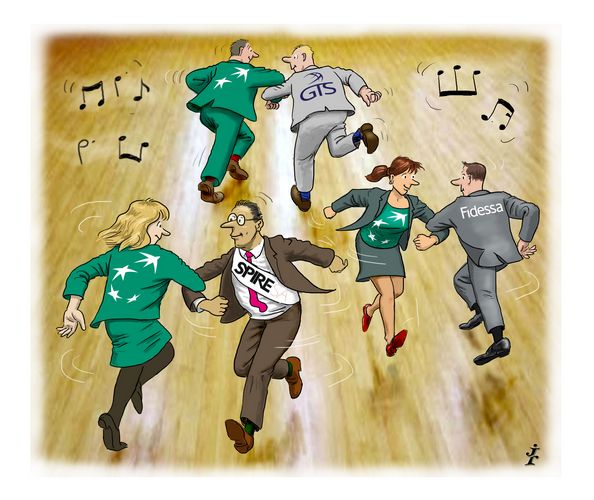

Take your partners

As volatility evaporated, derivatives businesses had to focus on core strengths to make headway in 2017. For an integrated approach that spread equity know-how across asset classes and enabled effective risk transfer across the broad client franchise, BNP Paribas is IFR’s Derivatives House and Equity Derivatives House of the Year.

Even as the US Federal Reserve pulled the trigger on rates, markets remained unshaken and banks had to battle for their share of a shrinking wallet as volatility plumbed new lows. Three years after combining equities and fixed income under a global markets umbrella, BNP Paribas outpaced much of the competition – dramatically so in equities – gaining market share in all client segments as equity derivatives innovation was unleashed across rates and credit businesses.

“We’ve been able to grow the franchise from a product house to a full-service client house and we want to be seen as a market leader around the world in derivatives,” said Olivier Osty, executive head of global markets at BNPP. “We’re a strong European partner and want to be the European bank of choice for global clients.”

Extensive corporate, institutional and retail networks helped maximise capacity. The bank’s alternative risk transactions framework allowed structured product risks to be transferred to yield-hungry institutional investors, while receivables from corporate swaps were repackaged for institutions via its XVA platform.

Serving more than two-thirds of large European corporates, the bank retained capabilities in products that others had largely discarded – for example, balance-guarantee swaps that hedge pre-payment rates in corporate securitisations.

“We are one of the very last banks standing in that space; so much so that some bulge-bracket banks that have given up on balance-guarantee swaps come to us for hedging their flows coming from securitisation deals,” said Pascal Fischer, head of global markets, EMEA.

Operating across 38 markets, BNPP expanded its capabilities in G10 rates and beyond. For example, it provided a full contingent cap on Polish zloty rates to a private equity fund acquiring a target in the country.

“Our clients view BNP Paribas as a reliable long-term partner and we’re here in all weathers,” said Fischer. “We’re a primary dealer across Europe, Asia and the Americas, and we know what’s going on in terms of regulation. This combination means we’re too visible to ignore and that helps a lot when you’re facing a shrinking revenue pie.”

SMART AT HEART

The bank ramped up its digital aspirations in preparation for MiFID II. The Smart Derivatives platform for automatic structured products pricing went multi-asset, adding credit-linked notes and rates products.

“There’s a technological revolution going on and choices being made today will be a huge differentiating factor tomorrow,” said Nicolas Marque, global head of equity derivatives.

The platform was used by 3,700 users to price more than 20,000 products a month and clients singled it out as a key tool for idea generation.

“It’s versatile, reliable and the support team is extremely responsive and efficient,” said Aurelien Callegari, head of structured products Europe at Barclays Wealth.

When it came to filling gaps, partnerships were the name of the game. In November, the bank agreed a tie-up with electronic market maker GTS, aiming to increase its share of Treasuries trading to 5% from 1.5% and drive gains in US dollar swaps trading.

“It’s a game-changer for all of us and something we couldn’t have done without global markets because it’s an initiative coming from equities and global rates,” said Osty.

The bank partnered Fidessa for listed derivatives trading. That supported a turnaround in the derivatives clearing platform, which returned to profitability in 2017.

