After China outlawed trading and Jamie Dimon likened bitcoin speculation to tulip mania, what’s next for digital finance in Asia?

The virtual currency world will remember 2017 as the year in which this niche and somewhat shadowy industry exploded into the public consciousness. The seemingly day-by-day rise in the price of bitcoin and the explosion of the number of smaller rivals, known as alt-coins, created a spate of headlines. Virtual currency also barged its way into the corporate finance world through the much-maligned initial coin offering (ICO).

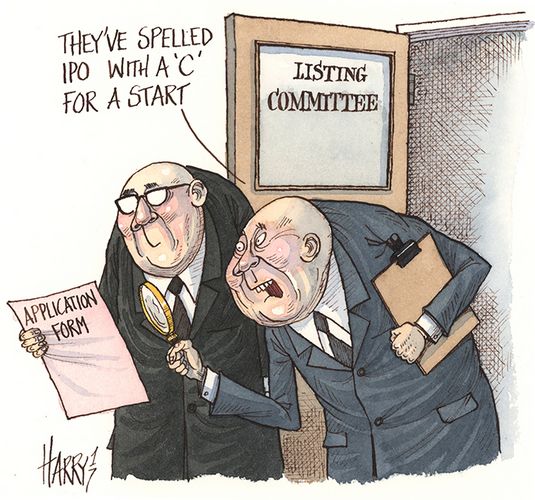

The concept of the ICO is one that is so far not being taken seriously in traditional corporate finance circles. The plethora of scams and bizarre celebrity issuances have as yet only served to create a toxic reputation for ICOs. But once the hype dies down, there is a serious question to be answered for the investment banking industry. Are bankers in danger of being cut out of the fundraising process?

A typical ICO involves the sale of virtual currency, which provides capital to the seller and allows buyers to access the company’s platform or product. The virtual currency tokens are usually facilitated by blockchain – or distributed ledger – technology and tradable after the primary issuance. Information is given to prospective buyers through a document known as a white paper.

Companies like Australia’s Power Ledger, which raised A$34m (US$26m) in the second half of 2017 from the country’s first ICO, seem particularly suited to the model. The deal gave token buyers, such as utility companies, retailers and households the ability to trade renewable energy on the company’s blockchain-based platform.

“The whole concept of the ICO is well-aligned with peer-to-peer energy trading,” said Power Ledger managing director David Martin. “The token is used in energy trading and useful for the business model … we had other alternatives, but the ICO stood out head and shoulders as the right way to go.”

CRYPTOGRAPHIC MODEL

The thinking behind Power Ledger’s decision can provide both comfort and worry for those in the corporate finance business. On the one hand, the company’s ability to raise its own funds without relying on outside help is hardly encouraging for intermediaries. On the other hand, the model’s appeal seems to be limited to companies where blockchain is integral to their business model.

“I think that the ICOs that you have seen do well are the ones where there’s a cryptographic model central to the business,” says Martin.

As of November 27, a total of 228 ICOs had raised over US$3.6bn in 2017, according to industry website Coinschedule. This figure represents a phenomenal rise from the mere US$100m raised in 2016.

As the publicity around ICOs grew, several heavyweights of the banking world weighed into the debate, with JP Morgan CEO Jamie Dimon calling bitcoin a “fraud” and warning that it will eventually “blow up”.

The price of one bitcoin has shot up to over US$9,000, up from around US$4,000 in mid-August.

Goldman Sachs analysts pointed out back in August that ICOs had in fact outpaced angel and seed funding for the internet sector in the preceding months, sounding alarm bells for an industry that thrives on early-stage investments in the tech giants of tomorrow. But despite the disruption lower down the chain, panic does not appear to be setting in just yet at the big investment banks, which typically service larger companies.

“There’s been an explosion of capital raising, but it’s too small at the moment to be taken seriously,” said one ECM banker based in Hong Kong.

“I think for smaller companies in this new economy of fintech and insurtech, it could become something, a real trend, but it’s still seen as a bit dodgy. My perception is there seems to be a lot of resistance from the established players. Everyone agrees that blockchain is coming, but ICOs are a bit marginal.

