Network effect:

Building on its globe-spanning corporate bank and a reorganisation that combined that unit with investment banking and capital markets, Citigroup made meaningful progress in 2019. In what was a down market for many, it moved up the league tables, increased market and wallet share, and added a host of star bankers to its ranks. Citigroup is IFR’s Bank of the Year.

![]()

First question: What has Citigroup got that its rivals haven’t?

Answer: A truly global – and entirely unique – corporate bank that joins the developed and developing world.

Second question: Is Citigroup making the most of its corporate bank and using it to grab client wallet-share across the gamut of banking and investment banking services?

Answer: It’s getting there – and has made considerable progress in 2019.

Indeed, the creation in September 2018 of a new structure bringing together capital markets, corporate banking and investment banking in one division – called banking, capital markets and advisory – was precisely designed to drive that advantage home.

It’s early days but it certainly seems to be working.

“What is very powerful is getting investment banking and capital markets aligned with the corporate bank,” said Manolo Falco, the London-based co-head of BCMA alongside New York-based Tyler Dickson. “We work as one team with aligned coverage and information flow – not just episodic deals but across the board to resolve client problems.”

DECENT TRAJECTORY

With Jack Ma and Alibaba it went like this: a decade or so ago, Citigroup used the global nature of its corporate banking business to convince the founder of the Chinese e-commerce giant to use it for cash management and payment processing. It then used the resulting relationships to get onto US dollar bond deals as Alibaba moved out into the world; parlayed those successes into a bookrunner role on Alibaba’s record US$25bn NYSE listing (it was a relatively junior role, although it did involve handling the depository receipts); moved on to advising on the potential acquisition of MoneyGram by Ma’s Ant Financial (the deal was blocked by the Trump administration) and finally in 2019 a global coordinator role on the company’s US$12.9bn secondary listing in Hong Kong.

A decent trajectory. And with more to come.

It was a similar story with Uber Technologies. Citigroup got its feet in the door with dull but sticky cash management and payment processing before working its way up the value chain – via securitisations, financing of drivers and their cars – to a bookrunner slot on 2019’s US$8.1bn IPO.

Sniffy rivals might point out that Citigroup wasn’t the driving force behind those ECM deals, but it would be fair to say that Citigroup’s overall share of wallet with those clients stands comparison with the rest of the industry.

Citigroup CEO Mike Corbat puts it like this: “What I think we bring a little bit different – and what resonates with our clients – is we're not there simply for a transaction. If you look at Alibaba, or you look at Google, or you look at Uber, we're house banks, we're managing their cash, we're helping them pay their drivers, work with their vendors, manage their foreign exchange. We're in their offices every day.”

The BCMA relationships start in the corporate bank. "And then they graduate up from there," Corbat said.

DECENT YEAR

And as those deals for Alibaba and Uber underline, Citigroup had a very decent year in ECM.

It participated in four of the five largest tech IPOs in the US; had another standout year in special acquisition company ECM; was the stabilisation manager for the US$2.3bn secondary sale in BR Distribuidora and top line on the US$2bn privatisation of IRB Brasil as LatAm volume surged; participated in four of the five largest EMEA IPOs; and reopened Russian ECM with a US$550m accelerated offer for Norilsk Nickel. From Africa it listed MultiChoice Group, Jumia, Airtel and MTN Nigeria while in Asia it can boast the largest pharma company IPO in Hong Kong since 2016 (Hansoh Pharmaceutical’s US$1.2bn deal) plus the first Chinese fintech convertible bond (a US$345m CB plus call-spread overlay for Qudian), while a global coordinator slot on Geely’s €400m bond exchangeable into Volvo shares is expected to be the first of many as Chinese companies monetise stakes in European companies.

DEFINING ADVANTAGE

Citigroup’s other defining advantage – and it’s once more a reflection of the corporate bank’s position – is its connection to global trade flows. While every major bank will make that boast, Citigroup’s history and geographical reach sets it apart. Being on the ground in nearly 100 countries and having been in many of those countries for well over 100 years has to mean something. And so does having 82 trading desks around the world to facilitate transaction services and money movements.

Hence Citigroup was quick on the uptake when US-China trade tensions started to shift global trade flows.

Corbat points out that as a result of US tariffs and Chinese retaliation the US was replaced as the major exporter of soybeans to China by Argentina and Brazil in a matter of weeks. "I think our abilities to move with our clients, both with exporters and importers, and to solve supply chain management issues were critical," he said.

Being in the flows also meant Citigroup was able to position itself well with other potential trade beneficiaries like India, Mexico or Vietnam.

“We want to be the world's global bank,” Dickson said. “And in an environment where fewer banks are able to do that, that's distinctive. When we see changing patterns of global growth and global trade flows, we want to capitalise.”

