Etihad Airways has issued US$600m five-year unlisted "transition sukuk" to finance its shift to a greener future, which it says is the first of its kind and the first sustainability-linked bond from the high-emitting airline industry.

The UAE flag carrier claimed another first for sustainable finance with an unusual framework that allows it to issue either project-specific "use-of-proceeds" deals, or sustainability-linked instruments that tie financing costs to achieving company-wide ESG targets.

As the deal is a sukuk issue, failure to meet the targets will trigger a penalty clause linked to purchasing carbon offset credits rather than the 25bp coupon step-up seen on SLBs for companies such as Italian electricity generator Enel and Brazilian pulp and paper company Suzano, as the rapidly developing market continues to expand.

“It is the first public aviation deal and demonstrates the feasibility of the sector. The amount of interest showed that investors want to see the aviation sector in the sustainable finance market and it is welcome if structured correctly,” an ESG banker said.

Bankers said Etihad opted for the structure to show its seriousness about sustainability and to overcome scepticism about a difficult sector that many investors view as inherently unsustainable.

Etihad also played it safe by issuing an attractively priced instrument compared with other Abu Dhabi entities and one that was primarily designed to appeal to a local investor base, several of whom put in anchor orders.

“This was not marketed as a traditional public bond,” a banker at one of the leads said. “It was more like a customised private placement.”

Etihad, which is owned by the Abu Dhabi government and rated A by Fitch, set the spread at 200bp over mid-swaps, while state holding company Senaat, also A rated by Fitch, has December 2025 sukuk that leads saw bid at 187bp over swaps.

It also provided a premium over lower-rated national cooling company Tabreed (Baa3/–/BBB), which has US$500m seven-year sukuk, priced earlier this month at plus 215bp, bid at plus 194bp according to Refinitiv. Tabreed is owned by state wealth fund Mamoura and French utility Engie.

Although the ESG angle attracted some international investors, it made little difference to the outcome. Local and regional investors are the mainstay of the sukuk market and were more interested in the credit than ESG considerations, while some green investors will not buy sukuk.

However, the transparency that ESG investors expect was marred by a non-disclosure agreement that investors wishing to access the financials were asked to sign, which led some investors to question the governance – or ‘G’ of ESG.

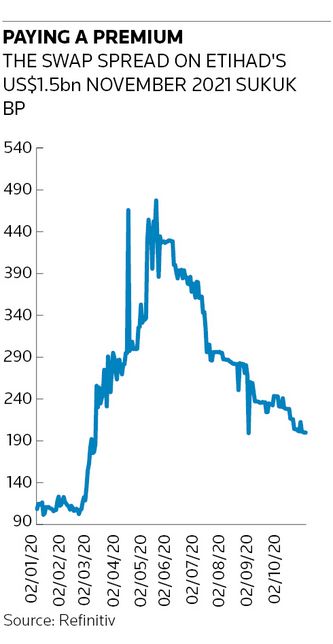

Although this curbed some interest, the leads were able to almost fully allocate the book of US$700m to buy-and-hold investors. Alongside the new issue, Etihad launched a tender offer on its US$1.5bn sukuk due 2021, of which it will buy back US$300m.

NOVEL APPROACH

Etihad’s sukuk deal supports its pledge to reach net-zero emissions by 2050 via carbon reduction targets that it says will see the airline halve its 2019 emissions by 2035. It has also pledged to cut emissions intensity in its passenger fleet by 20% by 2025.

The sukuk deal was issued under the transition financing and sustainability-linked financing framework, and the deal also has two separate second-party opinions by Vigeo Eiris.

“This way they have the transparency of the use of proceeds and the accountability of a KPI-linked instrument,” a banker said.

Etihad’s eligible "use of proceeds" focuses on investment in next-generation aircraft to replace old fleet and research and development into sustainable aviation fuel.

This investment includes the US$600m sukuk and any other financing required to help Etihad achieve a single KPI – to reduce CO2 emissions intensity in its fleet. The target has been set at a 17.8% reduction in CO2 compared with 2017 levels, and will be tested on December 2024.

Failure to meet the targets means that Etihad will have to buy offsetting carbon credits, worth 5bp–25bp depending on the CO2 range, in addition to its commitment under the Carbon Offset and Reduction Scheme for International Aviation, which could include local reforestation, biodiversity and natural carbon sink projects.

Despite Etihad’s strides in ESG and progress on biofuels, Vigeo Eiris described the framework’s contribution to sustainability as "limited" as the eligible projects and the airline sector’s targets are insufficient to align with the goals of the Paris Agreement to keep global warming to 1.5 degrees. However, the agency described the ambition of the targets as "robust".

Etihad’s dual-track approach could be copied by other airlines and high-emitting sectors such as oil and gas, and more SLBs are expected in the aviation sector, which has only seen a handful of sustainability-linked loans so far.

In February, US budget airline JetBlue completed the first SLL in the airline industry and Etihad also borrowed a US$100m SLL in December 2019 that was linked to the UN’s Sustainable Development Goals.

HSBC and Standard Chartered are global coordinators and sustainability structuring agents on the transition sukuk. They were joined as leads and bookrunners by Abu Dhabi Islamic Bank, Dubai Islamic Bank, Emirates NBD Capital and First Abu Dhabi Bank.