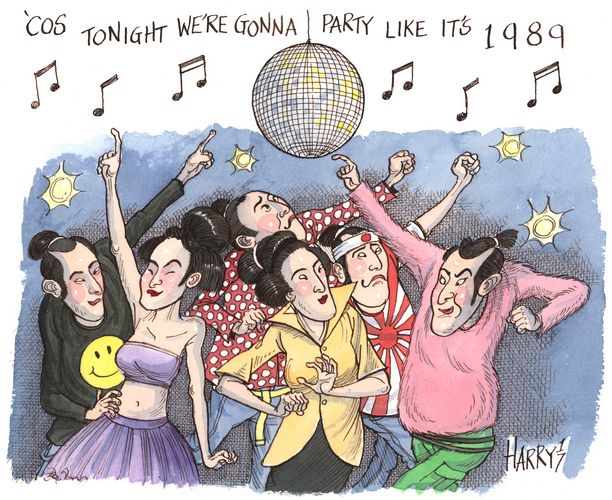

Growth is (relatively) strong, markets are up as a result and capital markets activity is buoyant. The return of Tepco to the bond markets and the funding dynamism of Softbank were among factors that gave bankers in Japan and those who focus on the market from abroad a certain swagger.

Markets like milestones, and Japan had its fair share in 2017. Even with North Korean ballistic missiles flying overhead, the Nikkei 225 closed a hair’s breadth away from 23,000 on November 7. The fact that this represented a jump of more than 33% year-on-year was remarkable enough. But more important for the market psyche was that the index had not seen those levels despite being on an upward trajectory for 30 years.

The re-election of Shinzo Abe’s LDP in October 2017 was a key political milestone insofar as it presaged a period of policy continuity around key tenets of Abenomics, including the maintenance of fiscal and monetary stimulus. That boosted the market’s confidence, which was further supported by the economic data: preliminary estimates for annualised real GDP growth for the third quarter, released on November 15, came in at 1.4% – for the first seven-quarter positive showing in 16 years.

Meanwhile, a bond market milestone was reached in 2017 with the return to the primary market of Tokyo Electric Power, the operator of the Fukushima nuclear power plant, for the first time since the disaster of 2011. This too played very positively to the market’s psyche as Tepco had formerly been the bellwether Japanese bond issuer.

Tepco Power Grid tapped the domestic market with four dual-tranche trades over the course of 2017, raising ¥360bn (US$3.2bn). Its debt re-IPO in March restored the Japanese bond market’s natural order in some respects and was seen as a symbolic return.

Softbank was front-and-centre of activity in 2017. The Japanese tech giant closed Asia’s largest-ever syndicated bank facility, a ¥2.65trn senior and hybrid loan package to refinance its Sprint acquisition loan and the bridge loan backing its £24bn takeover of chip designer Arm Holdings. It took ¥450bn from the domestic bond market in March; played into demand for yield in July with a US$4.5bn dual-tranche dollar hybrid (the largest-ever dollar perp) and raised US$6bn in dollar and euro senior notes in September – the biggest-ever sub-investment grade bond issue from Japan that pulled in orders of more than US$20bn.

In M&A, the company was behind six of the dozen biggest outbound Japanese deals of 2017 (to mid-November). It acquired robotics company Boston Dynamics and investment company Fortress. In the wake of the collapse of the Sprint/T-Mobile merger, it said it would increase its majority stake in Sprint. It also upped its stake in the Intelsat/OneWeb combo. The company or its Vision Fund acquired stakes in Chinese software company Xiaoju Kuaizhi, New York-based shared workspace provider WeWork, Indian wired telecoms carrier One97 Communications, New York biopharma Roivant Sciences and ANI Technologies, an Indian provider of taxi services.

ROBUST ACTIVITY

Activity generally in Japanese capital markets was buoyant in 2017. The jumbo US$11.5bn second privatisation tranche of Japan Post Holdings pushed Japanese ECM to a four-year high. Japanese debt issuance, meanwhile, and within that issuance of corporate bonds, both set volume records as issuers rushed to take advantage of historically low yields.

Among key trends of 2017 was a willingness by investors to move down the investment-grade credit curve and to buy longer-dated paper. The market saw corporates crowd into the 10-year space and beyond.

“There was a balance of supply/demand factors here,” said Naoyuki Takashina, co-head of Nomura’s international DCM business in Japan. “Coupons of 0.1bp–0.2bp for short to medium-term tenors were unattractive for buy-and-hold investors, so they were happy to take longer duration risk.”

