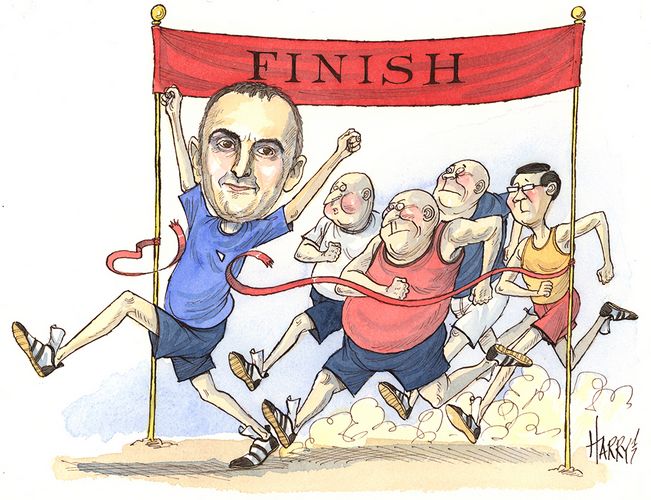

Asian equity offerings were back in fashion by the end of 2017 following a broad recovery in stock markets, but one bank set the trend throughout the year. For its unmatched range of deals across the region, Morgan Stanley is once again IFR Asia’s Equity House of the Year.

Morgan Stanley extended an already impressive track record in 2017 with a steady stream of high-profile equity offerings across the region. The US bank was in the driving seat for the key IPOs, led risk-on block trades and raised more capital for its clients than any other bank.

Morgan Stanley managed to stand out amid fierce competition, rising to the top of the underwriting league tables and making money in the process.

It focused on situations where it could play a leading role and used its strong balance sheet to take risk on big blocks from the right clients.

“This year everything is up and it’s a lot easier to get business for everyone,” said Alex Abagian, head of equity syndicate for Asia Pacific at Morgan Stanley.

“What is keeping us up there is the IPO franchise, which is something that we have been very strong at across the years. Our fully integrated syndicate on a global basis also allows us to react quickly on block trades and have a better read on pricing than anybody else.”

Morgan Stanley was early to spot the investment themes of the year, and delivered major IPOs from the financial technology and education sectors to hungry US and Asian buyers.

It worked on the US$1bn IPO of Chinese online microlender Qudian, the largest listing from China’s fintech sector and the biggest US listing from a Chinese company in 2017. It also arranged the US listings of online consumer lending company China Rapid Finance and wealth management platform Jianpu Technology.

Morgan Stanley also brought to the market the US$181m IPO of Bright Scholar Education, the largest ever China ADR float in the education space. It also completed the US listings of RYB Education, Rise Education and Four Seasons Education.

The US bank secured lead roles on the blockbuster transactions of the year. In Hong Kong, it was the lead left joint sponsor of the hugely popular HK$9.57bn (US$1.23bn) IPO of Tencent-backed online reading platform China Literature, a rare mandate for a bank with a close relationship with Tencent rival Alibaba.

Morgan Stanley handled the biggest US listing from South-East Asia in the US$989m New York IPO of internet group Sea, as well as South Korea’s biggest IPO of the year, the W1.1trn (US$1bn) listing of ING Life Korea.

It also helped manage a long list of important deals across the region, including Singapore’s biggest float of the year, the S$2.3bn (US$1.7bn) IPO of NetLink NBN Trust, a M$2.56bn (US$610m) sell-down in CIMB, and a Rp5.4trn (US$400m) re-IPO of Indonesia’s Protelindo.

In the fast-growing Indian market, Morgan Stanley was joint global coordinator on the Rs95bn (US$1.5bn) HDFC Standard Life IPO, one of few big Indian IPOs to produce a positive performance for investors. It was on the top line for Kotak Mahindra Bank’s Rs58bn qualified institutional placement, the largest such sale from a private sector Indian bank, and bookrunner on Piramal Enterprises’ Rs50bn placement of compulsorily convertible debentures, the first deal of its kind.

Morgan Stanley balanced its primary markets expertise with a healthy appetite for risk and sound market judgement, winning several competitive block trades without getting caught long.

The bank worked hard on its relationships with potential vendors, in some cases presenting the same ideas over a number of years. It leveraged a long-term relationship with ASM Pacific Holding into a sole mandate for a HK$4.1bn (US$526m) block in ASM Pacific Technology, one of several sole-book trades during the year.

A steady flow of business throughout the year gave Morgan Stanley the confidence to bid aggressively when Royal Dutch Shell looked to sell a stake in Woodside Petroleum in November. The bank responded within two hours for a fully underwritten A$2.2bn (US$1.68bn) sell-down and won the deal alongside one other bank. The block sold quickly, and Morgan Stanley helped Shell increase the trade to a hefty A$3.5bn, cleaning up its entire residual stake.

To see the digital version of this report, please click here