It wasn’t the first perpetual deal – that came from Citicorp in 1980 – but it was the first “true” perp in that, unlike the Citicorp transaction, it could not be redeemed at the behest of noteholders – only by the issuer itself.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

1984: NatWest’s US$300m perpetual FRN – the first true perp

It wasn’t the first perpetual deal – that came from Citicorp in 1980 – but it was the first “true” perp in that, unlike the Citicorp transaction, it could not be redeemed at the behest of noteholders – only by the issuer itself.

Officially called junior subordinated FRNs, the US$300m of notes paid 3/8 percentage points over Libor and came with a call option for NatWest after five years.

Structured by NatWest and lead manager County Bank – after encouragement from the Bank of England – the notes provided primary capital for the bank.

“For NatWest, the notes are an ideal vehicle. For such a borrower, with a lot of dollar loans underpinned by loan stock of varying maturities, such a source of permanent dollar capital is obviously attractive and acts as a source of capital very close to equity,” the now renamed Agefi International Financing Review said.

IFR added that “fast development of FRN-related capital for banks is expected” before sounding a warning note: “Acceptable borrowers for ‘infinity’ FRNs would be limited, analysts suggested.”

A sensible note of caution, perhaps, but one that would soon prove to be misplaced as the issuance of such instruments became widespread and a market for all sorts of capital instruments developed.

1984: Texaco’s US$1bn CB – pioneering convertible bond

Once again breaking with its often terse style, IFR piped this deal into the markets with unabashed enthusiasm, with the headline: “The Global Texaco Convertible: It drills a US$1bn gusher.”

The deal, which some have called the first “real” CB and which was certainly much bigger than any other similar deal, saw remarkably wide distribution and was increased from US$800m, thanks to overwhelming demand.

The increase required that the coupon be raised from the originally marketed 11-1/2%–11-3/4% to 11-7/8%, with the conversion price set at 28.6%.

The deal was a trailblazer for global bond issues that followed, something IFR correctly predicted. “Many senior bankers believe that the Texaco deal opens the way for the truly globally syndicated issue, including placement in the US,” it said.

That certainly proved to be the case and it wasn’t too long before the convertible became an asset class in its own right, with its own dedicated desk within banks, and a dedicated investor base.

The market has ebbed and flowed since then but it has never fallen into irrelevance. In 2012, for instance (in a relatively poor year for the converts market), the world saw US$64bn of CBs – all of which can, to some degree, trace their lineage back to Texaco’s gusher.

1984: Irish Telecommunications £25m 10-year loan – foundation stone of loan trading

“We’re convinced it works!” bankers at Samuel Montague told IFR about their latest innovation – the transferable loan instrument. The 10-year deal was for Irish Telecommunications and raised £25m.

The structure was designed to give flexibility in the (still relatively illiquid) secondary loan market, while providing an unencumbered but legally watertight system of transfer.

At the time, the secondary loan market in Euroloans turned over an estimated US$15bn a year, but the vast majority of such transactions were conducted on an ad-hoc, informal basis.

The deal’s development lay in the standardised and comprehensive documentation that meant that a sale agreed between parties evidenced commitments under the credit agreement and entitled the holder to receive the interest and benefits of the loan. The TLI could be converted into strips. Each TLI had its own serial number and a transfer of a TLI took the old lender out of the syndicate entirely, with no ancillary costs such as stamp duty of registration charges.

Such things seem obvious now, but clearly weren’t at the time, given the amount of work IFR reported that Montagu put in with the Bank of England to win approval.

The deal followed a few months after Citicorp’s own attempt to structure Euroloans that could easily be traded – through transferable loan certificates – but that structure had at that point struggled to gain much traction.

1985: Waste Management’s US$187.5m LYON – introducing the zero-coupon convertible

It might seem that the Liquid Yield Option Note’s most lasting contribution was to accelerate the trend of dreaming up daft names for equity-linked instruments. But that would be to overlook its genuinely innovative structure – a zero-coupon, accreting note convertible into equity – that proved a breakthrough in corporate finance that has endured for decades.

Instrumental to bridging issuer and investor needs was the ability of the issuer to call the security after one year and investors to put it back to the company in three years.

From the US$250 issue price, the security accreted to an initial call price of US$297.83 a year later and annually thereafter at the straight-line accretion through to maturity at par. Investors gained similar flexibility through serial puts beginning in June 1998 at US$301.87 (a 6% implied yield) that increased to a 9% implied yield beginning in 1991 and every year thereafter at that same rate.

