Primary bond markets have proved a testing ground for the transition from inter-bank offered rates to new alternative risk-free rates. But the abundance of issuance referenced to Sonia and SOFR should not obscure the unfortunate fact that most of the proceeds have immediately been swapped back to Libor by the borrowers.

![]()

When regulators decided that it was no longer tenable to have deals worth trillions of US dollars linked to Libor it was for good reason. There are, after all, virtually no underlying transactions in actual Libor. But in their rush to chart life after Libor regulators overlooked something vital: the new money market, risk-free benchmarks they are pushing do not possess some of the key characteristics of Libor that market practitioners have come to rely on.

And if large, sophisticated issuers are selling bonds linked to new risk-free rates (RFRs) but in reality still reference them back to Libor, what chance is there that real end-users will embrace such comprehensive change in a hurry?

Even asking the question signals how difficult a feat it will be for all the key players – banks, investors and corporate treasuries – to have in place fail-safe systems in time for Libor's planned cessation at the end 2021. Especially considering that regulated entities are facing fierce heat from their supervisors – not their clients – to get on with the move.

“Our customers clearly don’t care. For them, it’s number six or seven on their list of priorities,” said a senior fixed-income banker at a major European bank. "The regulators want us to do it, but our customers don’t care. There’s a disconnect."

And it’s not like Libor is fading away. US dollar Libor interest rate swaps stood at a mighty US$237trn at the end of the third quarter 2019, and up from US$199trn in the first quarter.

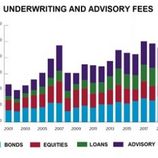

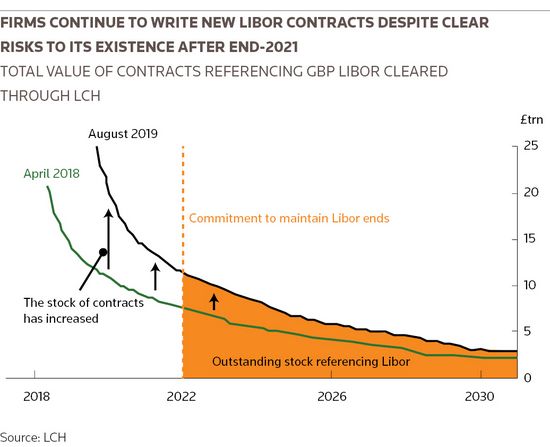

It’s not only US dollars or interest rate swaps. Sterling Libor dominates the UK loan market and many new long-dated derivatives contracts continue to reference it. Analysis by the Bank of England at the end of September highlights that the total value of contracts referencing Libor cleared through LCH has also increased, to around £25trn in August 2019 from around £20trn in April 2018 (see graphic).

DISCONNECT

This disconnect is understandable considering the scale of the challenge of unpicking the Libor framework.

Francois Jarrosson, a director in the debt advisory team at Rothschild advising corporate clients on derivatives and hedging strategies, said that treasurers cite several issues delaying their move off Libor.

They require new systems for calculating RFRs and are waiting for the formal adoption of International Accounting Standards Board draft rules setting out how the transition should be accounted for. And at the moment it costs more to raise debt using a new RFRs than Libor while banks are not technically ready to provide corporates with capped hedges using the new rates.

“Treasurers don’t want to be seen in the short term to be doing the wrong thing [by switching from a low Libor] even if it might be the right thing to do in the long term," Jarrosson said.

GOOD SHAPE

The difficulty lies in persuading an entire market to stop using a benchmark that is so useful and so pervasive that the exposure to it has continued to grow despite its near-assured obsolescence in a little over two years.

One way is to attempt to recreate some of the existing ways of doing things. Further to the good progress made in primary bonds, the development of futures markets for SOFR, for instance, is in good shape.

It is worth remembering that Eurodollar futures is where price discovery takes place for three-month Libor and how market participants price OTC instruments, interest rate swaps, and all the other instruments that are benchmarked at a spread to Libor, such as bonds, securitised products, and Treasury futures.

