Icing on the cake

As equity capital markets activity concentrates among a trio of US banks, those firms become responsible for the highs and lows of activity. For picking the right deals, reacting to investors, and using its experience to make better decisions, Morgan Stanley is IFR’s Equity House, Asia-Pacific Equity House and EMEA Equity House of the Year.

![]()

Global ECM activity is increasingly concentrated on the US trio of Goldman Sachs, JP Morgan and Morgan Stanley, with clear blue water – aka, US$10bn of league table credit – between them and the chasing pack. But in 2019 the spoils of victory have been fleeting, with the focus far too often on what has gone wrong.

Morgan Stanley stood out in such an environment as the smartest broker between issuer and investor. More often than its peers Morgan Stanley got the tough decisions right, whether that was achieving a better outcome on the Uber Technologies IPO than was the case for other new economy floats; sole underwriting Marks & Spencer’s first equity issue in 30 years; or leading the first GDR issue to use the Shanghai-London Stock Connect on behalf of Huatai Securities.

The bank can legitimately claim not just to have been involved in the biggest deals – typically alongside one of its closest rivals – but also to have walked away from the right deals.

And, crucially, in a difficult year, that led to fewer missteps than its rivals.

Indeed, while Morgan Stanley’s US ECM team had a down year (it slipped to second in the league tables) that worked to its advantage. While the bank played a role on most of the largest ECM deals in the awards period, it dodged the most notorious flops of the year: the likes of WeWork, SmileDirectClub, Peloton Interactive and Endeavor.

“I am as proud of our selectivity in IPOs as the ones we actually won and completed,” said Paul Donahue, Morgan Stanley’s head of ECM for the Americas.

In such a tough year, every bank had failures, but Morgan Stanley minimised the slips. In EMEA it had just two IPO cancellations.

This is not to pretend that the bank was perfect – far from it.

Kazakh firm Kaspi’s IPO failed to get going for a multitude of reasons (GDR, valuation, positioning) but the problems were soon acknowledged, and the deal stopped after pre-marketing. The IPO of ReAssure was the other flop. Despite a high yield it lacked a retail tranche and failed to convince institutions to sell established players in the sector to buy the Swiss Re spin-off.

But that was it.

“Our pulled-to-priced ratio is better than our peers and we jealously guard that,” said Martin Thorneycroft, Morgan Stanley’s head of EMEA ECM.

FROM JEERS TO CHEERS

Without doubt the biggest blot on Morgan Stanley’s copybook would have been the failed IPO of AB InBev’s Asian operations in July – had it not been for the successful float of the business (now without Australia) as Budweiser Brewing Company APAC in September.

Compared to July, market conditions were even worse in September as months of protests in Hong Kong had escalated and the US-China trade war rumbled on.

To get the HK$45bn (US$5.7bn) IPO of Budweiser APAC through, Morgan Stanley, as one of two sponsors, added flexibility to the float with a rare upsize option in addition to a greenshoe. Singapore sovereign wealth fund GIC was also introduced as a cornerstone, taking US$1bn of the float.

The tweaks worked and momentum ensured the upsize was partially used and shares traded up. More importantly, the deal re-opened the Hong Kong IPO market (arguably having closed it in July), fuelling the listing rush at year end.

The US bank used the same tactics of a cornerstone investor and an upsize option on logistic property developer ESR Cayman’s HK$14bn IPO.

The Warburg Pincus-backed company pulled a HK$9.8bn IPO in June because of insufficient demand. Morgan Stanley was not involved in the first attempt but was put in charge for the second effort, which raised 43% more than the target in the June attempt.

“When things get a little bit more difficult, we outperform even better,” said Alex Abagian, the bank’s co-head of ECM for Asia-Pacific. “We continue to dominate and work on the most important deals.”

AHEAD OF THE REST

Innovation is increasingly important for the big three to differentiate from one another, but it isn’t the only way. Market judgment can be surprisingly differentiated across the trio.