The rate of accretion was similar to Waste Management’s straight-debt costs, with the express benefit of a zero coupon and tax-deductibility at the accreted rate. Investors received equity participation in a 10% conversion premium.

“If the stock performs well you got participation in the upside. The flip side of a security with a high delta is that you typically sacrifice the bond component. That was not the case with LYONs because of near-term puts,” said Fred Fiddle, a long-time managing director at Merrill Lynch and the current head of strategic equity and convertible origination for the Americas at BNP Paribas. “What investors sacrificed was a cash yield because all LYONs were zero coupon.”

Merrill, as architect of the structure, held exclusive domain, underwriting a total of US$9.1bn of LYONs for 39 corporations, on a sole bookrun basis after Waste Management’s deal. It wasn’t until 1989 that rival banks were able to replicate the trade.

1986: Canada’s US$1bn 9% due February 1996 - ‘The Nines’

Not many bond issues enjoy such iconic status as to warrant a party to mark their redemption.

But that is exactly what happened when the “Canada Nines” matured in February 1996 after a 10-year lifespan that had seen it become easily the most liquid Eurobond.

The event was hosted by ScotiaMcLeod, although Deutsche Bank had been lead manager on the deal. Such was the syndication process in pre-pot 1986, however, that a myriad co-leads, co-managers, sub-underwriters and selling group members felt they had equal reason to celebrate the bond’s passing, as did a swathe of traders and investors for whom it had become a quintessential part of their day-to-day business.

“It became obvious pretty early on that it was a special deal,” said Stuart Young, who was head of trading at Deutsche when it was launched. “The sales people were going crazy, with demand coming in globally in a way we had never seen before.”

“It was an extraordinary thing. Sometimes deals just work, everything clicks,” said Robert Stheeman, now chief executive of the UK Debt Management Office, but then on the syndicate desk at Deutsche in Frankfurt.

Such was the weight of early orders that the issue, originally launched as a US$750m offering, was upsized to US$1bn – at the time a significant increase.

“It was a US$1bn deal in the context of a US$250m–$300m market, maybe US$500m,” said Martin Egan, global head of primary markets and origination at BNP Paribas, who was then trading the paper at UBS.

“The US$250m upsize would in itself have constituted a decent-sized issue on its own in those days,” said Stheeman.

Many in the market had an inkling that something momentous was in the air.

“We were told to get in early that day, just like you would for your own new issue,” said Kevin O’Neill, currently executive director of debt syndicate at Daiwa Securities, who was then head of syndicate at CSFB, a co-lead manager on the deal. “So, up we turned, and out it came – the rest is history.”

But if the primary experience was notable, it was the secondary performance that made the Canada Nines the most talked about Eurobond issue ever.

“It injected new adrenalin into a market that had been developing at a steady pace,” said Egan. “It marked the beginning of a new benchmark market – we had never seen anything like it as far as liquidity was concerned.”

“It remained liquid way beyond what you would have expected for a Eurobond, in time becoming the five-year, then the three-year benchmark,” said Stheeman.

Most bonds end up being so tightly held that liquidity drains away. However, this was not the case with the Nines, which maintained its exalted position throughout its life.

“It was just so easy to trade. It became the Eurobond benchmark and a Treasury equivalent, indeed a Treasury proxy to a large degree,” said Young.

Back in 1986, the prevailing trading convention was still on a cash price basis, even though some had begun using Treasuries to hedge positions. The Nines not only persuaded more to think about spreads but also offered a ready-made, liquid, globally traded hedging instrument in itself.

According to IFR data from the time, the paper came at a 15bp spread over Treasuries, tightening to 4bp as it outperformed, before drifting back out again.

“It took the market to a completely different level: it traded on a tight bid/offer spread 24/7,” said Egan. “And that was across the globe; traders in Europe, the US and Asia all loved it. Investors had to have it and traders had to have a position.”

Whereas previous issues had generally traded on a quarter or half-point bid/offer spread in up to US$1m, the Nines routinely traded on a 10-cent spread, US$5m a side – and tighter and bigger in some cases.

And this became a self-perpetuating phenomenon.

“What’s the point of quoting a half-point secondary spread in US$1m when others are quoting 10 cents for US$5m? You have to go tighter and bigger size, otherwise you’re not in the game,” said O’Neill.

