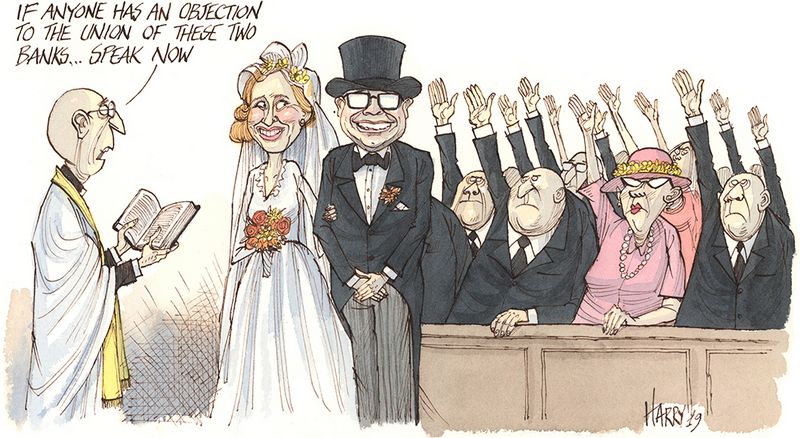

As another painful year for Europe’s banks draws to a close, the need for big bank consolidation has never been greater.

![]()

As another painful year for Europe’s banks draws to a close, the need for big bank consolidation has never been greater.

For years, calls for consolidation as the answer to the woes of Europe’s hobbled banking sector have fallen on deaf ears. But in 2019 a broader consensus began to emerge that there is a pressing need for intra-bank mergers & acquisitions.

Europe’s fragmented banking sector has been under pressure for almost a decade, and that ramped up a notch over summer when the European Central Bank cut rates, increasing the stress on banks already battling higher capital charges, disruptive new entrants in retail and larger US rivals sweeping all before them.

Industry figures say consolidation is the way forward. Commerzbank and Deutsche Bank held merger talks, while Italy’s UniCredit engaged advisers to run the rule over Commerz. Politicians have made supportive noises, while banking CEOs have called for action, with UBS CEO Sergio Ermotti telling a conference in Zurich in November that the issue for Swiss and EU banks has changed: They are “no longer too big to fail, but rather too small to survive”, he said.

Indeed, in its 2019 global banking report, McKinsey warned that many banks will not survive another downturn and that they should take steps now to avert another crisis. “Scale in banking, as in most industries, is generally correlated with stronger returns,” the report said.

The head of European FIG at a US bank said: “There is much more willingness to contemplate crossborder mergers. The pressure is building.”

But talk is cheap. For all the renewed noise about the need for consolidation, there has been precious little in the way of action.

The head of FIG at one global bank said: “We’re super busy. In 2020 we expect to see global consolidation in the insurance industry, and plenty of deals in payments and fintech. The only sector we don’t expect activity is in big bank M&A.”

One reason is that confidence is a crucial catalyst in M&A and after nearly a decade of cost-cutting and retrenchment European banking CEOs are drained of it.

The region’s banks are trading at a discount to book value and shareholders, who are already sitting on big losses, are wary of any deal that leads to further dilution or results in them owning stock in a weaker lender. Jean Pierre Mustier, CEO of UniCredit, the bank seen as a consolidator, has poured water on the prospects for consolidation because such moves will require additional capital and that with bank shares trading at a discount, buybacks are more viable than dealmaking.

“Europe needs bigger banks but I cannot see any M&A transactions at this stage,” Mustier told analysts following the bank’s third-quarter earnings on November 7.

NO RISK APPETITE

Instead, European banks stagger on, cutting costs to the bone while searching for growth. “In the current overwhelmingly challenging environment for European banks, the prospect of consolidation is undoubtedly being considered but it still ranks behind other items on the boardroom’s agenda,” said Stefanos Papapanagiotou, head of FIG for EMEA at UBS.

And with banks still focused on cutting costs “uncertainty pushes decision-makers to be more introverted,” he said.

Certainly, the current crop of banking CEOs, having emerged from the aftermath of the financial crisis, do not seem to have the risk appetite to pursue banking mergers, especially given the legacy of previous failed crossborder banking acquisitions, such as Royal Bank of Scotland’s ill-advised purchase of ABN AMRO in 2007, a deal from which RBS never recovered. Such failures remain burned in CEOs’ collective consciousness.

“Bank executives [remember] the painful experiences of previously pursued large-scale, cross-border mergers among European banks, adding to their overall cautious approach,” said Papapanagiotou.

