Banks should move away from a popular breed of equity structured product and concentrate on less dangerous instruments, according to Societe Generale, one of the most prominent banks in this area of finance, following heavy industry losses earlier this year.

So-called worst-of autocallable products were the main culprit behind hundreds of millions of euros of losses investment banks suffered in March and April, when stock markets collapsed and companies cancelled dividend payouts to shareholders.

Societe Generale, which has traditionally derived a large portion of its equities revenues from selling these complex notes to Asian and European retail investors, is among the banks gently prodding their clients away from worst-of structures and towards other investments.

“We think the structured product landscape would be better off with products other than only worst-ofs,” said Jean-Francois Mastrangelo, European head of pricing at SG.

“All banks suffered from these products. We think product diversification will be the big story of the next two to three years across the industry.”

SG has been at the forefront of the structured products market, in both good times and bad. In 2018, it brought in more revenues than any other bank in structured equity derivatives, according to data from analytics firm Coalition, perhaps explaining why this business was largely spared in an investment banking overhaul the following year.

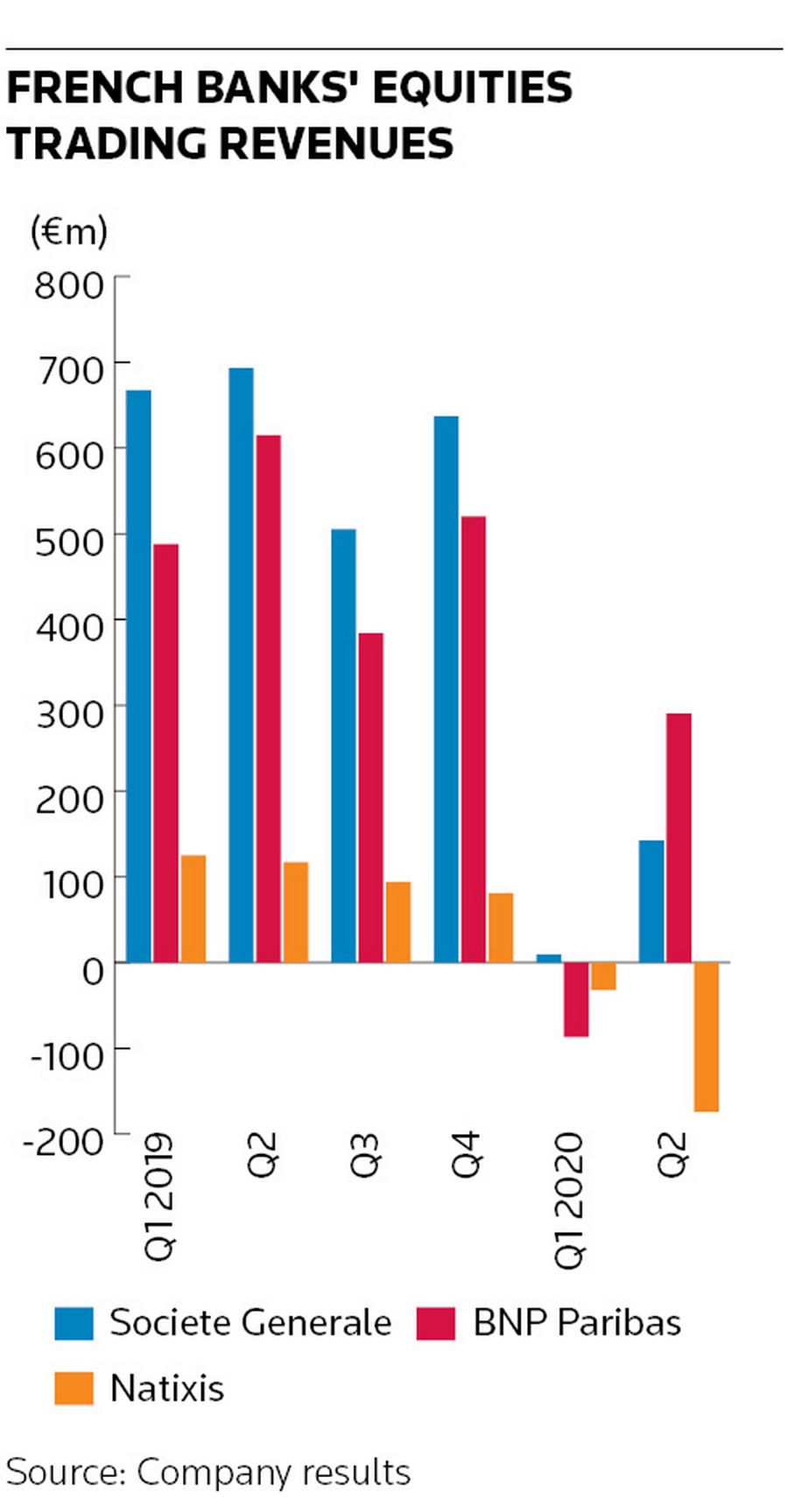

SG went on to report some of the largest losses of any bank from equity structured products after stock markets nosedived in March. SG disclosed structured product losses of €400m in the first half of the year as a result of companies cancelling dividends, while Natixis reported a €273m hit in the first half and BNP Paribas disclosed a €184m loss in the first quarter.

WORST-OF TIMES

Worst-of autocallable structures were the main drivers of the losses, bankers said, putting them first in line for the chop after banks reviewed the wreckage.

Autocallables are structured notes that provide chunky coupon payments depending on the performance of stock markets. Banks have had to get creative when crafting shorter-dated autocallables for retail investors in Asia and parts of Europe in recent years to ensure they offer juicy enough returns.

Enter the worst-of structure – arguably the most popular version of these products prior to this year’s equity selloff. Investors in these notes receive a coupon so long as the worst-performing stock or equity index out of a group of three has hit a pre-agreed level on a particular date.

The problem for banks is the design of these autocalls often leaves them vulnerable to surges in stock-market volatility as well as companies cancelling dividends. An additional danger for banks selling worst-of structures is how the different stocks or indices behave in relation to one another – or their correlation – which becomes fiendishly hard to handle when markets move in unison.

