012: liquidity.

“If you want to be big with clients, you need to deliver liquidity and if you want to deliver liquidity you need to be able to recycle risk,” said Escoffier.

“It’s about having the right model for the right time. It’s tough to deliver results in this business when volatility is so low but our engine is finely tuned to the current environment. We saw a lot of banks retrenching, but because of our ability to generate profits, we can expand our business. What makes us different is that stability.”

To address any residual counterparty concerns, the French dealer took a new approach to its structured product issuance at the start of the year with the introduction of a new collateralisation programme, SGIS.

A full suite of engineering capabilities for both secured and unsecured notes were made available across the full range of payoffs and underlyings, with Bank of New York Mellon brought in as collateral monitoring agent and liquidation management agent to add an additional layer of comfort.

Around the same time, the renewed focus on liquidity was also addressed with the launch of AlphaY, a cash equity trading venue that allows clients to tap the bank’s global equity and equity derivatives flows, including structured products and delta one trading.

It proved to be a timely addition for clients and enabled the bank to double crossing ratios to almost 20% with daily volumes regularly in excess of €200m.

In just a few weeks of launch, the bank ranked as a top three provider with hedge fund Marshall Wace. “We never realised how large and high quality [SG’s] volumes were until AlphaY,” said MW head of trading, Nick Nielsen.

Winning big

The liquidity advantage enabled SG to win some of the biggest corporate trades including an €800m roll of bank futures for a client, which represented 70% of the total open interest across those products.

The bank completed a EuroStoxx 50 dividend futures trade for another client on the 2014 maturity. At €1.5m per point, the trade was larger than total flows across all maturities.

In October, French investment bank Oddo Group selected SG to buy back the 12,000 lines of primarily single stock options in its books as it exited the business. SG was able to provide peace of mind on confidentiality, pricing all lines without going to the market but still offering competitive pricing.

“We were impressed by the quality of all SG’s teams,” said Oddo CEO Philippe Oddo. “From front to back office, they showed great professionalism and dedication to ensure a seamless transfer of our positions.”

SG also took control of a complex situation for Spanish construction firm ACS, which was facing the possibility of margin calls relating to its 8.25% equity stake in Iberdrola.

And it isn’t just Europe where the bank is winning big. SG continued to gain traction in the US, where structuring and balance sheet capabilities proved crucial in the bank’s ability to provide an innovative stock loan facility on a US$2.8bn equity portfolio for CalPERS.

“Our business is more global than ever. Some of the largest US pension funds are happy to trade with SG, and we’ve even seen some of the largest US banks coming to us when they have complex problems to solve,” said Escoffier.

Enhanced volatility

Amid the low levels of volatility, investors continued to embrace VIX-related trackers in anticipation of a potential spike as the European debt crisis rumbled on and concern surrounding the US fiscal cliff escalated.

Having previously struggled to gain traction with its listed volatility fund, SG attracted €120m to its Lyxor S&P VIX Futures Enhanced Roll ETF in 2012.

While the strategy produces similar VIX correlation to the larger Barclays’ iPath VXX note, LVOL limits the value erosion by holding longer-dated VIX futures and shifting into shorter maturities under more volatile conditions.

While the long-term performance has been one of decline amid falling volatility, the strategy provides investors with a few days grace on timing, according to Stephane Mattatia, SG’s global head of equity flow engineering.

“Investors like LVOL because it is much simpler and a lot more transparent than many alternatives out there,” he said.

Amid growing popularity, the bank launched its next generation of volatility products with Dynamic Long/Short VIX Futures strategies.

“SG is unmatched when it comes to proposing innovative solutions such as the dynamic long/short VIX futures,” said Eric Lhomond, CIO of AXA UK. “Also important to us, SG is the place we turn to when we need to implement one-off specific structured transactions.”

As a strategic hedge, DLVIX (long) switches between cash and LVOL to avoid the roll cost during benign times. The short version, DSVIX, can be combined with its long counterpart to create a total return strategy.

“Our approach is to create transparent tools that can be combined,” said Mattatia. “Our clients are smart enough to customise them further for their own needs.”

The bank also attracted more than €100m to its Quality Income ETF in the first month of launch and more than €300m in access trades since the index debuted mid-year. The benchmark tracks stocks that are able to deliver high long-term dividends.