Goldman Sachs made about US$100m from a series of trades involving Tesla in recent months, according to sources familiar with the matter, as it capitalised on a steep rise in the electric carmaker’s share price this summer that helped fuel a broader surge in US stock markets.

Bankers in Goldman’s equities trading division were behind a range of lucrative Tesla-focused transactions, including trading Tesla stock options, providing financing secured against shares in the company, and buying and selling its convertible bonds, according to the sources.

Those deals helped Goldman produce stand-out equities trading results in the second quarter in particular, sources say, when the bank reported revenues from equity trading approaching US$3bn – its best quarter from that business in over a decade.

The trades also reveal how one of the world’s most prominent financial institutions joined investors both big and small in profiting from the dizzying climb of one of a cluster of high-profile stocks that drove markets higher this summer.

OPTIONS FEVER

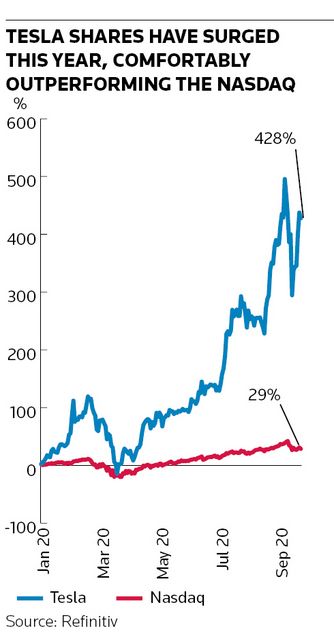

Tesla has been one of the hottest stocks of the last six months in what has been a particularly bumper period for equity markets. The company's shares are up 486% since hitting a low of about US$72 in March, when markets slumped amid concerns over the impact of the coronavirus pandemic on the global economy.

By way of comparison, shares in technology stalwarts Amazon and Apple have climbed about 79% and 97% since their March lows, respectively, while the S&P 500 is up 50%.

All this came during a frenzied period for stock option trading. US single-stock options volumes were nearly three times higher in the second quarter compared to the same period last year, according to strategists at Barclays, driven by a significant increase in activity from retail investors.

Analysts and media coverage have focused on how day traders on platforms such as Robinhood, along with institutional giants such as SoftBank, helped fuel the equity rally through their voracious appetite for derivatives providing exposure to rising share prices.

Goldman's equity trading desk doesn't deal with retail investors. But the sizeable revenues it raked in show how the investment bank's traders still managed to profit from these extraordinary market moves, in part through using derivatives to position for an upswing in Tesla shares, sources said.

TAILWIND

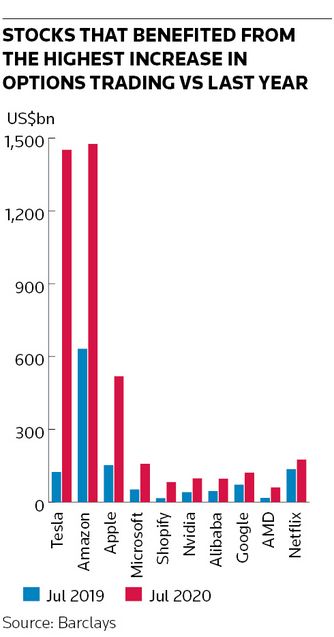

Barclays' analysis suggests Tesla benefited from the highest increase in options trading activity across the entire market, potentially providing a significant tailwind to the share price. Options volumes on the carmaker jumped to US$1.45trn in July from US$124bn in July 2019 on the back of the deluge of retail trading.

Amazon was the second-largest beneficiary of an increase in options activity, rising from US$632bn to about US$1.48trn. Apple, the next most affected, saw volumes increase US$367bn to US$519bn, Barclays said.

A steep rise in options activity can drive underlying share prices higher. That is particularly true in periods when demand in options markets is extremely lopsided, as was the case over the summer.

In the most extreme difference in demand in over five years, single-stock call option volumes have been around twice as high as put option volumes, Barclays said. That shows investors were predominantly interested in gaining exposure to potential share price gains through call options, rather than buying puts to protect against declines.

A lack of offsetting client flows forces traders who have sold call options to buy the stock to hedge their position, a trend that can gather momentum as markets move higher. Such hedging activity now accounts for about 40% of overall stock volume, Barclays estimates.

MARGIN LOANS

Trading in call options was just one of a series of profitable businesses related to Tesla for Goldman. Buying and selling Tesla's convertible bonds (which have a face value of over US$4bn), whose prices climbed sharply this summer as the company's shares rocketed, was another.

But Goldman bankers also made money from corporate equity derivatives deals involving the carmaker, sources said. That is an umbrella term for a range of transactions – including margin loans, or lending money against a company's shares – which usually involve providing financing against large equity stakes.

Elon Musk, Tesla's chief executive, has borrowed heavily against his Tesla holdings over the years, public filings show, pledging nearly half of his roughly 38.7m shares in such transactions at the end of last year.

Corporate equity derivatives more broadly have been an important source of revenue for some banks this year. Goldman was one of a few lenders to profit from structuring and selling a derivatives arrangement in June that enables Deutsche Telekom to buy SoftBank's remaining stake in T-Mobile US, according to sources.