2016 couldn’t have been much worse for equity capital markets bankers: big spikes in volatility, intermittent periods of market closure, pulled deals and a collapse in fees. How have they weathered the storm, and how will they carry their injuries into 2017?

Few equity capital markets bankers will look back fondly on 2016. For most, the year was a long, uncomfortable ride that saw markets lurch from one extreme to the other – a year of political upheaval in the UK and Brazil, of a collapse in the wider commodity complex, and of ebbing confidence in China’s growth model. Along the way, deal after deal was caught out; almost every team came out the year scarred in one way or another.

To make matters worse, many also finished one of the most challenging years in ECM with little to show for it. Fees from equity underwriting at around US$14bn are down by about a third on 2015 – itself a poor starting point – and for the industry as a whole, the pie is the smallest it has been since 2003. For the many teams still getting back on their feet after the post-2008 slowdown, it’s been a major blow.

The year started as it meant to go on. Most major indices shed 10% or more in the first two weeks of trading, as nervous investors – still struggling to figure out what the US Federal Reserve’s first rate rise in a decade meant for their holdings – were panicked by bad economic news out of China and a gradual devaluation in the renminbi. A commodity sell-off followed, with some indices 20% down by mid-February.

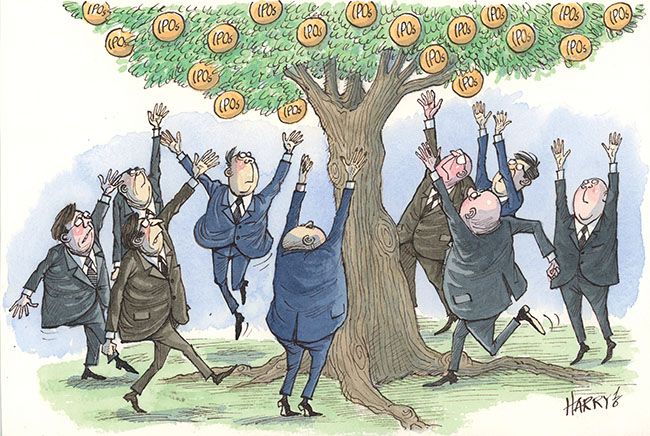

That marked the low point for most equity markets, with many indices posting a strong recovery in the months that followed. But while secondary prices rallied, primary activity never really took off. The initial public offering market in particular struggled: both the number and volume of listings globally fell by about 40%. At about US$120bn, proceeds from IPOs are the lowest since 2008.

Volatility

Bankers say that regular bouts of volatility were to blame. Each time markets – and sentiment – recovered from one knock, another blow would hit. The IPO market, with deals often taking many weeks of planning and pre-marketing and often restricted in timing to just after earnings updates, was perhaps most exposed to the regular bouts of volatility. Most major equity indices had five substantive sell-offs through the year.

“IPOs take time to get done and any spike in volatility can depress activity for quite some time,” said Sam Kendall, global ECM head at UBS. “A series of knocks – the China worries, the sell-off in commodities, political uncertainty in Brazil, and the Brexit vote – pushed deals further and further into the distance. Unsurprisingly, companies were not keen on selling in these conditions and, likewise, investors were cautious.”

But even those deals that managed to launch in windows between volatility hit resistance – especially in the second half of the year. The investor universe, which had been steadily pushing up equity valuations to multi-year highs, suddenly seemed to balk at the price of some of the listings on offer. Whether it was because of rising rate expectations, rising bond yields, or other factors is not straightforward.

“It is clear that the market turned more price-sensitive after the summer and that price ranges needed to reflect that sensitivity,” said Richard Cormack, co-head of ECM for the Europe, Middle East and Africa region at Goldman Sachs. “It is also true that the burden of proof on issuers around their outlook and guidance became more acute.”