NEW OPPORTUNITIES

The US-China trade dispute also forced many Asian businesses to rethink their expansion plans, and Citigroup was well placed to capture new opportunities as Chinese clients turned their attention to Europe.

The most obvious China-to-Europe deal came when the sovereign chose to issue bonds in euros for the first time in 15 years. Citigroup was a bookrunner on the resulting €4bn multi-tranche deal.

But the trend was a wider one and Citigroup took Chinese sportswear giant Anta Sports into Europe with the acquisition of Finland’s Amer Sports, sold UK-based payments company WorldFirst to Ant Financial (a year after the Chinese outfit found its purchase of MoneyGram blocked), and was again on the sellside when German wholesaler Metro sold its Chinese business to local retailer Wumart.

And in one of the corporate finance and capital markets highlights of 2019 Citigroup designed a reorganisation of CK Hutchison’s telecom assets that dramatically reduced the group’s cost of funding.

Citigroup was one of two global coordinators (with HSBC) on the resulting capital markets deal: a €5.15bn-equivalent six-part bond encompassing euro and sterling tranches that partly repaid a €10.4bn bridge (also provided by Citigroup and HSBC).

LEADING THE WAY

As those deals attest, Citigroup’s Asia-Pacific business has once again led the way for the bank, especially in terms of growth in fees.

Under Asia BCMA head Jan Metzger, who has risen quickly through the ranks since joining from Credit Suisse in 2015, Citigroup is translating more of its corporate banking relationships into investment banking revenues.

“Having a deeper partnership creates a different kind of conversation,” said Metzger. “If you are only interested in a one-off investment banking fee, there are a lot of companies in Asia you simply cannot cover.

“We are seeing a massive professionalisation of families and companies in Asia, with a lot of companies cleaning up their corporate structures and moving decision-making down the chain.”

That, he says, will hurt pure-play investment banks and those that rely on private wealth relationships to drive deals, but will benefit firms with deep corporate banking relationships and a thorough understanding of their client’s industry – like Citigroup.

STRATEGIC ADVICE

Indeed, as many of those Asia deals also attest, Citigroup had a breakthrough year in M&A. And while Citigroup is no Goldman Sachs when it comes to M&A, it is certainly moving beyond its previous position as a buyside-focused franchise built on helping clients finance acquisitions. It can now plausibly claim to be providing strategic advice when an approach is made to a client.

“We have over the last several years taken a franchise that was seventh or eighth in the M&A league tables to one that is fourth, both in terms of volumes and fee-wallet,” said Mark Shafir, global co-head of M&A.

Over the past year the bank has been involved in some of the largest transactions, such as Shire’s US$78bn sale to Japanese drugs producer Takeda and Occidental Petroleum’s US$38bn purchase of fellow oil and gas company Anadarko.

The sellside mandates have increased markedly since the hire two years ago of Muir Paterson as global head of strategic shareholder advisory from Goldman Sachs, where he was senior activist defence banker.

“There was a perception that we were a buyside, financing-driven M&A house,” said Cary Kochman, the other global co-head of M&A. “That’s been dispelled. We are equally balanced today in terms of buyside and sellside.”

With Occidental, both sides of the business had to be deployed. The company managed to dislodge Chevron as Anadarko’s preferred bidder after Citigroup helped persuade Warren Buffett to pledge US$10bn of financing to lift Occidental’s bid.

Citigroup also acted as defence adviser to Shire regarding the approach from Takeda. The mandate came after Shire saw Citigroup’s work as adviser to Baxalta on its own defence from Shire a few years earlier.

Once again, it was Citigroup’s global footprint that helped make the case for its involvement. “It’s something of an advantage that of the big banks generally we are the most global,” said Shafir.

DON’T FORGET FINANCING

Of course, a new-found focus on sellside M&A does not overshadow the work the bank has done in M&A financing. Indeed, Citigroup arranged some of the most notable global acquisition financings in 2019.

In May, it committed US$21.8bn of loans with Bank of America to support the Anadarko acquisition and in March provided the US$15bn bridge loan with JP Morgan that allowed Walt Disney to consummate its acquisition of 21st Century Fox.

There were many similar examples in Europe: a US$3.75bn bridge loan for France’s Publicis and a £1.3bn-equivalent loan to UK-listed Synthomer. In Asia there was a €2.2bn five-year loan that enabled Anta Sports to buy Amer Sports (plus €2.015bn in non-recourse debt at the target level) and a quick-fire HK$25.2bn loan supporting the take-private of Hong Kong-listed Hopewell Holdings.

There were also triumphs aplenty in the DCM world, where Citigroup has long been one of the leaders of the pack.

The bank is second in the DCM league tables for Asia and the US, and fifth in EMEA – with a host of stand-out transactions. And as usual it excelled across the emerging markets with league table credit of US$54.7bn in the IFR awards period from 272 deals – for a number one position. Not for nothing is it IFR’s Emerging Markets House of the Year.

