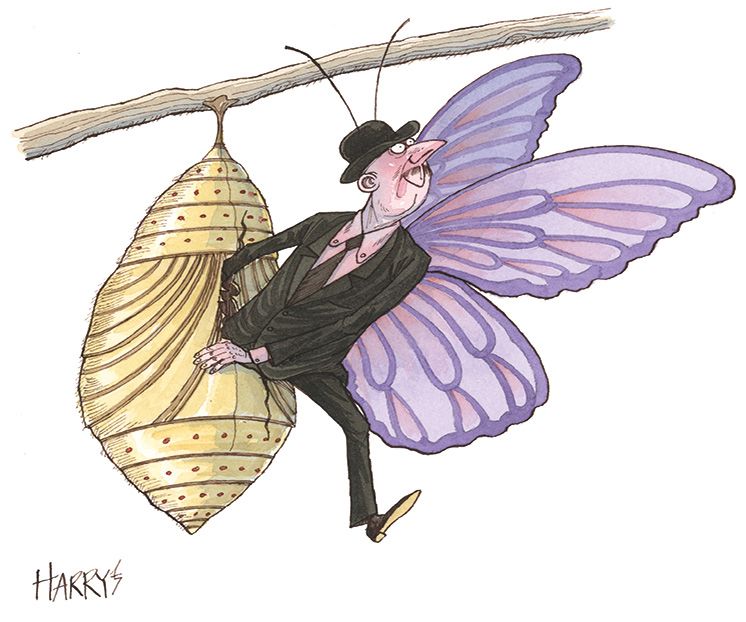

A reformed and reshaped global banking industry is investing for growth again. But with decent profits still elusive for some, and a host of headwinds to battle against, it’s too early to declare that happy days are here again.

The global banking industry has undergone a painful process of restructuring since the global financial crisis. The good news for the world’s largest banks is that the crisis-induced heavy lifting that witnessed them engage in arduous deleveraging, dramatic contractions in business lines, headcount and geographical footprints – and saw European and US authorities levy more than US$300bn in fines – is essentially at an end.

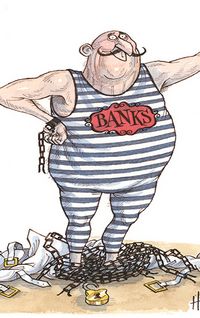

Institutions queued up in 2017 to laud the progress that has been made. In its Global Banking Annual Review for 2017, McKinsey says the recovery from the financial crisis is complete now that capital stocks have been replenished (they are deeper today, the firm notes, than at any time in recent memory, with the industry Tier 1 capital ratio reaching 12.4% in 2016), while banks have taken an axe to costs.

The IMF takes a similar line. In its October 2017 Global Financial Stability Report, it noted that the world’s most systemically important banks (aka G-SIBs) “have significantly strengthened their balance sheets with an additional US$1trn in capital since 2009 while reducing assets. Adjusted capital ratios … have in aggregate risen steadily since the under-capitalised pre-crisis period. G-SIB liquidity has also improved: loan-to-deposit ratios are down from the elevated levels a decade ago, and reliance on short-term wholesale funding has fallen.”

On a total-assets-to-tangible-book-value basis, EU banks have deleveraged by 30% since the crisis, notes Davide Serra, founder, CEO and CIO of Algebris Investments, the financial sector-focused hedge fund. Serra also points to an average 5.1% fully loaded Tier One leverage ratio (against a 3% requirement from 2018) and an average liquidity coverage ratio of 146% (versus a minimum requirement of 100%).

Higher capitalisation and liquidity levels; more focused business strategies, better operational risk management; less fragmented IT architectures (the latter is still a work in progress); and the new resolution framework have certainly diminished systemic risk factors. Even banks that remain entangled in various stages of reform (such as Deutsche Bank, Credit Suisse and UniCredit) are well into restructuring phases, and from an industry perspective are idiosyncratic laggards and outliers rather than representative.

Capital and cost optimisation, just like business line optimisation, has become an industry constant. The fact that banks, including recent and current reformers such as Barclays and Deutsche Bank, established financial resource management units in 2017, focusing exclusively on efficient capital allocation across the suite of core businesses, speaks volumes. More than a nuance, this is a step-change in approach and mindset.

POSITIONING FOR GROWTH

Given the strength of headwinds, it is perhaps too early to declare outright victory. And to be sure challenges remain. McKinsey, for example, points out that for all of the turnaround work, profits remain elusive, although that has much to do with poor underlying business conditions.

The focus for banks that are through restructuring is on positioning for and investing in growth.