UK waste management company Biffa was one of those caught out. It was forced to relaunch its IPO, cutting the price by a third from the previous top of the range after investors pushed back on the valuation. Others, including Spanish telecom towers operator Telxius and British banking software firm Misys pulled deals entirely. Even those that met price targets such as Danish digital payments company Nets saw little support in secondary markets.

Asia proves immune

Not all regions were hit as badly. Asia held up relatively well, helped by listings out of China. Chinese companies accounted for seven of the 15 biggest IPOs globally during the year, including the year’s biggest – the HK$57.6bn (US$7.43bn) listing in September of Postal Savings Bank of China. China Zheshang Bank, China Resources Medications, Bank of Shanghai, BOC Aviation and Bank of Jiangsu all raised over US$1bn each from their listings.

Cornerstone investors helped steer many of those deals through difficult markets, often guaranteeing juicy valuations for the stock. In many cases, half of the shares on offer were placed with just a handful of accounts. Unfortunately for US and European investment banks, the proliferation of cornerstone investors made it hard for them to compete with Chinese firms. Many lost out on some of the biggest mandates of the year.

“Foreign banks have largely missed out on the huge number of Chinese state-owned enterprises that have come to market this year,” said Kendall. “However, many SOEs have longstanding relationships with domestic banks and are keen to support them. It is a common-sense strategy. Many of these companies are looking for large domestic cornerstones that are bread-and-butter for Chinese banks.”

For many of the global firms, that has meant big declines – double-digit percentages – in ECM fees out of Asia. A cursory glance at the league tables show much of the bulge bracket dropping down, ceding further ground and ECM revenues to names like Citic, Guotai Junan Securities, China International Capital Corp, Haitong Securities and China Securities, all of which now feature in the top 10 for the region, excluding Japan.

Aggressiveness

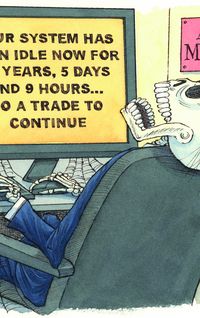

How have banks responded to the global slump in fees? According to some bankers, there has been an increase in aggressiveness from some players – particularly from mid-sized European houses that saw business collapse during the year. Many have taken to punchy bids for blocks. Syndicates have also swelled, with smaller houses fighting bitterly for even a small piece of the fees. As a result, average fees are down to 1.77% of proceeds, the lowest ever.

Having been through years of cuts to businesses – especially in Europe, where ECM activity flatlined from 2008 until 2012 – making further cuts to the franchise is not an option for many firms already operating with a skeleton crew.

“There is always business to be done, even during periods of volatility, so you need to retain a core number of people no matter what,” said Kendall. “Some employees may shift to M&A when the equity capital markets are quiet, but the core will remain in situ and will be proactively calling clients – perhaps pitching structured equity solutions which are a good alternative should cash markets be unattractive.”

Instead, banks have had to take a poor year on the chin, and diverted their focus to other products they can sell to companies that have found accessing equity markets more difficult than expected.

“There are some things you can do to minimise the impact on your P&L,” said Cormack. “One of the things that we have been focused on is growing our private placement and pre-IPO business, and that has held up even during times of market volatility. Our equity derivative business also has an element of counter-cyclicality about it and so becomes increasingly relevant in periods of volatility and lower primary market activity.”

Thoughts now turn to 2017. Most ECM teams will not be able to justify a third year of declining fees, not least at a time when many investment banks are failing to hit return-on-equity figures. Some ECM bankers are hopeful that activity will pick up in 2017 up as a backlog of deals that were postponed or not even attempted seek a return to the market.

But Cormack worries that 2017 may bring more of the same. ”This IPO cycle started in 2012 and so we came into the year realising we were past the peak and, as a result, that IPO volumes may be lower … Next year we would expect to see volumes in line to slightly better than this year on the IPO front.”

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com

<object id="__symantecPKIClientMessenger" style="display: none;" data-install-updates-user-configuration="true" data-extension-version="0.4.0.129"></object>