Southwest Airlines put itself in the strongest financial position of the major US airlines to weather Covid-19 and its after-effects by raising US$6bn split evenly between the sale of new stock, convertible bonds and straight debt.

The cash injection leaves the US's largest domestic carrier with US$16.8bn of cash to last it through a harrowing plunge in passenger numbers.

Though that staggering tally includes US$3.3bn in payroll support from the US government, the past week's financing means Southwest is far less dependent on the public purse than its major US airline peers even while it burns through about US$1bn a month in cash.

Southwest is eligible to collect an additional US$2.8bn Treasury loan that would give it even more leg room, but has until September 30 to decide whether to take it and may not do so.

In the US's biggest equity recap transaction so far in this crisis, Southwest found enough demand late on Tuesday to upsize the sale of common stock to US$2bn from US$1.5bn at launch.

“It’s great to see the magnitude of demand ultimately come through,” one banker in the underwriting syndicate said.

The sale of 70m common shares, up from 55m at launch, drew strong demand and delivered investors some quick gains, with the stock rallying to US$30.97 in Wednesday's aftermarket versus the US$28.50 offering price.

Southwest's Baa1/BBB/BBB+ rating, the only investment-grade rating in the US airline sector following recent downgrades, helped underpin a doubling in the size of the CB to US$2bn from US$1bn at launch.

The CB was priced with a 1.25% coupon and 35% conversion premium, the former well inside the 2%–2.5% talk.

“There just isn’t a lot of investment-grade paper in the convert market,” one CB banker said. “When one does come there tends to be a number of investors that, while not price-insensitive, are extremely interested.”

Ranking as the 11th biggest US equity/equity-linked combo financing since 2010, the deal also proved a big fee event for Wall Street.

The underwriting syndicate led by Morgan Stanley, Bank of America, JP Morgan, BNP Paribas and Citigroup as joint books and Goldman Sachs and Wells Fargo as senior co-managers shared about US$110m of underwriting fees on those two legs of the recap.

On Wednesday, a day after the equity was priced, Southwest raised another US$2bn from a two-part sale of bonds, partly to repay debt, but also to add to overall liquidity.

WITHERING CRITICISM

US airlines are facing withering criticism for failing to carry rainy day funds for an event like Covid-19 and instead spending spare cash generated in good times on buying back billions of dollars of stock at prices double and in some cases triple current levels.

Though the US government has set aside US$50bn of aid for the industry, airlines have also rushed to cut capacity, lower costs and raise as much cash as they can from a variety of sources, including capital markets.

"Cash, in this environment, is an asymmetrical risk," Southwest CEO Gary Kelly told analysts on the airline's earnings call on Tuesday. "Not enough and that is a huge problem. Too much and we'll pay down debt or we'll buy available assets opportunistically."

Southwest's equity recap dwarfed the efforts a week earlier of rival United Airlines, which raised US$1bn from an overnight block sale of stock.

United's stock traded poorly after the deal and some investors saw it as too small to materially improve United's liquidity.

Southwest's focus on the domestic leisure market (it is the largest domestic carrier in the US) and its lower debt levels going into the crisis have helped its stock price outperform those of United, American Airlines and Delta Air Lines this year.

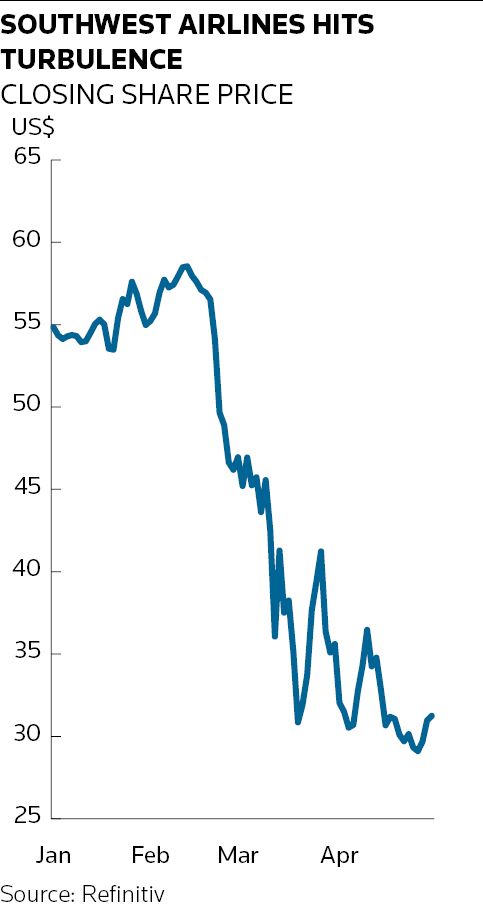

Southwest stock is down only 40% in 2020 versus 60%–70% declines in these three peers, enabling it to sell stock with relatively less dilution.

Delta has so far resisted raising equity, instead securing US$3bn last week from the sale of a US$1.5bn five-year bond and by taking out a US$1.5bn credit facility.

Delta is getting US$10bn of government aid on top of US$8bn of cash it has raised since the start of March to offset a US$50m daily cash burn.

American, which reported a US$2.2bn first-quarter net loss on Thursday, is relying mainly on government aid to see it through Covid-19 and has given no indication that it plans to raise equity.

The nation's biggest airline by capacity stands to collect a total of US$10.6bn of government aid, including US$4.1bn of grants, a US$1.7bn low-interest loan for payroll support, and a separate US$4.75bn five-year Treasury loan that will charge only about 4%.

American CEO Doug Parker told analysts the airline formally applied for the Treasury loan earlier this month.

While the airline was looking at other forms of financing, the government loan was "the most efficient financing out there", Parker said.

A condition of the loan is that airlines demonstrate they do not have reasonable access to public markets and they must issue an agreed amount of equity warrants to Treasury.

With government help, American now has US$17.4bn of liquidity, though it expects to burn through US$6.4bn this quarter (US$70m a day) to leave it with US$11bn at the end of June.

“Not having enough [cash] is really expensive; having too much may be somewhat expensive, but you just use that to pay down the debt sooner,” Parker said.

“That's certainly the way we view it, and we're going about it in a way of raising that which is most efficient first and getting to those [options] that are less efficient later.”

![]()