“What we need to see is a proper tech company raise capital in that form. I think that will change things.”

REGULATORY MISHMASH

The key to whether ICOs make it into the mainstream will depend on the development of more coherent regulation. Regulators have scrambled to get a handle on the new sector, with responses ranging from warm and welcoming to outright bans and several more non-committal responses in between.

“Globally, we are seeing significantly divergent approaches,” said Urszula McCormack, a partner at law firm King & Wood Mallesons in Hong Kong.

“We have jurisdictions that follow a ‘middle of the road’ approach, publicly confirming that there are areas of regulation with which token issuers need to comply. Then you have the heavy end of the spectrum that effectively bans token sales. And finally at the other end are more supportive regimes that are proactively supporting the development of a digital assets ecosystem, often with regulation.”

The country that caused the biggest splash with its reaction was China, which pulled up the drawbridge on ICOs back in September with a ban that sent shockwaves through the fledgling industry. In a joint statement, a bevy of government bodies, including the People’s Bank of China, ordered individuals and organisations that had completed ICOs to return the funds.

McCormack also puts South Korea and New Zealand in the category of countries that have come down heavily on ICOs. South Korea followed China barely a month later by implementing its own ban amid negative headlines around scams. When the New Zealand Financial Markets Authority published its thoughts on ICOs, it designated all tokens and cryptocurrencies as securities, obligating issuers to comply with all relevant regulation.

Similarly, the US Securities and Exchange Commission labelled a US$150m raising for an organisation known as “The DAO” as a sale of securities, which should have complied with the relevant securities laws. The DAO’s offering became notorious after around one third of the proceeds were stolen by hackers.

Earlier in the year, Japan became the first country to regulate virtual currency exchanges after recognising bitcoin as a legal payment method. Japan has long shown a more tolerant approach to virtual currency and its moves on the regulatory front have marked it out as one of the more welcoming jurisdictions for ICOs, along with smaller markets such as Estonia and Gibraltar.

Among those that have taken a more neutral line are countries such as Singapore, where authorities warned that token sales might be subject to securities laws if the tokens did not function solely as virtual currencies. Singapore’s traditional rival in Asia, Hong Kong, took a similar approach, with the territory’s Securities and Futures Commission saying it may regulate some fundraisings, but stopping short of an outright ban.

“We had the SFC statement in September which basically just said the existing law applies, but I think in terms of market behaviour, that’s changed a lot,” one market source told IFR.

“You’ve got people who are now aware that there is a law that applies to token sales and you have to take it seriously. And also, there’s been a significant uplift in projects that are being run out of Hong Kong. And that’s for a few reasons. One is that you’ve got some certainty from the regulator about the state of play. There is a genuine area in which you can operate without necessarily needing a licence.”

Down in Australia, the Anti-Money Laundering and Counter-Terrorism Financing Amendment Bill, introduced in parliament on August 17, contains plans to regulate digital currency exchange providers and is likely to be the government’s main response to the ICO surge.

The bill designates Australia’s financial intelligence agency, Austrac, as the supervisory body for the sector, and requires exchanges to register with the regulator. Under the proposed bill, exchanges will also need to monitor their anti-money laundering and counter-terrorism financing risks, know the identity of their customers, report suspicious transactions that involve A$10,000 or more and keep certain records for seven years.

The fate of ICOs is now inextricably bound to the decisions made by regulators around the globe about how to classify tokens. Whether they are securities, commodities, currency or some whole new asset class, it seems the days of operating in a regulatory void are fast coming to a close.

In the corporate finance world, the established players in the traditional equity and debt capital markets are betting that they do not have much to fear from ICOs just yet, although the venture capitalists and providers of funds in the technology industry may rightly be nervous about their future. Some of the smart money appears to be backing the possibility of a hybrid funding model, whereby ICOs sit alongside more traditional capital raising methods. For companies looking to expand their sources of funding, coin offerings may be a welcome alternative.

To see the digital version of this report, please click here