Is the traditional green bond market threatened by the emergence of transition bonds, SDG bonds, general-purpose bonds with environmental targets and other debt classes intended to encompass wider environmental goals? Does it matter if new market segments are more effective at reducing the emission of greenhouse gases?

![]()

How best to organise and develop an institutional fixed-income market to finance real environmental change has become a vital and urgent topic for the finance industry. A key question is whether green bonds – where proceeds are ring-fenced with a defined use, and that comply with defined standards such as ICMA’s Green Bond Principles or the Climate Bonds Standard – are fit for purpose as an effective driver of substantive climate-change mitigation.

Why? Because of the almost complete absence of environmental polluters in the green bond market – the very issuers that should be core to financing transition.

There is a genuine – and potentially intractable – debate around how the fixed-income market should address the climate emergency. But the absence of environmental polluters may demonstrate that the green bond market has lost sight of its fundamental purpose.

Certainly, the refusal of some market stakeholders to accept that brown companies even have a place in the green bond market – and that only certain use-of-proceeds financings can be considered true green bonds – may be counter-productively leading issuers to spurn the green bond market as an option.

A question now being asked with increasing frequency is whether something other than bonds labelled under the Green Bond Principles is required – either as an addition or as a substitution.

Other formats and ideas have emerged in 2019. From the creation of a parallel market to accelerate transition by companies in sectors such as oil and gas, metals and mining, chemicals, materials and transport, to an embryonic market for general purpose corporate bonds with environmental goals set at the corporate level rather than at the asset level.

But does the emergence of these new market segments threaten green-labelled bonds? Mirko Gerhold, head of corporate solutions and origination at Commerzbank, doesn’t think so. “Transition and ESG-linked bonds are complementary to labelled use-of-proceeds green bonds,” he said. “The benefit of traditional green bonds, structured in line with the Green Bond Principles, is that investors know exactly what proceeds are being used for, and they get a lot of transparency by way of allocation and impact reporting.”

NOT A PANACEA

Still, he acknowledges that there are issuers and sectors where green-labelled bonds may not be the right instrument, where sustainability is not based on use of proceeds but on the sustainability of the company, or where the use of proceeds is not pure green but more focused on transition. “In these situations, transition or sustainability-linked bonds offer issuers alternative sustainable financing instruments and investors alternative sustainable investment opportunities. They can then decide what type of instrument best fits their ESG strategy,” Gerhold said.

The experience of Spain’s Repsol set an unfortunate precedent in this broad debate. In May 2017, the company issued a €500m green bond with apparently reasonable emission-reduction projections, partially derived from efficiency improvements at its refineries (under a formal transition programme).

The Climate Bonds Initiative (a standards setter and pro-green bond lobbyist) concluded the bond didn’t meet its criteria and, because most of the green bond index providers include a CBI thumbs-up as part of their approach to bond inclusion, Repsol was excluded from the indices. It was the first and last oil major to issue a green bond.

When Italian natural gas infrastructure company Snam came to market for €500m in February this year with similar use-of-proceeds transaction to Repsol (including reductions in the environmental impact of existing activities), it gave the green bond market a swerve and issued under a self-created Climate Action Bond label instead.

Management went to great lengths to create this one-off label to avoid calling it a green bond, even though that is patently what it is. Opting not to issue under the umbrella of the GBP or CBI, the motivation seems to have been to avoid the kind of scrutiny from pricklier elements of the green bond market that Repsol suffered. Snam’s label even required second-party opinion provider Vigeo Eiris to adapt its green bond assessment methodology to create a Snam-specific Climate Action Bond Eligibility Assessment Protocol. Which just happens to use identical criteria to the GBP.

The company justified its efforts with a highly nuanced definition of the difference, which in essence is that its CAB framework is wider than a green bond framework since it covers green investments as well as efforts to reduce the environmental impact of its natural gas infrastructure projects. The fact it was forced to go to such lengths speaks volumes about the deficiencies of the green bond market.

