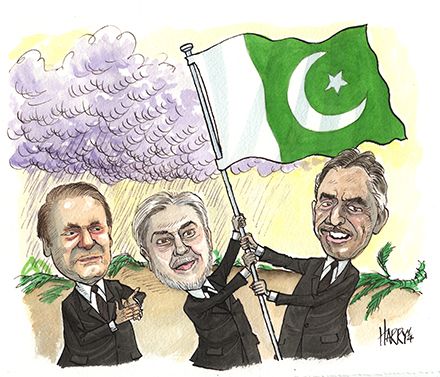

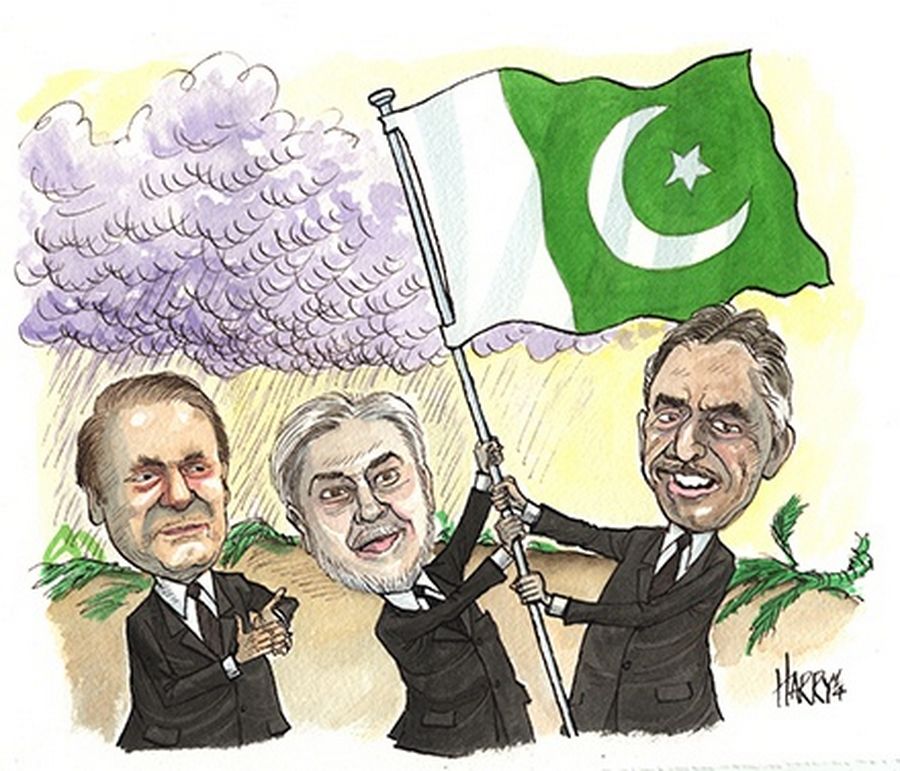

Many Asian issuers raised funds with ease in 2014, but only one capped a remarkable turnaround with offerings in both the debt and equity capital markets. For putting itself firmly back on the global markets map, the Islamic Republic of Pakistan is IFR Asia’s Issuer of the Year.

Issuer of the year

The Islamic Republic of Pakistan embarked on ambitious capital-raising plans in 2014, presenting investors throughout the international markets with an optimistic turnaround growth story. This allowed Pakistan’s new government to do two things the country of 180m had not been able to do in about seven years: price a US dollar bond and sell shares in the capital markets.

In April, the sovereign printed a US$2bn offering bonds at tenors of five and 10 years in April and, in June, it launched a Rs38bn (US$370m) offer for sale in United Bank and a Rs15 stake sale in Pakistan Petroleum.

These transactions were no mere showpieces. They were vital to Pakistan’s future. The proceeds helped increase foreign-exchange reserves and cut the fiscal deficit, two improvements required under a US$6.7bn conditional support package agreed with the International Monetary Fund in late 2013, just months after pro-business Prime Minister Nawaz Sharif came to office.

Pakistan had been forced to turn to the IMF to avert a balance-of-payments crisis in November 2008, after a run on the rupee, amid the global crisis, left it frozen out of the international capital markets. However, the IMF ended its support in 2011 after Pakistan showed little sign of economic reform, and the final US$3.7bn of a US$11.3bn rescue package was never disbursed.

Having regained the IMF’s support 2013, the government needed to show real progress in improving its fiscal position. It also needed to convince investors that the reform-minded prime minister could maintain stability in the face of severe political and economic challenges.

The country tested the waters with a US$100m 360-day loan in December 2013, its first syndicated facility in 15 years, and increased the size to US$172.5m after six other lenders joined leads Credit Suisse, Standard Chartered and Pakistan’s United Bank.

A mandate for a US dollar sovereign bond followed in early January 2014, as the government set out to take advantage of the global hunt for yield, which had led money managers lower and lower down the credit spectrum.

Days before the mandate, B1/B+/BB– rated Sri Lanka had priced a successful US$1bn five-year bond, hinting at the extent of global demand. Pakistan, however, with its far lower ratings of Caa1/B– and a bigger target size, needed to work hard to attract a similar response.

