In the driving seat

In a volatile year for Asia’s equity capital markets, one bank stood out on the most important deals across the region. For seizing the right market windows and completing deals that others couldn’t, Morgan Stanley is IFR Asia’s Equity House of the Year.

Morgan Stanley led the way in Asia’s equity capital markets in 2019, securing key roles on the biggest capital raisings of the year and showing its strength across a broad mix of markets and products.

The escalating China-US trade war and anti-government protests in Hong Kong made 2019 a challenging year, but Morgan Stanley proved that deals could still be done if the timing was right.

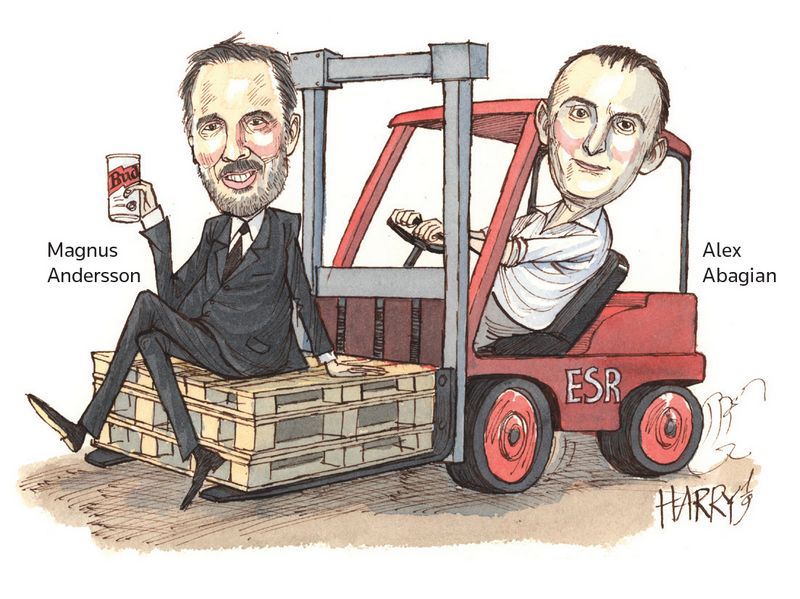

“When things get a little bit more difficult, we outperform even more. We continue to dominate and work on the most important deals,” said Alex Abagian, co-head of equity capital markets for Asia Pacific, alongside Magnus Andersson.

The US investment bank led 9 of the top 15 international equity and equity-linked deals in IFR’s review period in Asia Pacific, excluding Japan. In total, it raised US$12bn from 75 transactions.

After a glut of big technology IPOs in Hong Kong in 2018, Asia’s equity capital markets started 2019 on the back foot, with no clear pipeline of jumbo Chinese listings and weak risk appetite. Morgan Stanley worked hard to secure its leading position, landing key roles on almost all the big floats of the year, as well as introducing new products beyond the important Chinese market.

It led the HK$45bn (US$5.74bn) IPO of Budweiser Brewing Company APAC, the HK$9.04bn listing of Hansoh Pharmaceutical, the HK$9bn float of Chinese sportswear group Topsports International and the HK$14bn IPO of logistics property developer ESR Cayman.

The Budweiser and ESR listings, in particular, underlined Morgan Stanley’s ability to lead the most challenging deals to a successful conclusion.

After Anheuser-Busch InBev pulled the US$9.8bn listing of its Asia Pacific unit in July, opting instead to sell its Australian assets, Morgan Stanley helped it return to the market in even more challenging conditions in September, with protests in Hong Kong and the US-China trade war ramping up.

Morgan Stanley, as one of the two sponsors, added flexibility to the float with an upsize option in addition to a standard greenshoe, a feature that the US bank introduced in the Hong Kong IPO of insurer AIA in 2010. The smaller base deal size, as well as the introduction of Singapore sovereign wealth fund GIC as a cornerstone investor for US$1bn, helped drive momentum, and Budweiser was able to push the proceeds up by around 20%.

Budweiser rose 4.4% on its debut on September 30 gained 20% in its first two weeks. The strong performance reopened the Hong Kong IPO market, fuelling a rush to list in the fourth quarter.

ESR’s revived float was even more remarkable, as Morgan Stanley had not been involved when the Warburg Pincus-backed company pulled a HK$9.76bn IPO in June. When ESR came back to market in October, Morgan Stanley was firmly in the driving seat as lead left global coordinator.

The US bank used the same tactics, adding a cornerstone investor and an upsize option, and delivered another popular deal. ESR eventually raised HK$14bn, 43% more than the June attempt.

Playing to its strengths, Morgan Stanley helped US-listed Asian technology companies raise funds through follow-ons and convertible bonds, including US$1.6bn share sales for China’s Pinduoduo and South-East Asian e-commerce company Sea.

Morgan Stanley was also a joint global coordinator on Huatai Securities’ US$1.7bn landmark London GDR sale, opening the Shanghai-London Stock Connect scheme.

Morgan Stanley also impressed beyond the important Chinese market with a broad range of deals across the region, including the Rs48bn (US$670m) IPO of Embassy Office Park REIT, India’s first real estate investment trust.

India provided other highlights, including major share placements for Bajaj Finance (Rs85bn) and DLF (Rs32bn) and a Rs72bn overnight block in Kotak Mahindra Bank.

The US bank was also a leader in South-East Asia, acting as joint global coordinator on the record Bt48bn (US$1.59bn) IPO of Asset World in Thailand and sole bookrunner on a Malaysian client’s Ps5.3bn (US$102m) share sale in BDO Unibank, the first sell-down in a Philippine bank since March 2013.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@refinitiv.com