This was not only the case as far as traders were concerned. The brokers, too, found themselves having to cut their brokerage to five cents from the previous 1/16 (6.25 cents). The positive, however, was that trading volumes were bolstered by just this one bond to such an extent that a number of brokers would acknowledge that it made (even saved) their careers.

And liquid it remained, largely on account of its size but also because of head-to-head market-making commitments. The latter, however, was mainly predicated on the former, a US$1bn issue being too large for one firm to squeeze, meaning that paper was available to borrow and traders did not fear being caught short and ultimately bought in when they were unable to deliver the bonds.

1987: £7.2bn BP privatisation: the deal that defied Black Monday

For some, memories of the Thatcherite 1980s are dominated by football hooliganism, the cavernous North-South divide and the ascent of Welsh miners to the surface and straight on to the dole queue.

Among Thatcher’s many champions – more for economic achievements than social – are students of the equity capital markets for it was through her privatisation programme that global ECM took on its current form.

“The British privatisations really set the stage for the globalisation of the equity markets,” said Eric Dobkin, founder of the ECM group at Goldman Sachs and acknowledged as the father of modern ECM. “They occurred in the immediate aftermath of ‘Big Bang’ in the UK, at a time when investors were starting to pursue more global equity investment strategies.”

The UK government’s sales repeatedly broke records for the largest equity transactions ever, forcing the internationalisation of ECM and the development of new issuance structures. This provided a way in for US investment banks that could offer access to capital across the Atlantic.

Each trade was a benchmark in its time – Britoil’s £627m IPO that went largely unsold in 1982, the £3.9bn float of British Telecom that nearly doubled on its debut in 1984, and the £4.3bn British Gas float in 1986, which came complete with a £28m-plus ad campaign.

But it was an external factor – Black Monday – that made the £7.2bn selldown in British Petroleum the defining deal of its time.

Voters – more specifically taxpayers – were a focus of all privatisations, so deals were highly publicised, slow-moving and priced well in advance. It was in March 1987 when the planned £7.2bn BP follow-on was announced – but the deal wasn’t due to close until October.

As usual, pricing was set upfront to give retail investors certainty, but because BP was already listed, underwriters had to guarantee pricing for two weeks. They couldn’t have picked a worse time.

“By malign coincidence, the world’s largest ever share sale collided with the world’s most dramatic stock-market crash,” wrote Nigel Lawson, then the UK’s Chancellor of the Exchequer, in his memoirs.

The government was not looking to give shares away, so, with underwriters and sub-underwriters already signed up, pricing was set at 330p per share on October 14 versus a trading level of around 350p.

Then Black Monday hit. That day, October 19, saw the worst ever single-day drop in both London and New York stock indices. Over October 19–20 London markets fell by more than 20%, leaving underwriters staring at heavy losses – with the ongoing BP trade the biggest contributor.

By October 27, BP was trading at 262p, versus the 330p offer price. Fees of just 18bp did little to cushion the blow.

For UK banks and brokers the pain was bearable as the process of sub-underwriting meant the risk was shared among more than 400 firms. Size and BP’s desire to increase North American representation on its shareholder register, however, meant the US and Canadian allocations were substantial and held entirely by the lead banks.

Goldman Sachs, Salomon Brothers, Morgan Stanley and Shearson Lehman Brothers as US underwriters were on the hook for 22% of the deal. The prized mandate of sole lead in Canada went to Wood Gundy, which went out of business as a result.

Bankers met at Rothschild’s offices on Friday, October 23 and discussed triggering the force majeure clause but could not reach agreement. Back at Rothschild’s after the weekend the view had hardened and UK banks – foreign firms were present but had no vote – sought to exercise the clause.

The move was rejected, but the Bank of England did offer to buy partly-paid stock at 70p (versus the 120p initial payment) to avoid the apocalyptic events outlined by US underwriters – which cited an inability to place BP shares in the market at any price, heavy selling by now overweight sub-underwriters, and an open door for a hostile buyer.

In retrospect, those on the deal recognise it was the right move as the government had to consider its whole programme of sales and hold banks to their promises, or what Lawson called his “insurance policy”.