When bookrunners Bank of America Merrill Lynch, Barclays, Citigroup and Deutsche Bank started marketing the US$2bn deal around the end of March, they had many data points with which to impress investors. The IMF had just increased to 3.1% from 2.8% its growth forecast for Pakistan in the 2013–14 fiscal year, and the government had just announced an ambitious plan to privatise more than 60 companies to help fill a hole in its budget.

Pakistan’s outstanding dollar bonds were also trading at all-time low yields. The 6.875% June 2017 notes – the country’s last global issue before the crisis – dipped below 7% in February for the first time since they were launched in 2007, quite a recovery from yields of over 15% in early 2012.

The results were striking. The US$1bn five-year bond priced to yield 7.25%, and the US$1bn 10-year tranche printed at 8.25%.

The rate on the 10-year bonds was particularly low. Just days before Pakistan came to market, B+/B rated Zambia printed a US$1bn 10-year offering at 8.625%. Investors clearly valued Pakistan’s prospects, despite the lower rating.

“In broad terms, Pakistan’s credit fundamentals have improved since the new government came into office last year,” said Agost Benard, associate director of sovereign ratings, at Standard & Poor’s. “Given a B– rating, Pakistan’s current conditions are fairly benign, and the improved macroeconomic setting was what enabled the government to launch a bond this year.”

Fund managers in the US, the UK and Europe bought the majority of both tranches, signalling a strong vote of confidence in the country.

Privatisation

It was only a matter of weeks before Pakistan was back in the international markets, this time with a share offering of Karachi-listed United Bank. In June, the country disposed of its 19.8% stake in the bank, raising Rs38bn, the government’s first equity offering since it sold a 7.5% stake in Habib Bank for Rs12bn in 2007.

It was a crucial first step towards the government target to raise Rs198bn through privatisation in the fiscal year ending June 30 2015, and the first of 65 state-owned companies earmarked for partial privatisations over the next five years.

There was a lot riding on this transaction, something Mohammad Zubair, chairman of the privatisation commission, knew well. Before investors could really be convinced of the viability of Pakistan’s privatisation plan, Zubair and his associates had to convince bankers, advisers, lawyers and accountants that the country was serious. Pakistan had hired equity advisers in the recent past, only to have those planned deals go nowhere.

“I went to New York and London within two months of taking the job (to talk to the financing community),” said Zubair, who was appointed in December 2013. “This was the first indication for them that we were serious about this. If we couldn’t convince them, obviously we couldn’t do this.”

Arif Habib, Credit Suisse and Elixir Securities were eventually named joint lead managers.

Because the bank was already listed, and the government held a minority stake, it was easier to garner political support for the trade.

“Pakistan restarted its privatisation programme with the less controversial deals, and it’s a smart move,” said Ali Naqvi, head of equities for Asia Pacific at Credit Suisse. “They sought to sell companies that were already partially privatised – and at smaller stakes.”

In the end, foreign investors bought almost 80% of the 241.9m shares on offer.

“Investors liked the story a lot because the banking sector is growing and, with more stock from the sale, the name would become more liquid,” Naqvi said.

Additonally, money managers, including Templeton Asset Management, Wellington Management, Everest Asset Management, Lazard, BlackRock and Morgan Stanley, participated despite reports of militant attacks at the country’s main airport days before the deal closed.

“It was actively participated by the major funds,” Zubair said. “When we went around on the roadshows, we were able to sell the Pakistan story – Pakistan as a place to invest. There is interest in our economic momentum.”

Professional team

The transaction also put the country in good stead for what would come next.

“United Bank’s story is good, and the government delivered on execution like a professional team,” Credit Suisse’s Naqvi said. “Because of that, we were able to generate a well-oversubscribed order book. Then, once it was listed, the stock did well, which was good news for the rest of the privatisation plans.”

United Bank priced at Rs158 in early June and on August 5 it hit a 2014 high of Rs202. That was good news because Pakistan had plans to sell takes in Allied Bank and Habib Bank.

The government did not waste any time building on the success of the United Bank sale. Weeks afterwards, it sold a 5% stake in Pakistan Petroleum for Rs15bn, its second capital markets privatisation of the year and one that was heavily marketed to domestic investors.

“We went around the country to places where the privatisation commission would never have gone (in the past) to drum up interest – even among people who never would have participated,” Zubair said. “We wanted to spread the idea of privatisation around the country to everyone in the country.”

It sold 70.1m shares at Rs219 each in a mainly domestic deal that was twice covered, with a handful of foreign investors also taking part.

Not every deal was a success, however. Oil and Gas Development Corp decided to pull its offering of up to Rs69.8bn in global depositary receipts, owing a weak response from investors as oil prices tanked globally. Zubair said the country would try to sell the deal again in 2015.

As ever, it is difficult to disentangle the fiscal benefits of privatisation from politics. Indeed, one way the government sought to put Pakistan in a positive light locally was to show citizens how much international investor interest there was for its companies.

“That was another challenge. We had to say to people: ‘Look, Pakistan’s not falling apart. These financial institutions participating in UBL is a great thing for us. This is positive momentum’,” Zubair said.

To see the digital version of this report, please click here.