That made March and April something of a perfect storm for banks with large worst-of exposures.

"Everything moved according to Covid news – it correlated everything,” said Mastrangelo. “That hurt one business in particular: short-term autocalls, usually with worst-of features.”

A NEW CHAPTER

SG plans to keep offering worst-ofs given the product's popularity, but will scale back in them and push alternatives.

Senior management have said the bank’s appetite for the riskiest investment products has halved, which is likely to lead to a roughly €250m decline in trading revenues.

“We want to continue to be a global player on the high end of structured products activity,” said Yann Garnier, global head of sales at the bank. “Innovations that allow us to reduce our risk will mean we can design alternatives that are more attractive for investors."

Bankers say the price of worst-of baskets has risen steeply across the market, suggesting SG isn’t alone in reviewing the riskiness of this activity. Mastrangelo said clients had also been asking for new products, having found that worst-of autocalls "can be volatile and risky".

Certainly, banks like SG had already been steering investors elsewhere prior to the crisis, favouring products that are easier to risk manage.

Payout structures that give equal weighting to all the underlyings in a basket is one option. Building products based on custom indices is another. That allows banks to diversify away from mainstream indices like the Euro Stoxx 50, where large amounts of risk are already concentrated, and instead tap into popular themes such as sustainable-friendly investments.

“It has become an easy solution to show the worst-of basket - private banks have industrialised a lot on this product,” said Mastrangelo. “But this product hasn’t been there forever. We believe it’s the moment in the cycle to think of the investment product for the next five years."

MEANWHILE IN CREDIT

While the equities revamp grabbed the headlines, SG is also reviewing another complex structured product business: credit.

This has historically formed a far smaller part of the bank's markets activities. Even so, SG has been one of the most prominent banks involved in selling notes to private banking clients that slice up pools of corporate credit-default swaps.

Concerns about a jump in company defaults upended this corner of credit markets in March and SG suffered around €60m in losses, according to sources familiar with the matter.

Mismatches in hedges for these exposures was one issue, sources said. The notes tended to be structured on a “zero recovery” basis, meaning investors don't receive any compensation for money that CDS contracts pay out after a company defaults. That contrasts with the market norms when banks trade CDS tranches between themselves, where some degree of recovery is baked in.

Competitors said that SG has raised its prices for these notes already. Sources say the French bank will probably scale back its activity in zero-recovery products, but won't exit the market altogether.