Richard Gnodde, now co-chief executive of Goldman Sachs International, had just joined the firm as an analyst: “It was my first lesson in risk management,” he said. “When we underwrote BP we didn’t expect the market crash, but we made clear we would stick to our commitments. You can only do that if it is a risk you can deal with. Today, when taking on new commitments you use the depth of experience that you have to hand, such as the likes of Eric Dobkin, who still sits on our commitment committee.”

1987: NTT’s US$36.8bn-equivalent follow-on equity sale – size matters

Bigger is not always better. But sometimes size can’t be ignored. This deal was one of those occasions.

The deal – the second tranche of Nippon Telegraph and Telephone Corp’s privatisation – raised the then equivalent of US$36.8bn from the sale of 1.95m shares and was the largest ECM deal ever. All these years later, it still is.

To put the size into context, at the time the largest ever ECM deal in the US – a government selldown of Consolidated Rail – totalled just US$1.46bn.

The big question at the time was whether the market would be able to absorb such an offering. It could – easily.

The Japanese stock market had that year passed that of the US in size and, with NTT listing on the market for the first time, the stock was a sought after position for investors the world over.

The deal was led by Nomura, Daiwa, Nikko and Yamaichi.

1988: Mexico’s US$2.56bn Aztec bonds – the proto-Brady bond

Much credit, quite rightly, goes to then US Treasury Secretary Nicholas Brady for the development of what became known as Brady bonds – instruments that enabled hundreds of billions of dollars of debt relief for what were still known – at least in the pages of IFR – as “less developed countries”.

But it is sometime forgotten that he was building on an existing structure, devised by JP Morgan.

In particular, the signature characteristics of Brady bonds were already included in Mexico’s US$2.56bn 20-year Aztec bond when it was issued (with a Libor plus 1-5/8 percentage points coupon) in March 1988 – two years before the first Brady.

Like Bradys, the Aztec bonds were 100% collateralised by zero-coupon US Treasury bonds and were issued to bank creditors in exchange for defaulted debt at a significant (in this case, 30%) haircut.

The deal was effectively a proto-Brady bond and is therefore partially responsible for the deals that followed.

It is easy now to forget just how crucial Brady bonds were, not just in providing much-needed debt relief but also in developing the emerging market bond market.

For example, according to the Emerging Market Traders Association, less than a decade after Mexico’s first deal, the outstanding face value of Brady bonds stood at US$130bn. As soon as 1993, indeed, Bradys accounted for more than half (51.6%) of the nearly US$2trn of EM bond trading.

1989: RJR Nabisco’s US$25bn LBO – when banking meets pop culture

KKR’s behemoth US$25bn leveraged buyout of food and tobacco giant RJR Nabisco in 1989 stretched the LBO model to its very limits, sparking heated debate and inspiring a bestselling book “Barbarians at the Gate”, which was later made into a television movie.

The US$13.75bn loan package was arranged by Bankers Trust, Chase Manhattan Bank, Citibank and Manufacturers Hanover Trust.

The senior loan financing comprised a US$13.6bn tender facility, which was refinanced into a US$13.75bn permanent bank financing including US$12.75bn in acquisition financing, divided between a US$6bn, two-year asset sales bridge loan; a US$1.5bn, two-year refinancing bridge loan; and a US$5.25bn term loan.

There was also a US$1bn working capital facility.

Subordinated debt for the buyout was provided in the form of a US$5bn bridge loan from Drexel Burnham Lambert and Merrill Lynch, which was refinanced through zero-coupon debt and high-yield bonds.

The equity portion of the deal comprised US$1.8bn of convertible debentures, US$4.1bn of preferred stock and US$1.5bn of common equity.

The unease the deal engendered is made clear in IFR’s pages. The US regulators launched detailed enquiries into the risks of LBOs and even flirted with changes to tax rules to make them less attractive. That made banks, especially the foreign ones that the syndication was reliant on, nervous.

“It is very controversial,” one Japanese banker told IFR.

Needless to say, in the end, his bank – and many others – overcame their apparent fit of the vapours and piled in.

RJR remained the largest leveraged buyout ever, until 2006 when Bain Capital, KKR and Merrill Lynch got together to buy US hospital operator HCA for US$33bn.

1989: World Bank’s US$1.5bn 10-year – the first ever Global bond

The World Bank’s next huge contribution to moving the market forward – the culmination of a two-year long project – came in the form of the first globally traded and settled bond.

