Lee Buchheit Profile 2165

Source: Lee Buchheit Profile 2165

Lee Buchheit Profile 2165

When Mauricio Macri took power as Argentina’s president just over a year ago with the intention of solving the country’s long dispute with bondholders, there was only one person to turn to: Lee Buchheit.

The result was a relatively quick deal with bondholders that opened the door for Argentina to return to financial markets and bring its mammoth US$16.5bn bond sale last April.

It was the highlight of another good year for Buchheit, adding to his position as the sovereign debt restructuring adviser of choice.

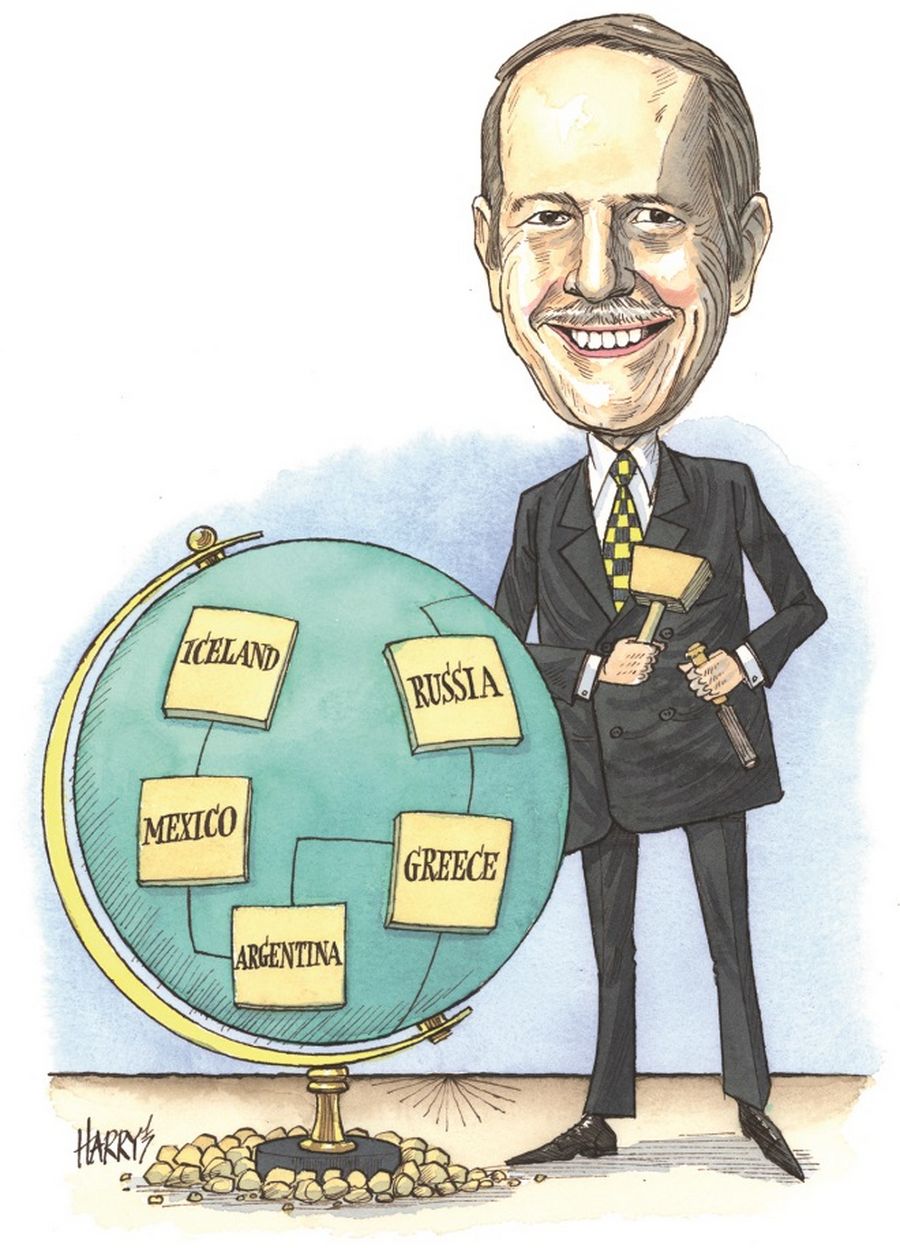

Buchheit, a senior partner at law firm Cleary Gottlieb, has led restructuring negotiations for more than 20 countries, involving some of the most seismic debt work-outs of the past three decades. His client list has included Russia, Mexico, Iraq, Iceland and Greece, where he helped orchestrate the biggest restructuring ever.

