Focused effort

In a fiercely competitive market, one bank held off a growing number of local rivals to win an impressive number of sole-sponsor mandates from mid-cap clients in 2017. For its consistent focus, BNP Paribas is IFR’s Asia-Pacific Mid-Market Equity House of the Year.

BNP Paribas has been focused on helping Asian mid-cap companies raise funds across the years and added to its reputation in 2017, despite fierce competition. Of the French bank’s 18 Asian equity placements during IFR’s review period, 16 were in the mid-cap sector, including a number of sole-sponsor mandates from Chinese clients.

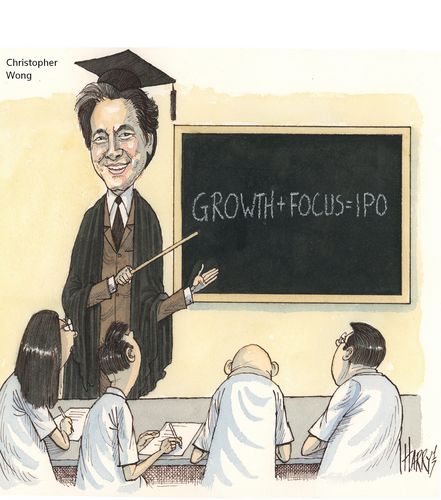

“We have been very consistent in serving mid-cap clients, be it a good or bad year. We don’t jump on the mid-cap deals just because there are no big deals in the markets,” said Christopher Wong, co-head of equity capital markets for Asia-Pacific.

The clarity of focus paid off in 2017, especially in the China education sector. After bringing international school operator China Maple Leaf Educational Systems to the Hong Kong market in 2014, the first China education IPO in the city, BNPP has established a reputation as the go-to bank for many other Chinese education companies.

The strong performance of Maple Leaf shares, which have nearly tripled since its IPO, helped BNPP secure the sole-sponsor role on the HK$913m (US$117m) IPO of Wisdom Education, a Chinese primary and secondary education provider, and the HK$795m float of China New Higher Education, which provides undergraduate education and junior college education focused on applied sciences.

The Wisdom IPO in January was particularly important as it was the first Chinese education company to go public after the country introduced new rules in late 2016 to clamp down on private education firms.

The new rules ban for-profit schools from teaching first through ninth grades, forcing many education companies to turn themselves into non-profit schools, which in many respects will subject them to government controls, including set tuition fees.

As a result, Wisdom floated at a discount to the listed comparables, but it has since outperformed. The shares stayed around the IPO price in the first month after listing and began to climb afterwards. As of November 29, the stock was up 175% from the issue price.

The deal opened the door for other education companies to list, with three more such listings in Hong Kong this year after the Wisdom float. BNPP also helped arrange the US IPOs of Bright Scholar Education and RYB Education.

Beyond the education sector, BNPP was also the sole sponsor of the HK$855m IPO of automotive components supplier Xin Point, which has gained more than 50% since listing in June.

BNPP also delivered for mid-cap clients in South-East Asia and India, requiring skillful underwriting and innovation. It was one of the three joint global coordinators on VietJet Aviation’s D3.78trn (US$166m) IPO, a groundbreaking Vietnamese deal that narrowed the time between fundraising and listing.

Innovations in the IPO included an offering of participatory notes to help overseas investors overcome the complex account opening and documentation requirements in Vietnam, and BNPP delivered more than its one-third share of total demand.

In India – one of the most vibrant IPO markets in Asia – BNPP helped cable operator GTPL Hathway raise Rs4.8bn (US$74.4m), while in Indonesia it was one of the bookrunners on Chandra Asri Petrochemical’s Rp5trn (US$370m) rights placement. The deal was launched into a weak market, following a near 30% drop in rival Lotte Chemical Titan’s shares after its Malaysia IPO, but went through successfully and traded well, despite a higher valuation.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.