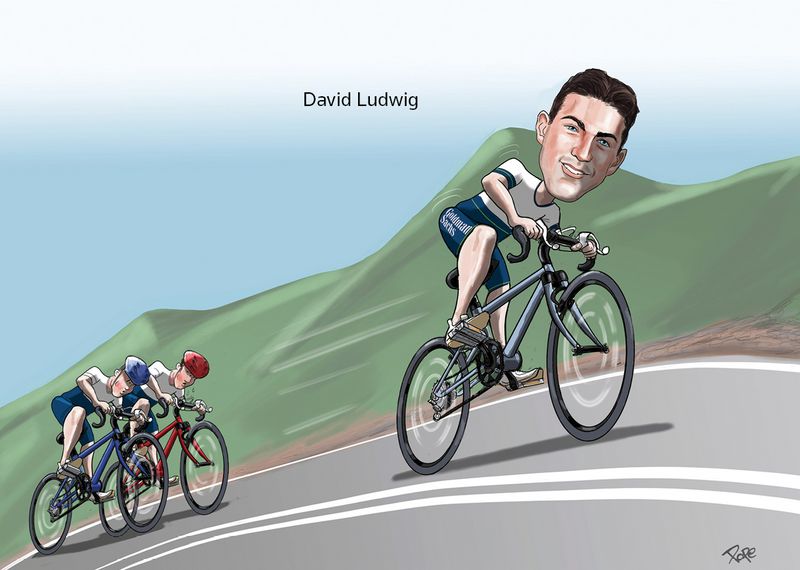

Breaking away:

In a tricky year littered with IPO landmines, Goldman Sachs broke clear of its peers in the league table and adapted most successfully to a changing ECM landscape. The firm is IFR’s North America Equity House of the Year.

![]()

The past year saw the biggest ECM underwriters in the US price at least one or two IPOs they would rather forget.

Goldman Sachs was no exception, taking its lumps for bookrunner roles alongside other banks on disappointing IPOs such as ride-sharing company Uber Technologies and exercise bike maker Peloton Interactive. Then there was flexible office space WeWork, whose failed IPO efforts triggered a corporate implosion for the ages.

“The jumbo transactions in the market were really hard this year, particularly the ones with unproven economic models,” said David Ludwig, Goldman’s head of Americas ECM.

While banks were mostly able to put deals together for these high-profile floats they often fell apart once shares began trading. Uber’s IPO priced a little over a month after Lyft’s, by which point the smaller ride-sharing company had already seen its shares lose nearly a quarter of their value.

Deals like Peloton also stumbled into a period of rotation in September that saw investors shun momentum stocks though it was able to recover its IPO price a few months later.

Despite those difficulties nine of the 12 US$500m-plus IPOs where Goldman was either lead-left or stabilisation manager scored in-range or above-range pricing and produced aftermarket gains for investors.

Though the unicorn deals drew a flurry of headlines and left the big banks red-faced, 2019 nevertheless saw the three titans of US ECM – Goldman Sachs, JP Morgan and Morgan Stanley – break even further away from the pack. Their combined market share of US ECM activity topped 40% in the awards period.

Goldman was the undisputed leader of the trio by the traditional measure of bookrunner credit for US common stock, adding a remarkable 6.5 percentage points to its market share as most of its peers went in the opposite direction. Goldman ended with 18.9% market share, compared with Morgan Stanley in second with 11.5% and JP Morgan third with 11.4%.

“It says something that in the most sophisticated market out there, we have a massive [league table] lead,” said Ludwig. “I feel really good about our breadth and diversity of issuance and our leadership role.”

The firm’s highlights included lead-left bookrunner roles on IPOs including Pinterest’s US$1.6bn listing in the wake of Lyft’s float, the debuts of iconic jeans company Levi Strauss (US$717m) and cybersecurity company CrowdStrike (US$704m), not to mention the year’s most stunning new issue, the US$277m IPO of plant-based meat alternative Beyond Meat.

On the follow-on front, Goldman led and stabilised a US$1.6bn marketed offering from Nasdaq-listed Chinese e-commerce player Pinduoduo, handled EV maker Tesla’s dual-tranche US$2.3bn convert and marketed follow-on, and executed General Electric’s US$1.5bn final sell-down of Wabtec.

Goldman dominated in technology and healthcare, the two busiest sectors. It scored execution props for separately bringing in strategic investors to buttress large financings for Nasdaq-listed Mercadolibre (US$2bn) and Aqua America (US$2.5bn), and, as lead-left bookrunner, for structuring lab products maker Avantor’s US$4.4bn IPO to include a concurrent mandatory convertible.

The firm remained an innovator in raising alternative forms of equity capital, leading the trend towards more direct listings with Slack and leveraging data to make the bookbuild process more efficient and second-guess which companies need capital.

Some of Goldman’s league table lead is attributable to blocks. The bank handled a string of blocks on its own, including US$500m-plus trades in Atmos Energy, Assurant and PRA Health Sciences.

The firm locked its position at the top of the league table late in the review period with one of the biggest sole-led blocks ever. Early November’s mammoth US$3.15bn clean-up of French insurer AXA’s holding in AXA Equitable was won in an auction and priced at a 2% discount.

“We know how to take risk and how to distribute it,” Ludwig said. “We have made significantly more money this year in blocks than last year.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com