“The modern history of sovereign debt is Lee Buchheit. The rest of us are footnotes, at best,” said Mitu Gulati, law professor at Duke University.

When Argentina needed to resolve its debt crisis, there was a problem, however.

Cleary Gottlieb had already been engaged by Argentina, helping the country deal with Paul Singer’s Elliott Management, an aggressive hedge fund that had led a group of bondholders fighting its 2005 and 2010 debt exchanges.

But Buchheit had not been part of the team advising Argentina’s previous administration, led by Cristina Kirchner, who had excluded him because he had previously advised creditor Kenneth Dart on his holdout from a Brazilian restructuring in the 1990s.

Working for a creditor was a rarity for Buchheit, who has almost always advised sovereign debtors.

Macri took a more pragmatic line after taking power in December 2015, however, and was willing to listen to Buchheit’s counsel. Buchheit said a compromise should be reached with the Argentina debt holdouts, particularly since they had obtained an unchallengeable New York court order that they should be paid in full before any other creditor.

Once that was accepted a deal was reached relatively quickly. “There was no need for financial advisers to help resolve these overdue claims. Lee could do it alone,” said another sovereign debt adviser.

FILLING THE VOID

Buchheit, 66, was born in the Pennsylvania steel town of Pittsburgh, where he lived until the age of six. He can still remember putting his initials on dust-covered cars every morning, which was a “good sign” since it meant the factories were open and people employed.

He has a degree in philosophy from Middlebury College, Vermont and law degrees from the University of Pennsylvania and Cambridge University.

After joining Cleary Gottlieb in 1976 Buchheit was made a partner in 1984. He has worked for the firm in Washington DC, London and Hong Kong as well as New York, where he is now based.

In London he worked on syndicated Eurodollar loan deals, gaining useful experience for when he returned to the US and assisted on the restructuring of such loans when Mexico hit difficulties in 1982, the first major sovereign debt restructuring for decades.

Since then he has developed, through his work for distressed sovereigns, new solutions for their problems. That has often involved filling a void where no formal sovereign bankruptcy law exists.

Most significantly, in 2002 Buchheit developed collective action clauses, which say that if a supermajority of bondholders votes in favour of a restructuring, it becomes legally binding for everyone, even for those who voted against it.

He used them to most dramatic effect in Greece, where he proposed solving what was seen as the most complex sovereign restructuring in history by retroactively changing the terms of Greece’s debt, which had largely been written under domestic law.

Buchheit was taken ill at the time of the restructuring with a serious throat ailment and was unable to implement the plan, but he is credited with setting the framework.

“Lee gave us the recipe. We merely followed the cooking instructions,” said Andrew Shutter, a colleague of Buchheit’s and a partner in Cleary Gottlieb’s London office.

RESOLVING CONFLICTS

Buchheit regards the workout of Iraq’s US$130bn Saddam-era debts after the regime fell in 2003 - the largest sovereign debt restructuring up to that point - as a career highlight.

“The magnitude of that debt restructuring and the intellectual challenge was huge,” Buchheit recalled to IFR. “There was determination from the Coalition partners to get the situation sorted out quickly too so that the Iraqi economy could recover swiftly.”

Buchheit said a lesson from his restructuring work is that corruption hurts countries twice: first, when the sovereign debt is incurred and public funds are pilfered by those in power; and second, when the restructuring occurs and higher taxes are levied and deeper budget cuts made to compensate for the straitened circumstances.

The keen fly fisherman says he has no plans to retire. There is plenty of interest in sovereign debt restructurings to keep him actively engaged, much as he would like to spend more time writing and teaching.

BREAKING THE ICE

Another highlight of his busy 2016 was breaking the ice on the long-standing dispute between Iceland and the international creditors of its banks.

Capital controls prevented foreign creditors taking out any dividends arising from their claims against Icelandic banks that failed in 2008, and the island’s authorities were worried that allowing large sums to leave in one go would lead to a run on the Icelandic krona.

Buchheit helped broker a compromise, signed in March, which saw a tax levied on the claims as they were gradually withdrawn.

Another sovereign debt expert called reaching a consensual deal “an astonishing outcome” in view of the long delays in the process.

Buchheit has also been consulted over the past year temporarily by Mozambique on its unexpected financial difficulties. But he has so far resisted talking to Venezuela, the major outstanding distressed sovereign debtor.

He has written about Venezuela’s problems and their possible solution in an academic article, however, as he has frequently done in the past.