EQUITY LEADS THE WAY

Equity trading was the star of the global markets show as revenue jumped 23% in the first three quarters – a remarkable achievement against an industry-wide trading slump. That compensated for a 5% fall in fixed income trading and secured overall revenue growth for the global markets division.

“Equity derivatives faced many pressures, but we have been taking market share,” said Marque. “We had another good year in the institutional and corporate business but the real difference was a strong rebound on structured products.”

Years spent buying and integrating structured products portfolios paid off and in May, the bank agreed to acquire over €5bn of structured products risk from ING.

Risk-transfer trades, such as corridor index variance spread payoffs, were given a makeover. Knockouts were added to more accurately mimic autocall products that knock out on a market rally. That also addressed the “dead capital lock-up” by returning initial margin to clients following a knock-out event.

“For us, BNPP is the leading franchise as they offer the full landscape of products, but their main strength is dispersion,” said one equity derivatives hedge fund trader. “They have a real edge in global dispersion as they can sell packages on worldwide indices, which is very innovative.”

Ultra-low volatility meant traditional dispersion strategies that monetise the spread between the vol of the index and its constituents did not work. BNPP optimised returns with global dispersion trades on baskets of 250 stocks across Europe, the US and Asia. That saw investors buy single stock volatility and sell the vol of the basket, which was typically under less pressure than index vol.

Clients welcomed the bank’s leadership in dividends research and trading and one asset manager was impressed by volatility recycling on illiquid indices.

“The difference with BNPP is innovation – they just have more interesting trades,” said the asset manager.

New requirements to post margin on uncleared OTC derivatives saw BNPP work with Frankfurt’s Eurex exchange to recreate over-the-counter equity swaps in listed format. Launched in December 2016, Total Return Futures on the EuroStoxx 50 traded over €10bn of notional in their first 10 months and BNPP took a 50% market share, including blocks as large as €700m.

Clients cited delta one as a core strength, welcoming timely market intelligence, tight spreads and interesting axes from the structured products business.

“BNPP backs up its strength in sales and trading with an excellent clearing and derivatives prime brokerage proposition as well as a commitment to product innovation,” said David Elms, head of diversified alternatives at Janus Henderson Investors.

CREDIT WHERE IT’S DUE

BNPP responded to a backdrop of tightening credit spreads and ailing cash liquidity by merging its primary and secondary credit teams.

The dealer capitalised on its position as Europe’s top-ranked trader for credit default swaps, emerging as a rare European player in the revival of a cleansed version of the synthetic collateralised debt obligation.

For one European hedge fund, the bank constructed a US$1bn portfolio of names on which the investor was comfortable taking two-year first-loss risk. The bank lined up three other global investors to take the senior and mezzanine tranches within one day, eliminating the need to charge for risk or balance sheet.

“To be able to line up all of the players in one go, you need a broad franchise and you need to be able to trade 150 names in a matter of minutes,” said Denis Gardrat, global head of credit structuring.

With asset class silos broken down, innovation flowed from the equities business to help insurers hit minimum yield targets without incurring excess capital requirements under Solvency II. By combining iTraxx Crossover positions with systematic put option purchases to cap the downside, the High Yield Protected Europe Index delivered 70% of crossover returns for just 30% of the capital requirement.

RATES INSPIRES

The bank combined flow and structured rates sales teams, while a new approach to large global clients saw the creation of client-specific sales, trading and research teams across regions.

“What we did better is to turn rates into a solutions business,” said Fatos Akbay, head of rates structuring, EMEA. “The solution might be flow, but the discussion can go a long way down the structured route before it gets there.”

Once again, innovation was borrowed from the equity business, as reverse convertibles were sold on interest rates, bond yields and inflation.

“Other banks that reduced are piling back into rates and that’s put us under pressure to be more innovative,” said Arne Groes, global co-head of G10 rates.

BNPP was part of a four-strong bank group behind SPIRE – a centralised special purpose vehicle that aims to bring secondary liquidity to customised bond repacks that embed derivatives for yield enhancement.

BNPP led two of the 13 deals, including one for a French insurer that repackaged bonds into a long-dated forward inflation-linked payoff to accurately hedge its liabilities.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.