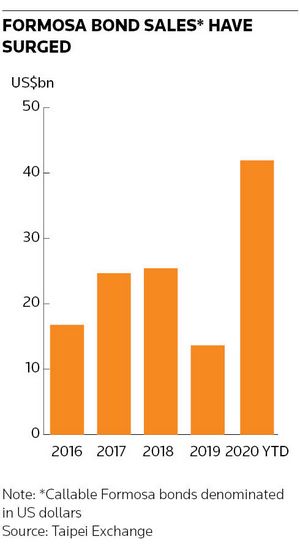

International companies have sold a record amount of US dollar debt in Taiwan’s Formosa bond market this year, a sign that investor appetite for these complex securities – and banks’ desire to sell them – is stronger than ever following a plunge in global interest rates.

Foreign banks and corporates have raised about US$42bn in callable US dollar Formosa bonds so far in 2020, according to data from the Taipei Exchange, more than triple last year’s total and comfortably surpassing the previous full-year high of US$25.4bn in 2018.

The flood of new issuance comes despite some banks struggling with interest-rate derivatives positions stemming from old Formosa debt sales when financial markets slumped in March. That experience may have spurred a rethink in how some trading desks manage their Formosa exposures, bankers say, but has failed to act as a wholesale deterrent to this activity.

Quite the opposite appears true, in fact, judging from the billions of US dollars banks have sold in Formosa bonds in recent months. Many appear keener than ever to tap the Taiwanese market (and help clients to do so), underlining just how significant this business has become not just in terms of fundraising, but also as a source of revenues for derivatives trading desks.

LUCRATIVE BUSINESS

Formosas are foreign-currency bonds sold in Taiwan. The market has grown in recent years thanks to demand from local investors, predominantly life insurers, for higher-yielding securities.

The call option built into many of these notes also makes them appealing to borrowers, particularly banks, allowing them to redeem and replace the bonds when interest rates fall or keep them in place if funding conditions deteriorate.

The call option can also provide a juicy stream of revenues for banks’ derivatives trading desks, which typically sell interest-rate options to hedge the call feature on the Formosa bonds.

“Formosa bonds have been one of the key drivers of the rates derivatives business in recent years,” said Bhaavit Agrawal, global head of private placements, rates and currencies at Citigroup.

But some prominent investors have long believed that issuers are overly compensated for the value of the option.

Portfolio managers at Pimco wrote a 2016 commentary saying that despite the similar or higher yields Formosa bonds often have compared with regular debt, most “are callable, and the call option is often undervalued” – a view the US$1.9trn asset manager still holds, according to a spokesperson.

Certainly, the related options activity can be extremely profitable for banks, which have accounted for about two-thirds of callable Formosa US dollar bonds sold this year.

“Formosa bonds have probably been the majority of the PnL in banks’ structured rates businesses over the last several years. It’s very significant,” said one senior European banker.

CHALLENGING TIMES

The business can nonetheless be extremely challenging for derivatives traders during tumultuous periods in markets, particularly for those that have been more aggressive in selling large amounts of interest-rate options to hedge Formosa issuance.

That was the case in March when interest rates collapsed after global central banks moved to stimulate economies in response to the coronavirus pandemic.

Banks were suddenly underwater on the so-called swaptions they had sold. These contracts give the buyer on the other side of the trade the right to enter into an interest-rate swap at a pre-agreed level in the future, potentially allowing them to profit from the sharp drop in rates.

Put simply, the market moves had made these swaptions far more valuable to the buyer – and problematic for the banks that had sold them. Bank traders duly scrambled to hedge their positions, sending the cost of these swaptions soaring higher.

The implied volatility, a proxy for the cost, of a 10-year US dollar swaption starting in 10 years’ time leapt to a record high of 117 points, compared with about 28 points at the start of the year, according to Refinitiv data (a move bankers say was exaggerated by the sharp decline in interest rates at the time).

Some banks “give a huge amount of value to all of the different call options [in a Formosa], which potentially gives you the most PnL on day one and more aggressive pricing on the bond," said a senior bank trader.

"The downside is on a day-to-day basis you have to rebalance far more risk. That would’ve been very painful in March because bid-offers just exploded and rebalancing anything was extremely expensive."

HEDGING RETHINK

That experience may be prompting banks to reconsider their hedging strategies, including the amount of swaptions they should sell to hedge Formosa issuance.

That is because the call function in Formosa bonds essentially gives banks an option on two things: interest rates and their own funding costs. The problem is banks can only hedge the interest-rate component of that when selling swaptions.

Some banks are reportedly adjusting their pricing on new Formosa issuance already with this in mind.

“There is a debate around what is the right amount of swaptions banks should sell given that they didn't really buy an interest-rate option when they issued the Formosa," said Agrawal. "It will depend on how strongly banks believe their funding spreads correlate with interest rates."