SoftBank Group's US$20.4bn sale of two-thirds of its 24.6% stake in mobile carrier T-Mobile US late on Tuesday delivered US ECM bankers their biggest payday in nearly six years – a fee bonanza late in what was already a record quarter for deal flow.

The US$238.2m underwriting fees shared by the 18-firm syndicate behind the US$15.9bn public offering portion of the deal (including exercise of a 7.5% greenshoe) represented the biggest US ECM fee event since banks collected US$300m from Alibaba's US$25bn NYSE IPO in September 2014, according to Refinitiv data.

The overall transaction, also the second biggest US ECM sell-down of all-time, was an even bigger windfall for banks that collected fees from a rare US$2bn rights offering and a US$1.86bn exchangeable bond issue that comprised the elaborate deal mix designed to maximise the Japanese conglomerate's proceeds.

The stock sale formed part of SoftBank CEO Masayoshi Son's plan outlined in March to sell US$41bn of assets to reduce debt and repurchase SoftBank's own stock, and came less than three months after the merger of Deutsche Telekom-controlled T-Mobile US and SoftBank-backed Sprint closed on April 1.

The sale had a second purpose in enabling Germany's Deutsche Telekom, T-Mobile US's 43.5% shareholder, to continue to consolidate T-Mobile in its accounts.

Since the merger it has held voting power over SoftBank's stock. After negotiations around the sale, Deutsche Telekom will continue to have voting rights over SoftBank's remaining 8.6% stake plus 5m shares that SoftBank sold to former Sprint CEO Marcelo Claure.

Deutsche Telekom also purchased four-year call options over most of SoftBank's remaining stake, allowing it to increase its economic stake over time.

"This process was designed to facilitate Softbank's monetisation but also to consolidate T-Mobile under Deutsche Telekom," said one banker involved in the transaction. "For T-Mobile, it is important to be fully aligned with one parent rather than two."

TRIPLE-PLAY

After a day of marketing, a syndicate of banks led by active bookrunners Goldman Sachs, Morgan Stanley, Citigroup, JP Morgan and Barclays priced the upsized sale of 143.4m T-Mobile shares at US$103, a 3.4% file-to-offer discount. The stock bounced to US$110.19 by Thursday's close, the aftermarket gains ensuring the syndicate will exercise a 7.5% greenshoe to sell another 10.75m shares.

The same banks also priced a concurrent US$1.86bn three-year exchangeable over 18.1m T-Mobile shares that was priced with a 5.25% coupon and 22.5% conversion premium, the issuer-friendly ends of talk and also with a 7.5% greenshoe.

The common stock sale was upsized from 133.55m shares at launch and the exchangeable downsized from 27m shares, enabling SoftBank to get more of the proceeds upfront.

"The exchangeable was put in place to soak up some demand if the common stock offering did not go well," the banker said.

Including greenshoes, a separate 19.75m-share rights offering and the sale to Claure (funded by a SoftBank loan), SoftBank is parting with a total of 198.3m shares, 64% of its holding.

Barclays and Deutsche Bank led the rights offering, which was pushed for by the independent committee of T-Mobile's board advised by PJT Partners. Subscription runs until July 27 and pricing is flat to the stock sale.

The rights offering may have contributed to the stock's 0.5% gain during Tuesday's session while banks pitched the sell-down to investors before the stock went ex-rights that night. The rights also complicated matters for hedge funds that would normally be looking to short the stock on the sale.

For SoftBank, the sale crystallises a 24% gain versus book value of US$82.99 a share on a holding that dates back to its 2013 investment in Sprint, though this has proved not nearly as lucrative as its much larger Alibaba investment.

SoftBank still plans to use the sale proceeds to buy back stock and reduce debt, though it said in a statement it needed to further enhance its cash reserves given "the current situation where there is a concern for a second and third wave of spread of Covid-19".

The doubling of SoftBank's share price from the Covid-19 lows in March may also have lessened the company's enthusiasm towards buying back stock.

NEVER BEEN BUSIER

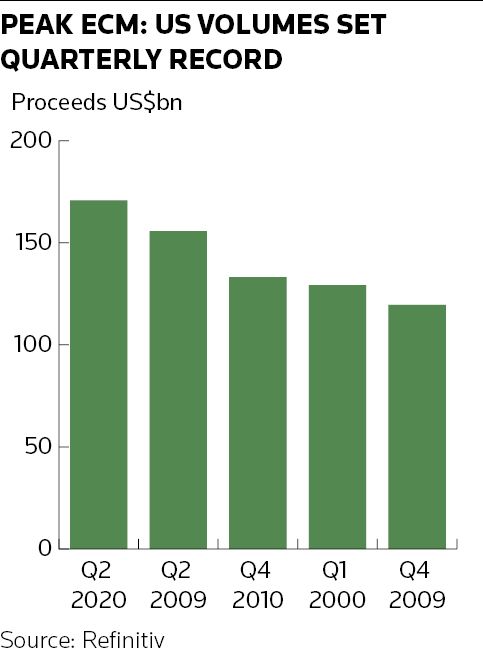

The current quarter has seen companies raise US$170bn in US equity capital markets through to late Wednesday, according to Refinitiv data, outstripping the previous record (US$155.7bn) set in the second quarter of 2009.

The quarter has seen banks called on to price IPOs, secondaries, convertibles – as well as at-the-market programmes and private placings that do not feature in the total – in aid of both recapitalisations and opportunistic financings, plus unwindings of long-held shareholdings.

Last month also saw banks collect nearly US$160m in underwriting fees from PNC Financial Services' sell-down of its US$13.3bn stake in BlackRock, the sixth biggest fee event in US ECM.

In short, this has been a "career quarter" for many ECM bankers. Even for many seasoned individuals Tuesday would have ranked as their biggest day in the business.

Just to further underscore the point, UBS analysts are forecasting league table leader Goldman Sachs will report global ECM revenues of more than US$900m for the second quarter, a gain of 90% versus the same quarter last year.

Of course, there is still more to come with Dun & Bradstreet wrapping its US$1.38bn IPO on the last day of the quarter. Goldman leads on that one too, alongside Bank of America.

| Biggest fees paid on US ECM transactions | ||||

| Date | Issuer | Issue type | Imputed fees | Proceeds |

| (US$m) | (US$bn) | |||

| 18/09/2014 | Alibaba Group | IPO (primary, secondary) | 300.4 | 25 |

| 23/06/2020 | T-Mobile US | Follow-on (secondary) | 238.2 | 15.9 |

| 08/11/2010 | BlackRock | Follow-on (secondary) | 191 | 9.5 |

| 19/05/2011 | Mosaic | Follow-on (secondary) | 186.9 | 7.5 |

| 17/05/2012 | IPO (primary, secondary) | 176.1 | 16 | |

| 12/05/2020 | BlackRock | Follow-on (secondary) | 159.4 | 13.3 |

| 09/03/2011 | HCA Holdings | IPO (primary, secondary) | 157.8 | 4.4 |

| 17/11/2010 | General Motors | Mandatory convertible | 137.5 | 5 |

| 17/11/2010 | General Motors | IPO (secondary) | 136.1 | 18.1 |

| Source: Refinitiv | ||||