Societe Generale will revamp its struggling equities unit by scything back its presence in some of the complex structured products it once pioneered, after this historically important source of trading profits triggered heavy losses.

The challenge it faces: lowering the risks associated with trading structured equity derivatives without giving up its prominent position in this market.

French investment banks announced another sorry set of equities results in the second quarter on the back of sustaining hundreds of millions of euros of losses related to structured equity derivatives positions in the first half of the year following a collapse in stock markets and sweeping cancellations of company dividends.

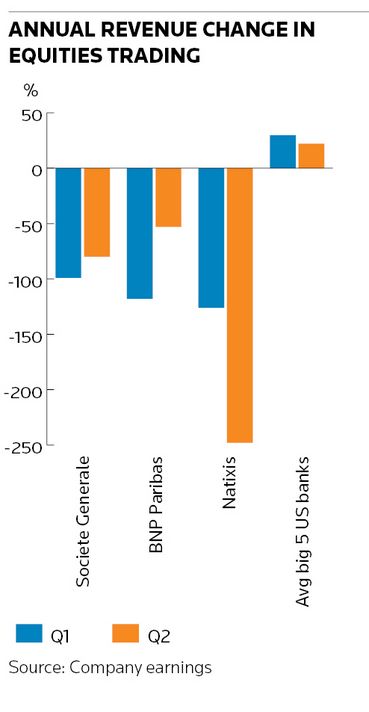

In part as a result of the pain from equity derivatives, BNP Paribas and Societe Generale reported overall equities revenue declines of 53% and 80% for the second quarter compared to the previous year, respectively, while Natixis recorded a €174m second-quarter loss from equities (down from a €117m profit in the same period last year).

Natixis has parted ways with its chief executive, Francois Riahi, and is set to announce a new strategic plan next year, while scaling back its equity derivatives operations in the meantime. SG also confirmed plans to overhaul equity structured products, one of its core activities.

Severin Cabannes, deputy chief executive of SG, told IFR the bank intends to maintain its “worldwide leading franchise" in this area. But he also said SG would significantly lower its risk appetite for more complex types of autocallable structures – a product that has been instrumental to the growth of the equity structured products market in recent years – even though that would cost the bank up to €250m in annual revenues.

“The risks attached to these products in such an unprecedented, dislocated market have been shown to be too high,” said Cabannes. “When you have simpler underlying products, even in such a dislocated market, the hedging cost is more manageable.”

SG last week announced that Cabannes would leave the deputy CEO role at the end of the year ahead of retiring in 2021.

BNPP and SG have long derived a substantial chunk of their equities trading profits from packaging and selling structured products that provide payouts to retail investors based on the performance of stock markets.

Structured equity derivatives on average accounted for 39% of equities revenues at the duo last year, according to Amrit Shahani, research director at analytics firm Coalition, compared with an average of 14% across the top 10 global investment banks.

POPULAR RISKS

Autocallables have been the most popular type of structured product in recent years, providing investors with exposure to stock markets while capping both gains and losses. These investments work well when markets are rising, but they create serious problems for banks when markets plummet as they did in March.

Exposures from autocallables, particularly the most complex ones, leave banks vulnerable to a surge in volatility and correlation. The mass cancellation of company dividends – as happened in Europe as the Covid-19 crisis began – can also inflict heavy losses, as an assumption that dividends will be paid is baked into the price of some of these products.

Equity "derivatives suffered from the tail effect of the cancellation of dividends at the end of March,” Philippe Bordenave, BNPP’s chief operating office, told IFR after the company’s second-quarter results.

He said that BNPP's move into prime brokerage would make it better able to cope with such unexpected events. “We will benefit from more flow activity after our expansion in prime brokerage. This will give a better balance with structured derivatives. These add high value in good times but can suffer during crises."

SG has looked to expand its flow activities, too, following the acquisition of Commerzbank’s equities and commodities business two years ago. But it also plans to reduce its risk tolerance to complex autocallables by 50%, meaning it would halve the size of its losses during stressed markets, Cabannes said. He noted that alternative products already exist: such as so-called volatility-targeting products, where volatility is confined to a much more manageable range.

“We will have less exposures to those types of complex autocallables with such correlation, volatility and dividend exposure,” said Cabannes.

Such a change was perhaps inevitable given the scale of the losses, which, while unusual, are not entirely without precedent. In the 2008 financial crisis, BNPP and SG both cited sharp changes in volatility, correlation and dividends when reporting equity losses of €1.9bn and €519m respectively in the final quarter of that year.

RIVAL OPPORTUNITY

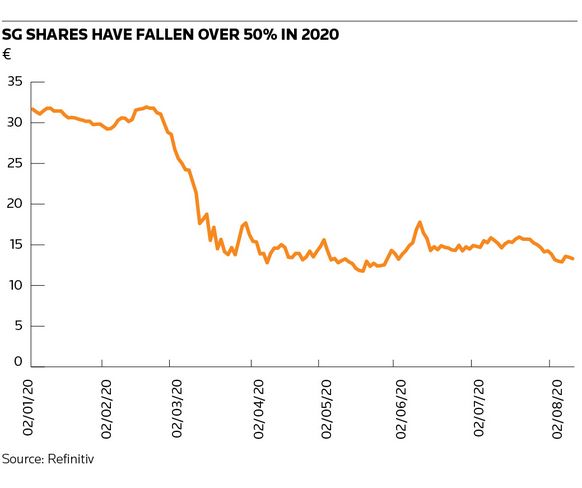

To offset its expected revenue loss of up to €250m – accounting for about 5% of SG’s 2019 total markets’ revenues – the bank intends to make €450m of costs savings by 2022–23.

Still, some analysts reckon the bank could lose more ground in equities than it plans. Omar Fall, an analyst at Barclays, forecasts equities revenues of €1.8bn in 2021, a 28% decline from last year.

And despite BNPP’s and SG’s commitment to the business, rivals certainly sense an opportunity.

One equities banker said the French banks' woes have made it easier to engage with clients. Another said trading the kind of exotic equity derivatives that SG and BNPP have traditionally specialised in has become more profitable in recent months.

“Does it mean less competition or a repricing of risk on a broader basis?” he asked.

Either way, “we’ve seen quite a significant shift in terms of the margin [we can make] for those types of risks”.