And both CME and ICE have seen strong monthly growth in the 18 or so months since their respective SOFR futures contracts have been operating.

Made to look and feel as familiar as possible to Eurodollar futures, their growth is important for the creation of an ecosystem similar to the existing one based on Eurodollars and replicating the swaps market's development - from the Eurodollar strip.

IMPASSE

But elsewhere, much of the transition is stuck. The buyside is reluctantly taking it on board and many can at least purchase the new RFRs but Libor benchmarks are used almost exclusively in their floating-rate product funds.

"You’ve got a bit of an impasse. (Banks) have got clients saying all they want is Libor and you’ve got regulators saying ‘tell me how you are transitioning away from Libor’. This is a very uncomfortable place for the banks to be in,” said David Clark, chairman of the European Venues and Intermediaries Association.

It has not proven easy to switch end-clients to the new RFRs which, among other things, lack the forward-looking term structure – set in advance and paid in arrears – that participants in cash markets find useful.

“For a lot of corporates, the big thing is doing a loan,” said Shaun Kennedy, group treasurer at Associated British Ports. “Banks are still generally doing Libor loans as a standard product because banks haven’t got themselves ready. Banks can say corporates aren’t ready, but corporates also aren’t getting offered a Sonia-based product as standard.”

UNWANTED LEGACY

Although multilateral banks and financial institutions have been at the vanguard of new issuance, ABP can legitimately claim to be the first mover from the corporate world.

ABP decided a year ago to move to Sonia-based instruments. So far, it has shifted around a quarter of its £4bn in swaps and debt to reference Sonia.

“If we do nothing and it’s a very messy transition, that’s quite a big risk for us. By being proactive, we can take control of that transition process and do it on our terms,” said Kennedy.

But there are precious few signs that other companies are following with anything like the same sense of urgency.

Faced with the prospect of crystalising steep break-fee costs from exiting swaps and lacking a clear roadmap to transition, many fear wasting time and money by jumping through hoops, especially when they hope there is a chance that either Libor staggers on in some form – “zombie Libor” is a phrase frequently used – or that an alternative forward-looking term rate will materialise.

"What's holding people back is the desire to have a forward-looking rate," said Trevor Wood, a corporate finance specialist at Pillsbury. “And the expectation that forward-looking Sonia and SOFR are going to be forthcoming.”

Rothschild’s Jarrosson has advocated compiling a user-friendly index of compounded RFRs, whether Sonia, SOFR or ESTR. Natwest Markets has now computed this.

“At present a treasurer can calculate the cost of accrued interest on Libor-referenced loans quite easily as it is a term rate. But under Sonia, as it is an overnight index and therefore it moves every day, it is more difficult to work out,” said Jarrosson.

"This index, set up by Natwest Markets, makes it easier to work out borrowing costs as it will show how Sonia has compounded since a certain date. This will help a broad range of market participants as it will give a more transparent, data-led benchmark.”

Wood said that the loan market is still deliberating on how to move forward on the transition, and the pace of change is far slower than in bond and derivatives sectors. That said, there have been recent signs of movement. At the end of September, the Loan Market Association published exposure drafts setting out compounded term and revolving facilities agreements for Sonia and SOFR.

Still, there is little coordination across currencies and jurisdictions between the bonds, derivatives and loan markets – and between the different users.

And even within a single financial institution there can be a major disconnect between the derivatives, bonds and loans teams, said Wood.

In these circumstances is it little wonder that the end-users are suffering from "denialism" about the end of Libor – a phrase recently used by John Ewan, a director at Benchmark Advisory Services.

With a little more than two years until life after Libor is supposed to be begin, it’s still too early to say whether the market is complacent. It’s equally likely that doing nothing for the moment – in the hope that something turns up – is the most sensible response.

Additional reporting by Christopher Spink

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com