The slump in equity markets at the end of 2018 led to a hangover at the start of 2019, with US activity massively curtailed by the record government shutdown shuttering the SEC.

It was a sluggish start in EMEA, too, with first-quarter volumes down nearly 50% on the previous year. Without Morgan Stanley it would have been much worse.

“Hand on heart, we came into the year with trepidation and ended up printing 19% more than last year as the only [major ECM house] to increase activity,” said Thorneycroft.

The first quarter defined the bank’s year in the EMEA region. In the first full week of the year Morgan Stanley worked on a €200m tap of a convertible bond by Cellnex (IFR’s Corporate Issuer of the Year and a client Morgan Stanley would lead to two rights issues in 2019). Alongside Credit Suisse, it brought the first major IPO of the year – a SFr547m (US$540m) deal for Switzerland’s Medacta.

The bank wrote a series of cheques backing rights issues by Cellnex (€1.2bn, where it had the biggest share of underwriting), M&S (£600m sole) and Sunrise Communications (SFr4.1bn) in the first quarter, having already agreed to take on all the (considerable) risk of a €600m recapitalisation for troubled Spanish retailer DIA in December 2018.

With the £3.44bn mandatory convertible bonds for Vodafone and a £2.69bn accelerated capital increase for AstraZeneca, Morgan Stanley was on some of the biggest deals in the quarter, but the overall level of dealmaking also marked it out.

At quarter’s end when overall issuance in EMEA had fallen by nearly half over the previous year Morgan Stanley’s league table credit had doubled with 13 deals printed, ahead of all others. Sunrise and DIA never happened, but Cellnex returned for another €2.5bn and Morgan Stanley once again had the largest share of the fees.

Brexit cast a shadow over the entire year in UK ECM, which Morgan Stanley dominated with a 16.5% market share including equity-linked. At £2.69bn, AstraZeneca’s ABB on the back of its US$1.35bn tie-up with Japan’s Daiichi Sankyo was the largest primary ABB in the UK for more than 15 years.

Not only did the news coming out of Japan require launching just before midnight in London, pricing had to be timed around the third “meaningful vote” in the UK parliament on its EU withdrawal agreement the following day. IPOs for Trainline and Watches of Switzerland were similarly choreographed around Brexit votes, though prime minister Theresa May resigning while they were in the market was not part of the plan.

UBER TECH FRANCHISE

Global ECM dominance cannot be achieved without a high-performing tech franchise.

“If you’re not a global leader in technology, you’ve no chance of making money [in ECM],” said Henrik Gobel, Morgan Stanley’s head of global capital markets in EMEA.

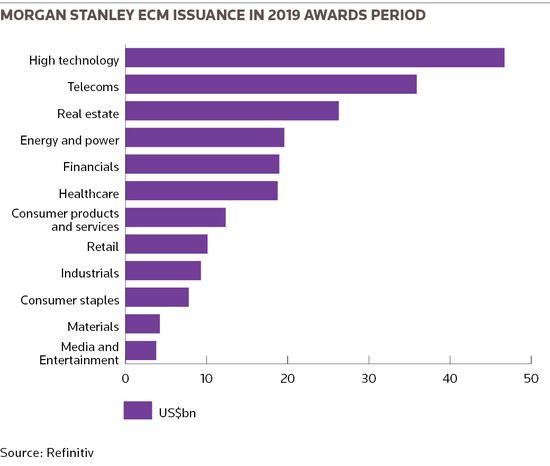

In EMEA technology represented more than 20% of all equity issuance in the awards period and 33% of Morgan Stanley’s activity, according to the bank’s numbers. In tune with the pivot to direct listings in the US, Morgan Stanley was one of two advisers on Naspers’ spin-off listing of broadcaster Multichoice at a US$3bn valuation, before taking on its mammoth Prosus carve-out in September.

