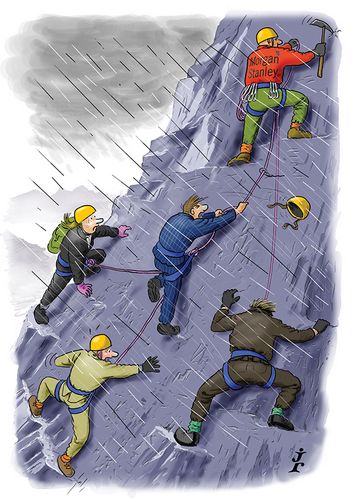

The number of bookrunners seems to increase with every year that passes, but issuers are listening to fewer banks. While some just go along for the ride, Morgan Stanley prefers to lead from the front. Morgan Stanley is IFR’s Equity House and Americas Equity House.

From Hong Kong to London, New York and all the geographies in between, no investment bank had issuers’ ears quite like Morgan Stanley. The bank ranked at or near the top of the underwriting tables across all three regions, and – more importantly – was the trusted adviser frequently earning disproportionate fees in a world that continues to favour bloated syndicates.

Companies from across the world continue to plot a path to market through the US, making a strong US footprint vital to be a global leader in equity capital markets. Banks, like Morgan Stanley, with those global footprints have increasingly found themselves facing clients in far-flung parts of the world.

“The five of us probably spent more time outside the US this year than we have any time recently,” said Raj Dhanda, co-head of global capital markets, talking about himself and other US-based colleagues: co-head Daniel Simkowitz, co-heads of ECM for the Americas Paul Donahue and John Moore, and global head of equity syndicate Evan Damast.

“This is one of those years where Europe and Asia really came back, but companies weren’t always going to do transactions locally.”

There is no better example of the global attraction of US markets than the listing of Alibaba. By virtue of advisory work provided to the e-commerce giant years ago, Morgan Stanley earned an out-sized fee on the US$25bn IPO and was mandated as one of two banks to control lock-up agreements. As further recognition of its contribution, the bank was mandated lead-left on Alibaba’s US$8bn bond sale just two months later.

Thomson Reuters estimates put Morgan Stanley equity underwriting fees across all products (follow-ons, IPOs, blocks and structured equity) at US$960m, with its 10.3% market share making it the only firm to achieve a double-digit level in percentage terms. The lead was even more commanding on IPO fees for US companies, which put the firm 120bp ahead of its nearest rival by market share.

Arguably there is no other firm where equity capital markets are so intertwined with senior management. Global equity and research head Ted Pick, global investment banking co-head Franck Petitgas, institutional securities co-COO Mohit Assomull, and global wealth management head Eric Benedict all once occupied senior leadership positions in ECM.

“There is a lot of continuity here at Morgan Stanley. The institutional camaraderie we share allows us to predict outcomes better than any other firm,” said Damast. “And that allows us to get the right price more often than not, to buy a given stock at the right price and at the right time.”

On the left

But it hasn’t been plain sailing for the firm, with 2014 offering its fair share of ups and downs in the markets.

“This year has been about windows that have opened and closed with much more velocity,” said Moore. “There was a pull back in spring, exhausting supply in June and July, the huge supply of Alibaba in September, and an October that was as difficult a time as we have seen recently.”

Conditions were tricky in Europe, too. But not as tricky as they have been in recent years. “These were the first 12 consecutive months of open markets [in EMEA] since 2006,” said Henrik Gobel, co-head of GCM EMEA. “IPO execution was the most important aspect of the last 12 months.”

Measuring IPO contributions by bookrunner roles became obsolete in 2014. As the European IPO market reopened in the second half of 2013 there were occasions when deals were run by the global co-ordinators and bookrunners were glorified lead managers. In 2014 that became the norm.

Morgan Stanley was joint global co-ordinator on three of the four largest IPOs in the EMEA region during the IFR Awards period and raised more as joint global co-ordinator than any other bank. Still, bankers at the firm were left disappointed with their tally as the €3.9bn privatisation of Spanish airport operator Aena was cancelled due to a clerical error. The leads had de-risked the trade by lining up cornerstone investors to take over 40% of the offered shares, but will have to wait until early 2015 to price the deal.

Of 21 IPOs as bookrunner, Morgan Stanley was a global co-ordinator on 16, one of only four banks to be in charge more than 75% of the time. In the US, it is a similar picture, with the bank claiming top spot when split by stabilisation manager, while the US$2.4bn IPO of WH Group – the second largest in Asia-Pacific in the awards period – provided an explicit example of the US bank being preferred to its peers. The pork producer failed to list in April with a fat syndicate. In July it successfully returned having slashed the number of sponsors from seven to two and putting Morgan Stanley on the left.

Outperformer

It is all well and good being in charge, but did Morgan Stanley produce better outcomes? Unquestionably the answer is yes.

In the US, that manifested in more deals pricing within guidance, the greenshoe being exercised more on Morgan Stanley deals than non-MS trades and pricing more deals in the increasingly volatile period following Labor Day. In Europe, it was measured in euros.

Investors in European IPOs did not have an easy ride in 2014. While IPOs did comfortably outperform their benchmarks, the absolute performance was nothing special and many investors – long and hedge – ended the year with barely any annual return. Morgan Stanley, however, provided outsized returns to investors that bought – and held – their floats.

As of November 24, Morgan Stanley IPOs (US$50m plus and weighted by size) had returned 9.1% in 2014 (and that includes OW Bunker, which collapsed when its hedging strategy for oil prices brought down the company) versus the 3.4% average of non-MS deals.

The performance improved significantly after that date when German tech companies Zalando and Rocket Internet produced their first set of results post-IPO, with the former gaining 28% by December 1 and Rocket 19%.

However, this was not a case of a bank preferring its investor clients over corporates – the stock performance was not always immediately positive.

Card Factory is one example. The £300m IPO was priced at 225p but that price was never seen on its debut, with the shares ending the first day at 201p. It took more than four months for the stock to reach 225p – but once it did, it kept going. On November 24, the stock closed at 249.7p, an 11% return from the IPO.

Pricing was ultimately shown to be correct, but the bank would not provide a free put to investors by desperately defending an issue price with the greenshoe.

It was a similar story with the US$1bn New York listing of Catalent. Morgan Stanley, as stabilisation agent, oversold the 42.5m-share IPO at US$20.50 to boost its short position. Only when the stock hit US$19.30 did the bank step in. The overallocation meant Morgan Stanley could still exercise the full 6.375m share greenshoe and deliver the additional proceeds to the company. The stock has since traded steadily upwards to end November at US$28.79.

Those are just some of the highlights in a year when the bank’s energy was boundless. It led the IPO of Emaar Malls in Dubai, where demand totalling US$40bn and a first-day pop has single-handedly revived the Gulf region.

It dominated the flow of mandatory convertible bonds across regions and was hired by the UK government for the £4.2bn sale in Lloyds, the largest ever accelerated bookbuild in EMEA. It was one of two foreign banks on the US$53bn CITIC Pacific fundraising that provided the backdoor listing of the Chinese state-owned CITIC Group’s operations.

The year also saw the US team harness the power of its recently acquired wealth management business, leveraging the US$2trn of assets for both information and huge orders.

The results of the ECM team’s efforts are ultimately shown in Morgan Stanley’s own numbers. Equity sales and trading revenue rose 7% in the first nine months of 2014 to US$5.45bn, but equity underwriting has been a standout as nine-month revenue surged 50% to US$1.27bn, higher on an absolute basis than all but one US peer and unrivalled in terms of momentum.

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.