LIMITED ISSUER UNIVERSE

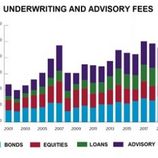

Cheerleaders may well extol the market’s growth, but green bonds aren’t pushing much beyond single-digit percentages of annual bond issuance. How to multiply that number and create a sustainable market for repeat large-scale industrial issuance that moves the needle on emissions reductions is the critical but vexing topic confronting policy makers, regulators, the finance sector and other market stakeholders.

“Green bond issuance is growing fast on an aggregate basis, but the supply volumes become a little bit less impressive for investors looking for investment-grade corporate issuance,” said Philip Brown, head of green and sustainable capital markets at Citigroup.

That is particularly the case for corporates from brown sectors. As such, the market is misaligned with many of the major sources of pollution. Many say the green bond market hasn’t done enough to accelerate a reduction in greenhouse gas emissions or play its part in financing projects in sufficient volume to help meet the two-degree temperature cap that 195 governments signed up to in the COP-21 Paris Agreement.

Indeed, the green bond universe is predominantly made up of one-off sub-benchmark issuers. It has become a market mainly for public finance issuers, pure-play companies financing renewable energy, electricity utilities financing renewables, property companies financing green buildings, and banks (hardly the greenest sector) financing green loans.

The market also lacks environmental additionality: well over 50% of issuance is estimated to have gone to refinancing assets rather than funding new environmental projects. Issuers in carbon-intensive industries or sectors like extractives have ignored the green bond market for their climate financing needs.

In other words, does the green-labelled bond market risk becoming stranded as a haven for issuers that don’t actually need the label? Perhaps, but not immediately. “New sustainable finance bond instruments are being created and the ESG bond sector is broadening but I don’t think issuance of labelled green bonds will become restricted to pure-play companies,” said Gerhold. “The benefit of the labelled green bond is that it allows companies that aren’t pure-play green issuers to segregate the funding of their sustainable activities. By doing that, green bonds can help promote transition to more sustainable business models. In addition, the ambition of sustainability-focused investors to diversify their portfolios creates demand for green bonds from a broad range of issuers that are not pure-play companies.”

TRANSITION BONDS

There are clear gaps, however. In June, Yo Takatsuki, head of ESG research and active ownership, and Julien Foll, responsible investment analyst at Axa Investment Managers, proposed a parallel transition bond market. “The key objective of our work on climate change is to effectively address global warming and efficiently allocate investment capital to help achieve the Paris Agreement goals,” Takatsuki said.

“We have a huge and urgent challenge to decarbonise the global economy. The active and transparent participation of all parties is critical to achieving that aim. We published the Guidelines for Transition Bonds principally as a call-to-action to the industry and to provoke discussion on the issue of climate transition-financing. We have had incredible response from companies, investment banks, other investors and broader stakeholders.”

Axa supports the green bonds market; it has €5bn in green bonds and sits on the GBP Ex-Com. But the baseline in the “Financing brown to green: Guidelines for Transition Bonds” paper is that the fight against climate change needs to shift up a gear. The paper also argues that there is a significant opportunity for investors to provide finance to companies that are brown today but that have the ambition to transition to green. That definition, the paper, includes most businesses in the world today.

Transition bonds are intended for companies in greenhouse gas-intensive industries that do not (and may not for the foreseeable future) have sufficient green assets to finance but that have financing needs to reduce the greenhouse gas footprint of their business activities, products and services. Proceeds must be used exclusively to fully/partly finance/refinance new/existing eligible projects aligned with Transition Bond Guidelines that pre-define climate transition-related activities using the same structure as the Green Bond Principles, the Social Bond Principles and Sustainability Bond Guidelines.

An additional element – and a critical difference with the Green Bond Principles – is that alongside issuance-level components, transition bonds will set clear expectations about an issuer’s broader environmental strategy and practices, something investors already consider when assessing green bonds for investment. Issuer-level practices – ie, what climate transition means in the context of business models and strategy; senior management/board commitment to COP-21 – are particularly important, Takatsuki and Foll wrote, to legitimise transition bonds as an environmental investment.

