As global M&A activity came to a grinding halt during the first quarter as the coronavirus pandemic spread, some investment bankers are flipping the switch and becoming restructuring advisers. The retooling is happening at the fastest pace since 2009.

Independent investment banks like Lazard, Evercore, Moelis & Co and PJT Partners are structured to take advantage of countercyclical trends. When the economy is booming, M&A will drive returns; when the economy sags, robust restructuring groups take centre stage, balancing out revenue.

“These guys are an enormous resource. They know industries very well. They are very connected to clients and often get the first call when there is trouble,” said the head of one restructuring shop. “A CEO may not know a restructuring banker, but he will often know an M&A banker.”

A rival banker agreed: "Many corporates are not used to confronting such a dramatic situation threatening their survival.

"We are having lots of conversations, mainly with debtors. We are using our network who have many corporate relationships to do this. All restructuring advisers are busy. They are currently working out what they will be doing."

Some of the most established networks are at Lazard and Rothschild & Co, both of which are present in many locations beyond London and New York, specifically to advise corporates. They can refer to restructuring experts based in larger financial centres.

ALL IN THE TIMING

Ahead of the latest downturn, boutique Greenhill has been busily building up its restructuring group, taking bankers from Barclays and Rothschild as it looked to balance its M&A practice.

The decision to fully build out the practice was made at a time of turmoil for Greenhill’s M&A group, when European deals on which the investment bank relied, slowed considerably and revenue slumped.

The timing could not have been better.

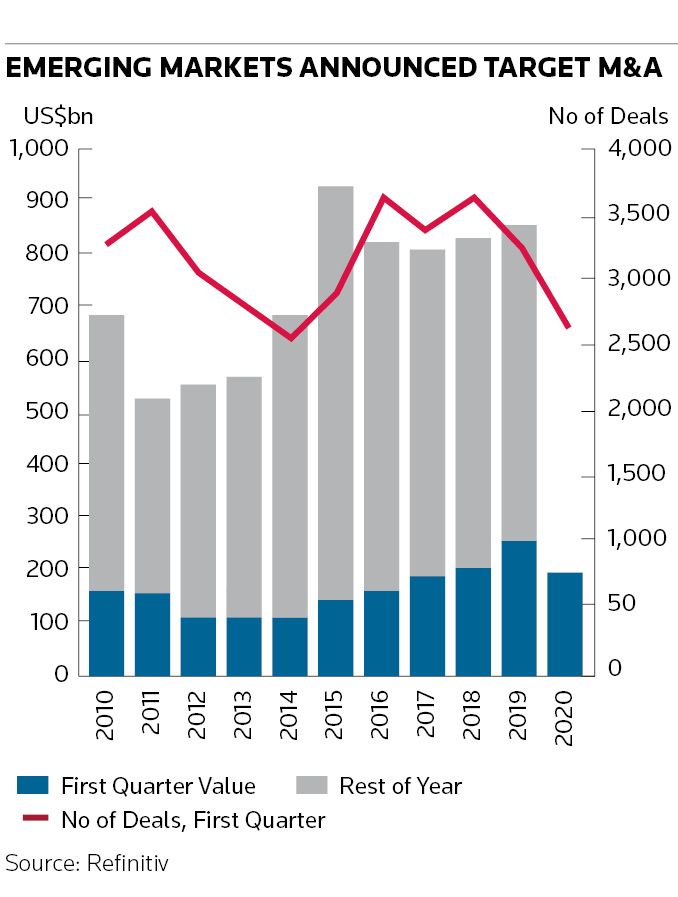

Global M&A activity in the first quarter slumped 25% from a year ago to US$730.5bn, based on the value of announced deals, according to Refinitiv. That made it the weakest first quarter since 2016.

Cross-border M&A fell 16% to US$208.6bn to a seven-year low. Megadeals – those transactions above US$10bn, which had been driving the market for the past three years – fell 53% in the quarter. US dealmaking activity fell 50%, the weakest first quarter in the region since 2014.

The bright spot during the period was in Europe, where the value of deals surged 122% to US$237bn on the strength of a couple of megadeals, including the proposed US$30.1bn merger of insurance brokers Aon and Willis Towers Watson.

The total number of deals announced worldwide in the quarter fell 13% from a year ago to its lowest level in six years.

"It’s not that M&A bankers are sitting around twiddling their thumbs waiting for a rebound,” said an M&A banker. “These markets will create opportunities if you are creative.”

BALANCED BOUTIQUES

The perfect blending of groups can allow M&A bankers to bring industry expertise to restructuring and has been useful in energy and retail, and increasingly in technology, media and telecoms, one banker said.

As with previous cycles, restructuring clients will often become banking clients on the other side.

"M&A people are being retooled and repurposed so they can advise on capital markets and restructuring," said another restructuring banker.

"These are very sensitive times for companies. We are helping them look at their liabilities and whether they can raise equity and other capital. We are basically helping them think these things through.”

Boutiques have also done well picking up government mandates. Rothschild is advising the UK government on the airline sector. PJT is acting for the US Treasury in the same capacity. The Treasury has also retained Moelis and Perella Weinberg on separate crisis-related mandates.

At the bulge bracket shops there is less room to retool M&A advisory teams as restructuring specialists.

Most major banks avoid restructuring as it can cause conflicts of interest with existing or potential lending relationships. But even M&A bankers at those banks are paying attention as distress ticks up.

When some solid companies were forced to restructure in the 2008 downcycle it created acquisition targets, and more opportunities will emerge with this cycle, said a banker at a lending bank.