Chinese property developer Seazen Group (Ba2/BB+/BB) on Monday raised US$100m from a 364-day green bond, becoming one of the few real estate companies from the country to complete an international deal this year.

However, market participants speculated that the trade was heavily anchored by friends and family and is unlikely to revive the market for Chinese high-yield property bonds.

The deal, which carries a coupon rate of 7.95%, was priced at par, according to a filing on the Hong Kong stock exchange.

Haitong International was the sole global coordinator for the Reg S deal. Seazen Resources and SunRiver International Securities Group were the bookrunners and lead managers.

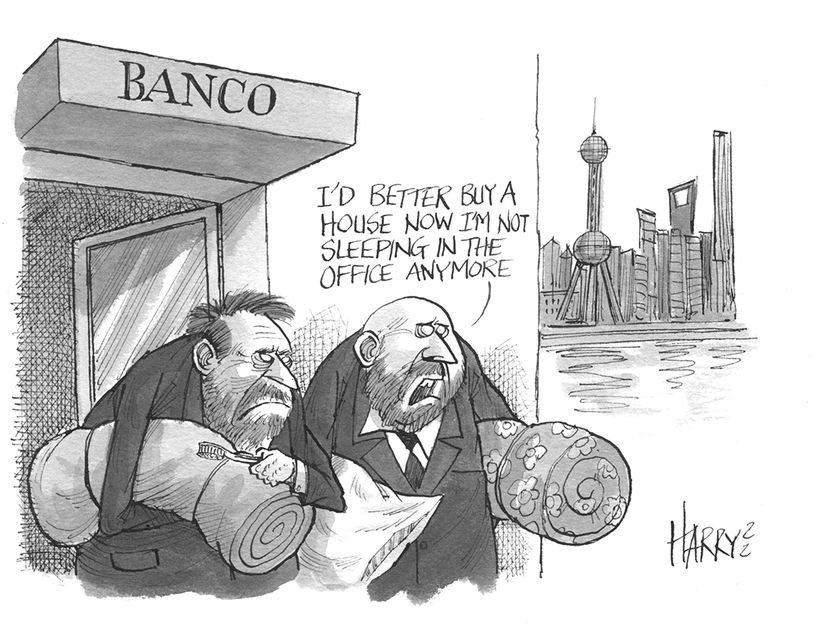

A source close to the situation said that Seazen was taking advantage of government-driven onshore bond issuance from three property developers in the past two weeks. He said that investors have become slightly positive towards high quality real estate names following the signs of government support and relaxing rules.

Longfor Group Holdings, Midea Real Estate and Country Garden Real Estate Group raised a total of Rmb2bn (US$299m) in the onshore bond market in the past two weeks. They were reportedly chosen by the government to boost market sentiment, and their deals were accompanied by CDS or credit risk mitigation warrants, a similar credit-protection instrument used in the onshore market.

However, analysts from Lucror Analytics in a note on Tuesday questioned whether any global investors had bought into the Seazen deal, given that Chinese house Haitong was the sole coordinator and Seazen Resources, which is 60%-owned by Seazen Group, was a bookrunner. Lucror also said there were rumours that a Shangdong state-owned enterprise was the buyer of the bonds.

Lucror said this could explain how Seazen was able to become the first Chinese developer this year to sell a new line of high-yield US dollar bonds without any credit enhancement. In April, property company Sino-Ocean Group sold a US$200m three-year green bond with a standby letter of credit from China Zheshang Bank's Beijing branch, and Greentown China Holdings also used an SBLC from Zheshang Bank in its US$400m three-year green issue in January.

A Hong Kong-based DCM banker speculated that Seazen's new deal was anchored by the existing bondholders of its US$400m 6.45% note maturing in June who were willing to roll over their exposure for another year.

The June bonds were trading at a cash price of 96.875 on Tuesday morning, while the company's 6.15% April 2023 notes were trading at 69.

The new notes were issued by subsidiary New Metro Global and guaranteed by Seazen. They are unrated.

The proceeds will be used to refinance medium to long term offshore debt that will be due within a year, in accordance with the company's sustainable finance framework.

Meanwhile, Seazen Group's parent Seazen Holdings raised Rmb1bn (US$150m) from a medium-term note with a CRMW provided by Bank of Shanghai and China Bond Insurance, the company said in a filing on Shanghai Stock Exchange on Monday.

The two-year bond with a one-year extension option was priced at par to yield 6.5%. The annual rate for the CRMW provided by Bank of Shanghai is 3.2% and for the one offered by China Bond Insurance it is 3.06%. Both CRMWs have a tenor of two years.

Bank of Shanghai was the trustee and bookrunner for the onshore bonds, while Haitong Securities was the joint underwriter.