By contrast, confidence is high among US and Asian banks that could act as potential consolidators. “If a Chinese bank wanted to take a long-term view on the European economy then now might be a good time for them to buy a bank, given that valuations are so cheap,” said one head of FIG.

But any such move would be greeted with intense regulatory scrutiny, ramping up the execution risk.

As for US banks, they are doubling down in a home market that offers more favourable returns. “The message from US banks is ‘no-one cares about Europe’,” said one seasoned M&A adviser.

NO UNION

Two more obstacles relate to politics and capital rules. One of the biggest “show-stoppers”, as one banker put it, is the lack of European banking union, which has been long-mooted but slow to put in place. While Europe’s banks fall under the supervision of a single regulator in the ECB, in reality local rules prevail. Domestic regulators apply different rules on capital and ring-fencing, leading to trapped capital and preventing a merged crossborder institution from moving capital seamlessly between borders.

There have, though, been some encouraging noises in that respect. In November Olaf Scholz, Germany’s finance minister, suggested he was open to backing a single European deposit insurance scheme – something that the country has previously fiercely resisted and that many believe is the main reason banking union has not happened. Germany’s argument has been that its government and taxpayers are simply not prepared to use their funds to bail out weaker foreign banks.

Scholz’s apparently softer stance is a nod to the fact that for all of the industry’s challenges, Europe’s banks are better capitalised and safer than at any point in recent history, reducing the likelihood of bank failures. But no-one is getting too excited about Scholz’s speech unless it is backed up with tangible progress.

“There needs to be more progress towards banking union before we will see big-bank consolidation in Europe,” said John Cronin, a banking analyst at Irish stock broker Goodbody. “I’m not confident we’ll see a change on a three-year view, let alone in 2020.”

KICKING THE G-SIB BUCKET

The other major obstacle is punitive capital rules. Consolidation between so-called global systemically important banks will create much-needed scale, but also put the combined entity into a higher G-SIB bucket and forcing it to set aside more capital. Typically moving from one bucket to the next amounts to an extra 50bp charge and that, depending on the size of the target, requires billions of euros of extra capital, killing the benefits of any merger stone dead.

Some bankers are calling on regulators to water down or overlook the G-SIB rules in order for consolidation to happen, while for others banking union will be the game-changer. “A true banking union would facilitate, to a large extent, the alleviation of the cost burden associated with the G-SIB rules,” said Papapanagiotou.

STAYING HOME

Domestic banking mergers will not face the same obstacles and bankers say they are more likely to happen. There has already been progress on that front, with Santander buying stricken rival Banco Popular in 2017, while the merger in 2016 between Italy’s Banco Popolare and Banca Popolare di Milano was the first to be executed under the ECB’s supervision.

Both deals took place with the support and orchestration of regulators keen to see the weaker players among Europe’s 4,000 banks being taken out.

Certainly there is a rationale for domestic consolidation. FIG bankers, for instance, point to a merger between Credit Suisse and UBS as one that will solve the strategic problems of both firms – UBS will bolster its US business while Credit Suisse gains the scale in Asia that it craves. And more generally, domestic tie-ups will give rise to big cost savings from closing branches, reducing duplication and cutting technology costs.

But again there are stumbling blocks. The obvious one is the prospect of heavy job cuts that was one of the reasons why Deutsche and Commerz talks failed.

It is also clear that (with the exception of the Santander/Popular deal) well-capitalised banks have since the financial crisis been unwilling to assume the execution risk associated with buying a hobbled rival. And for good reason: JP Morgan forked out US$19bn in post-crisis fines, with a large amount of that sum related to its acquisitions of Bear Stearns and Washington Mutual. And it was hardly the only institution that suffered.

So should the industry write-off the chances of any meaningful banking consolidation in Europe for the foreseeable future? Probably, but it might just be possible that in weakness there is strength: if bank CEOs no longer believe they are all-powerful and all-conquering, maybe their current travails will force them to act. In 2012, Deutsche’s then co-CEO Anshu Jain declared that the bank would be the “last man standing” as Europe’s global pre-eminent investment bank. Much has happened since then, not least to Deutsche, which has massively reduced its global ambitions. In 2019, Jain’s fighting talk has been replaced by Ermotti’s admission that Europe’s banks are too small to survive.

Perhaps this admission of weakness will serve as a catalyst for consolidation, as banks run out of all other options and hit rock bottom.