The unbundling of Naspers’ internet holdings as Prosus on Euronext was necessary as its 10% stake in Tencent meant it had outgrown the Johannesburg Stock Exchange. Floating a company with a reference valuation of €95bn in a new market where the main asset was on another continent involved just as much effort as an IPO even without a placing, but the push was rewarded when the valuation surged past €123bn.

The bank was also active on two sales in payments company Adyen and completed the remarkable hat-trick of IPO for Trainline and then exit for the sponsor through two follow-ons, one of which is IFR’s EMEA Secondary Equity Issue of the Year.

Again there were volatile situations with the weak aftermarket of the IPO of German software company TeamViewer (performance pinned on a late decision to upsize the offering by 25% – a decision rivals do not criticise) and Jumia Technologies, the “Amazon of Africa” as it was helpfully termed by the US press, providing a roller coaster ride for investors. Jumia’s US$196m IPO priced at US$14.50 each and shares ended their debut at US$25.46, up 75%. Within three weeks the stock was trading at more than three times its issue price, though by the end of November it had fallen to US$6.26, making it comfortably the worst performing IPO for an EMEA company.

Playing to its strengths, Morgan Stanley helped Chinese e-commerce company Pinduoduo and South-east Asian e-commerce company Sea each raise US$1.6bn from follow-on offerings in the US, and also led a US$873m convertible bond cum follow-on for Chinese video-streaming site Bilibili.

TROPHY ROLE

Morgan Stanley’s trophy role in 2019 was as lead-left and stabilisation agent (with Goldman Sachs to its right) on the largest IPO of the review period – May’s US$8.1bn debut of ride-hailing company Uber Technologies.

It was a challenge to say the least, not made easier by the disappointing debut of rival Lyft the previous month, Uber’s own regulatory and reputational issues, public investors’ doubts about the growth-at-any-cost business model and the need to ensure the company’s disparate group of pre-IPO shareholders were mostly locked up.

Though down 35% from the US$45 IPO price at the time of writing, it is easily forgotten that 30 days after the IPO Uber shares were down only 1.9%, far better than the 20%-plus declines of Lyft, SmileDirectClub and Peloton at the same mark.

“Of the high-profile offerings that really struggled, Uber was actually the best performing and we made the best attempt to find something that worked for both the buyside and the seller,” said Donahue.

Bankers in each region make much of the selectivity in the deals they were attached to and it certainly seems the case that the bank was wise to the structural overhang of private investments on IPOs.

The longevity of the ECM team at Morgan Stanley plays a part in the decisions it made. Gobel recalled when he directed a client to speak to the EMEA head of syndicate Jamie Manson-Bahr and the client said – in a positive way – “you all say the same thing”. This consistency of delivery is crucial.

“The collective experience when tough judgments are needed for IPOs, follow-ons, blocks, converts and other solutions is unrivalled,” said Donahue. “There’s not another team on the planet that has this combined experience.”

CHANGING WORLD

Another testament to Morgan Stanley’s influential place in the changing ECM landscape was its role as one of the financial advisers on June’s NYSE direct listing of workplace messaging software platform Slack, a deceptively complex process and an emerging trend that is challenging the foundation of the traditional IPO process.

Direct listings are “not straightforward at all”, said Evan Damast, the bank’s global head of syndicate.

“There’s more work that we do as a bank and as capital markets professionals specifically in a direct listing than an IPO, especially where there’s a lot of shareholders, which will tend to be more often than not.

“We have to work with buyers and sellers. It’s hundreds and hundreds of calls and it’s unsophisticated and sophisticated buyers and sellers and it’s presenting to boards at every single level.”

Rather than fight the trend, Morgan Stanley is embracing alternatives to the traditional IPO.

“We have no vested interest in the old traditional IPO construct versus a direct listing construct or any construct that could emerge in the future, from merging into shell companies or SPACs or initial public mergers, which some people are using as a term of art now,” Donahue said.

“We are agnostic. We want to execute for the client in the way that the client wants. If we do that, we get paid fairly.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com