Transition strategies should be intentional, material to the business and measurable; transition bonds should principally finance the share of an issuer’s spending necessary to achieve quantifiable short-term as well as long-term targets.

Jacob Michaelson, head of sustainable bonds at Nordea Markets, would prefer to see the narrative evolve from discussions about labelling to how sustainability can be integrated across the financial market value chain. He believes the Green Bond Principles and Social Bond Principles have been fine to take the labelled bond market from niche to global but said that issuance under their simple and flexible governance structure might not be the most efficient or best way forward.

He’s similarly wary of transition bonds. “I’m not sure if a separate label for transition bonds is the answer. Instead of talking about transition bonds, we should be addressing the market’s current approach to – and governance of – the labelled bond market,” Michaelson said. “In the long run, however, we might need to disregard labelling altogether and only focus on use-of-proceeds-style bonds where targeted environmental impact is disclosed. We should also pay closer attention to the link between use-of-proceeds and overall ESG integration and how both are important tools to help move capital into areas that are aligned with a low-carbon economy,” he said.

GENERAL PURPOSE

On disregarding labelling, enter Enel, one of the few regular non-pure-play corporate green bond issuers. The company is ditching the green bond market and has taken environmental debt finance to a different level.

In September and October, the company sold US$1.5bn and €2.5bn general purpose corporate bonds linked to SDG goals number 7 (affordable and clean energy); number 9 (industry, innovation and infrastructure); number 11 (sustainable cities and communities); and number 13 (climate action). The bonds are part of the company’s ordinary financing, but management has committed to sourcing 55% or more of the company’s consolidated installed capacity from renewable sources by the end of 2021 (from 45.9% at June 30). Failure to meet that target will result in a 25bp coupon step-up.

“Enel broke away altogether from the use-of-proceeds Green Bond Principles, issuing with a structure that was driven by investor demand,” said Citigroup’s Brown. "The company has among the largest holdings of renewable energy assets on any private sector balance sheet globally. Those assets give the company access to a range of more advantageous funding sources than they can achieve through traditional use-of-proceeds green bonds.

“Yet Enel remains naturally keen to engage with the fast-increasing investor demand for ESG product, with a structure that highlights their leadership in the sector. I think the GBP are fantastic and will remain the cornerstone of the market. But to encourage corporate issuance from brown or non-pure-play sectors of the economy, capital markets will have to continue to innovate,” Brown said.

Just as with transition bonds, the critical factor in moving the needle on environmental transition is setting stretch targets. Comparability between bonds, meanwhile, will demand better quality standardised ESG metrics. Better ESG reporting will get the market nearer an ability to measure true environmental impact, as asset managers are increasingly being asked to measure green alpha – that is, the proportion of total return attributed to sustainability factors.

General purpose non-ring-fenced unlabelled environmental bonds will be problematic for some investors – specifically green bond funds and those who have grown accustomed to the tick-box approach that green bonds facilitate. Assessing general finance with environmental targets calls for a wholly differentiated level of investor engagement and a deeper understanding of the link between corporate strategy and ambition, environmental target-setting, and action.

The key is ensuring issuers and their advisers put ambitious hurdles in place. And, in parallel, better quality, more accurate, more honest and more frequent ESG disclosure and reporting (using the Task Force on Climate-related Financial Disclosures as a basis). Sustainable finance is not a one-size-fits-all concept. It's about corporates setting themselves challenging environmental targets, investors having the requisite data to judge how well issuers are doing, and promoting active engagement to ensure there’s full alignment on the path to measurable and material impact.

Labelled green bonds don’t provide a panacea and new emerging segments could well overtake them as the transition narrative takes hold. But whether the solution ends up being a co-mingled ecosystem of green bonds, transition bonds, bonds using other ESG labels, and general purpose bonds with ESG covenants, it’s ultimately about mobilising capital in sufficient amounts and moving it in the right direction. That holds a unique opportunity for the institutional finance sector to make a meaningful contribution to climate change.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com