GOING GREEN

One key aspect of the debt markets worth highlighting – and certainly the thing Corbat was most keen to underline – was the bank’s efforts in another major theme of 2019: the growth in environmental, social and governance financing.

In terms of transactions, perhaps the standout deal was the US$1.5bn five-year sustainability-linked bond for Enel, IFR’s ESG Issuer of the Year. The bond, on which Citigroup was a bookrunner, features a 25bp step-up if Enel misses targets linked to an increase in the proportion of electricity produced from zero-carbon sources. It was innovative – and controversial – but most investors loved it, and it was followed up by a similar trade in euros.

Corbat also stressed the bank’s decision to sign up to the Poseidon Principles, which saw a group of 11 banks led by Citigroup (the only US bank) agree to include climate factors in lending decisions to shipping companies, potentially cutting credit to those that fail to reduce greenhouse gas emissions.

The group represents about 20% of the global ship finance portfolio.

“It's core to who we are,” said Corbat. “We have a history as a shipping transportation bank, so being the primary signature on the Poseidon Principles this year was one that I loved. It's completely actionable – 80% of the goods shipped in the world today at some point go over water."

MAKING MONEY

Of course, despite the good intentions, Citigroup is not doing all of these deals across the capital and banking markets just to be a good corporate citizen. The objective is to make money.

And here again it can point to decent progress.

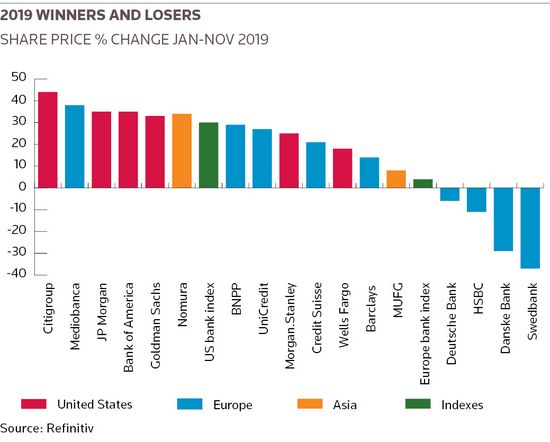

Citigroup can boast the best stock price performance among its peers – its shares are up 40% since the start of the year – even if revenues have been sluggish across the industry in 2019.

And Citigroup’s BCMA division outperformed rivals with revenues of US$3.9bn in the first nine months of the year – up 4% from a year earlier, compared with a 5% decline across the industry.

That was thanks in part to debt underwriting and M&A advisory, where fees were up 8% and 6%, respectively, from a year earlier.

Trading was more mixed. Citigroup's FICC revenues nudged up 3% to US$10bn, better than the flat performance by peers, but equities income slumped 13% to US$2.4bn, compared with an industry decline of 11%. Even in equities, though, Citigroup can point to some progress. The bank is IFR’s Equity Derivatives House of the Year after growing its business in a challenging environment and outperforming peers.

And as for that all-important corporate bank, Citigroup has been the leading bank for transaction banking revenues for the past three years and kept that crown for the first six months of 2019, according to the latest available figures from analysis firm Coalition. Citigroup stayed just ahead of HSBC and JP Morgan and held leading positions for trade finance and cash management in all three geographic regions, Coalition said.

PEOPLE FIRST

So how to bring this all together? Here’s one way: people.

Citigroup has done well to put the right people in the right positions. Corbat has much to be proud of when he looks back at his seven-year (and counting) tenure as CEO. His choice of ex-markets chief Paco Ybarra to replace Jamie Forese as head of the bank’s institutional client group (that is BCMA plus the markets business, the securities services unit and the private bank) is settling in well.

Meanwhile, the recent promotion of Jane Fraser to head of the global consumer bank looks to be a shrewd one (even leaving aside the inevitable speculation that she is best positioned to become the first woman to lead a major Wall Street bank).

But look also at the kind of people willing to join Citigroup now that it is punching its weight.

In one fell swoop in June it poached a clutch of big players in the tech and healthcare world: Mark Keene from Deutsche Bank to help oversee technology IB globally from San Francisco; Elizabeth Milonopoulos from Goldman and Brian Yick from Barclays, as global co-heads of internet IB; and in healthcare Doretta Mistras from Goldman. At much the same time it hired Michael Marcus from Goldman and Mark Hantho and John Eydenberg (both from Deutsche). There are numerous other examples.

"I think now people look at the power and the benefits of the platform, the globality, the stability, the investing, the very clear strategy, the balance sheet that can be put to work, and they say: 'Hey, you know, vis-a-vis where I am, or how I see the world continuing to evolve, Citi looks a pretty good place to be’,” Corbat said.

Additional reporting by Christopher Spink, Steve Garton and Steve Slater

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com