At the time, the World Bank achieved better pricing in the Eurobond market than in the US and the supranational hoped that a large, liquid issue, tradable seamlessly in Europe, the US and Asia-Pacific, would end that anomaly and convince US investors to treat it on par with US agency debt. It did all that and more, with the paper immediately trading on the tightest spread of any bond outside US Treasuries.

The four-times subscribed US$1.5bn 10-year was priced at 37.5bp over Treasuries through Deutsche Bank and Salomon Brothers. Distribution, split evenly between the three regions, was precisely what the World Bank had hoped for.

The deal also employed a US-style syndicate process, with a fixed-price reoffer and negotiated pricing – elements either rare or unheard of in the Eurobond market at the time.

New Zealand beat the World Bank to issue the first Eurobond with a fixed-price reoffer, but that was partly because it had taken note of the World Bank’s open endorsement of the concept.

At the time, there was some resistance in Europe to US-style deals with fixed reoffers. With the World Bank issue, that resistance crumbled and the structure became part of the everyday work of bond bankers across the world.

IFR reported that “the entire market agreed the issue had been a triumph”.

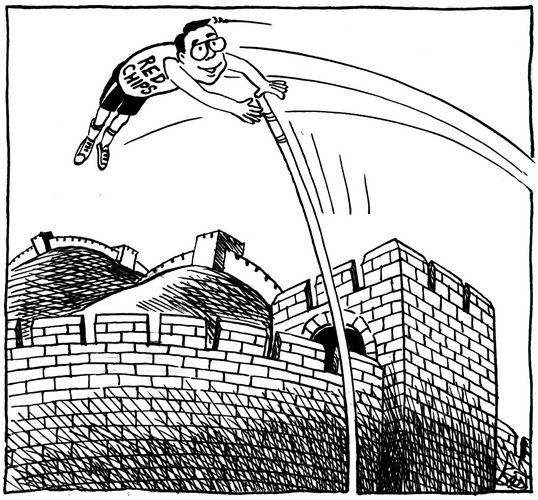

1992: Hai Hong’s HK$91.875m Hong Kong listing – the first red-chip offer

This deal, at the then-equivalent of just US$11.85m, is the smallest on the list – but it is certainly not the least significant.

It was the first time that a red chip – a Chinese mainland-controlled but offshore incorporated company – had listed in Hong Kong (or anywhere else) and was one of the most important steps in China’s emergence as a power to be reckoned with on the international capital markets.

IFR, which by now had deigned to cover the equity markets, called the deal an “overwhelming success”. Given that Hai Hong’s offer of 61.25m shares, led by Peregrine Capital and China Development Finance, was 373 times subscribed, that was presumably a relatively easy judgement.

On the other hand, the magazine also said that the deal represented “another step” towards Hong Kong “becoming the New York of China”. That must have seemed like hyperbole even to the person who wrote it. But it seems pretty much on the money now.

“Peregrine believes the issue’s success will encourage other Chinese companies to stage public offerings in Hong Kong,” IFR added.

That too ended up being a dramatic understatement. At the end of this July, China related shares (red chips and H-shares) listed on Hong Kong’s main board had a market cap of US$1.15trn-equivalent and made up more than 40% of the board’s total market cap.

1993: YPF’s US$3bn privatisation IPO – a turnaround story

Is it possible to avoid judging this deal – and its significance – by more recent events? Perhaps it should be.

Yes, 19 years after the US$3bn IPO that privatised YPF, Argentina’s government had renationalised the oil giant through what was in effect an expropriation.

But the IPO itself was a remarkable event – and it showed what was possible when it came to turning round lumbering state companies in Latin America.

From when President Carlos Menem and Economy Minister Domingo Cavallo got serious about the privatisation to when the deal was completed was a remarkably short time – less than a year – during which the company had been transformed.

The bankers on the deal, from CSFB and Merrill Lynch, knew they had to broaden the universe of investors that would consider investing in Argentina and they took Cavallo and YPF CEO Jose Estenssoro on the road to tell the story.

They both told a compelling story and the deal’s order book came together nicely in both the domestic and international markets. The size of the offering was increased to 140m Class D shares and/or ADRs representing 45% of YPF from the 110m shares planned. Even with the increase in the number of shares, the offering was well oversubscribed in all markets.

“We had almost 1,000 institutional investors, which is incredibly broad distribution,” Merrill Lynch International chairman Winthrop Smith told IFR at the time.