For James Davis, a partner in Oliver Wyman’s financial service practice, a year that started with optimism around prospects for the economy and for the regulatory environment turned to disappointment through the year.

“Historically low levels of volatility really held things back in markets businesses so despite a strong year for advisory and underwriting, overall industry revenues are likely to be slightly down. That’s led to a very competitive environment where most banks are looking to invest and grow but there isn’t enough revenue to go around,” he said

“A big thing to watch next year will be whether we see a return of volatility that will boost markets revenues and whether management teams are able to hold the course and stick to their growth plans. At the same time, weaker revenues will redouble focus on efforts to leverage new technologies to build new competitive advantages and streamline the cost structure.”

Another potential avenue for growth comes from consolidation, which has emerged as an option. Various mostly speculative combinations emerged through 2017 mainly involving Commerzbank tying the knot with, depending on who you believed, UniCredit, BNP Paribas, Nordea or Deutsche Bank. Expect this theme to accelerate in 2018.

CAUTION

Oliver Wyman adopted a slightly cautious tone in parts of its European Banking 2017 report. It certainly recognised the balance sheet repair and concentration on core business activities, noting that European banks have exited non-core or structurally unprofitable businesses and markets that generated annual revenues of €10bn in 2009, equivalent to 10% of total wholesale banking revenues. But it reckons banks still have a fair way to go in cutting costs and simplifying infrastructure.

And it is guarded about returns. “While the performance of European banks has recovered from the lows of 2008 the average return on capital of 4.4% remains well below the hurdle rate,” the report said. From a business standpoint, it believes Europe’s banks are emerging from the crisis only to face a whole new set of challenges (new customer preferences, digital interfaces and platform businesses). “The new agenda is going to require boldness of a kind: going beyond restructuring and making changes to the banking business model itself,” the report noted.

The IMF is also concerned about returns. “While many banks have strengthened their profitability by reorienting business models, several continue to grapple with legacy issues and business model challenges. Banks representing about US$17trn in assets, or about one-third of the G-SIB total, may continue to generate unsustainable returns, even in 2019,” it noted in its GFSR, urging supervisors to remain focused on business-model risks and sustainable profitability.

DRIVING UP RETURNS

The effort to reduce costs to drive up returns continues. Banks have aggressively cut costs across a number of fronts. But the problem is that revenues have also declined as a direct result of some of the same measures when underlying business conditions have been less than conducive. The result is that cost-income ratios have remained stubbornly constant or even worsened.

“Wholesale banks are still early in the journey of applying new technologies to restructure their businesses and we see lots more potential in this space. Delivering on this promise is not easy and banks have a mixed record to-date. If revenues remain weak, investors will be increasingly focused on the potential for technology to drive cost release. The ability to set out and deliver against a clear story on this is likely to be a differentiator across banks,” said Davis.

On returns, pushing industry ROE beyond the 8%–10% imputed cost of equity has been a conundrum, especially against a backdrop of unprecedented low interest rates and flat-lining volatility; a conundrum that is reflected in wide variations in bank valuations (some still showing considerable discounts to tangible book value).

But the reasons for the variations have shifted dramatically. In 2010, 74% of the difference was due to a simple correlation where banks operating in hot markets were valued more highly. In 2017, that accounts for just 39% of the difference. The rest is due to business models and their execution, strategy, well-aligned initiatives, and the other levers that banks command, McKinsey found.

What the industry clearly needs is a sustainable phase of growth in underlying economies. And perhaps as importantly, the cycle of higher interest rates to kick in and season, the yield curve to normalise and interest margins to widen to encourage greater volatility, create better conditions for lending and transaction banking and a preparedness among clients to trade.

That is likely to feed a phase of revenue growth, particularly for banks with large corporate franchises. Except even here there is uncertainty as to the short-term impacts of MiFID II and IFRS 9 and the longer-term impacts of streams such as Basel IV and the Fundamental Review of the Trading Book.

And as the cycle turns at the same time as banks move more fulsomely into the invest-for-growth cycle with cash on hand, the competitive environment will become more intense – just as digital innovations and regulatory-induced price transparency add to the downward pressure on margins while higher rates push up customer default rates. In other words, and to put it mildly, the backdrop is complex.

A fascinating element of the next part of the story will be to what degree US banks bring to bear the fact that they are much further ahead in the restructuring stakes on their competitive positioning in Europe.

“European banks have already ceded 10% of market share to US banks over the last few years and with the largest five US investment banks generating a combined US$8bn more profit before tax every quarter than the largest five European banks there is every chance this trend will continue,” said Davis.

To see the digital version of this review, please click here.

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com.