The past year was also characterised by a significant increase in non-yen funding, particularly in US dollars.

“Japanese corporates had been monitoring the international market for some time but were relatively slow to move forward. In 2017, the favourable dollar-yen basis and continuously constructive market conditions made US dollar funding very attractive,” said Tatsuya Yasuda, the head of Nomura’s international DCM business in Japan.

Corporates certainly tapped international markets to lock in good funding levels. Outbound M&A, where activity remained robust in the wake of 2016’s all-time high, played a role in this story but a number of factors propelled Japanese corporates into foreign bond markets.

“Some issuers upped their dollar funding in response to an increase in dollar assets; some switched short-term money [eg, repo, FX hedges] to longer-term funding. Others focused on investor diversification; others still, notably the mega banks, issued in response to new regulations,” said Vince Purton, head of DCM at Daiwa Capital Markets Europe.

Asahi Group partially refinanced its €7.4bn bilateral bridge loans backing its takeover of AB InBev businesses in five Eastern European countries with a four-part ¥280bn domestic bond issue but more strikingly a €1.2bn two-part euro bond debut.

Mitsui Fudosan (also a debut), Takeda Pharmaceutical (to refinance its acquisition of US-based ARIAD), Central Japan Railway, Central Nippon Expressway, Chugoku Electric Power, Suntory, Mitsubishi Corp, NTT and Orix all accessed dollars in 2017; alongside the more common Japanese FIG, auto and agency fare.

“The international bond market is wide open for Japanese corporates. As well as acquisition financing and arbitrage funding, international markets offer diversification,” said Morven Jones, head of DCM origination, EMEA, at Nomura International in London.

GOING THE OTHER WAY

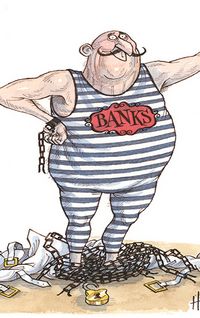

On the flip side, while Japan continues to be a very important component of international issuers’ funding strategies, issuing in yen demands the availability of good arbitrage, which is a major driver of supply. “On that basis, volumes were lighter in 2017 but issuers would love to do more in the Japanese market if cost efficiencies are there,” Jones added.

That said, activity was reasonable and 2017 saw a greater variety of issuing formats between Samurai, Global, Euroyen and Pro-bond options.

“The search for yield saw risk appetite develop. We saw longer tenors and a move down the investment-grade credit spectrum alongside an enthusiastic reception for regulatory funding instruments from banks. We also saw SRI Samurais resurface too, as a sign that institutional demand for this product is developing rapidly, following the strong showing for several years of such trades in the Uridashi and MTN markets,” said Purton.

Stand-out trades by foreign borrowers included the ¥100bn three-tranche affair from the Republic of Indonesia, its first clean sovereign-risk Samurai since 1983. EDF’s four-part ¥137bn Samurai was notable because it was the largest-ever corporate Samurai, had the biggest volume at 10 years and beyond and came with two Green tranches.

Starbucks’ ¥85bn offering was the first yen corporate sustainability bond (proceeds will fund sustainable coffee supply-chain management) but it was noteworthy too because it came in Global format and its success led the way for Walmart and Corning (the latter a remarkable outing from a Triple B issuer that raised seven, 10 and 20-year money) to also bring yen Globals as Japanese asset managers switched to this format to alleviate the impact of reduced Samurai issuance.

The regulatory capital trades by French banks were another stand-out feature. BPCE led the way in January with a ¥142.7bn three-part senior non-preferred Samurai, the first of its kind in yen. It was followed into the market by BNP Paribas, Societe Generale, Credit Agricole and BFCM.

“FIG issuers have been assiduously meeting investors in Japan, explaining their individual situations and their strategy to raise regulatory funding well in advance of actual issuance so investors had sufficient time to understand the dynamics, digest the changes and get the necessary approvals in place,” said Purton.

Investment bankers have also been laying the groundwork for issuers over the last couple of years, educating investors about the new capital regulations and the features of the different classes of TLAC/MREL debt.

“We received very encouraging feedback from investors and this provided the motivation to market these opportunities to our bank issuers. It’s been an important diversification play for issuers where the arbitrage has been attractive,” said Jones.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.