US equipment ABS issuance is ramping up in early 2021 as historically tight spreads in more liquid sectors such auto and credit cards push investors to look at higher-yielding sectors.

This week, Commercial Credit Group will test investor appetite with its US$327m CCG Receivables Trust 2021-1, which is backed by loans and leases on transportation, construction and industrial equipment, while GreatAmerica Leasing plans to raise US$630.3m with its GreatAmerica Leasing Receivables Funding LLC Series 2021-1 transaction, which is secured largely by office printers and copiers.

Last week, Crossroads Equipment Lease and Finance priced its US$162m ABS debut backed by commercial truck loans, Crossroads Asset Trust XROAD 2021-A, to solid demand.

In the secondary market, average spreads on three-year Triple A rated equipment ABS are running at 15bp over swaps, compared with 12bp on three-year Triple A prime auto paper, Bank of America data showed.

This spread differential, although small, still offers some appeal to yield-minded investors.

"Every basis point counts in this low rate environment," said Breckinridge Capital Advisors trader John Bastoni.

GreatAmerica for example is attracting heavy demand for its office equipment deal, which is being marketed wide of current secondary trading levels.

Price talk on a US$105.3m Triple A "A-4" note with a 3.51-year WAL, is in the low-30bp area over swaps and the tranche is nearly six times oversubscribed on Monday, a buyside source said.

Investors are accepting slightly higher risks for the return.

Fitch forecasts cumulative net losses at 2.45% and 3.25% for the GreatAmerica and Commercial Credit offerings, respectively. They are somewhat higher than 1.00% loss Fitch projected on Toyota's US$1.25bn prime auto deal, Toyota Auto Receivables Owner Trust (TAOT) 2021-A, in the market this week.

Bank of America also warned of tiering in the sector, with industrial equipment ABS tied to construction and transportation sectors looking more attractive than small-ticket loans tied to service industries.

"We remain cautious on small ticket equipment as the underlying obligors have likely been impacted by Covid-related shutdowns," Bank of America analysts wrote in a research note on Friday.

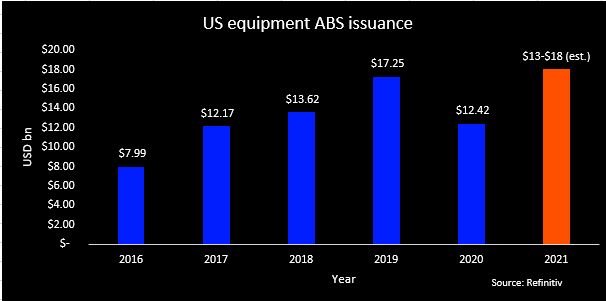

Banks project US$13bn-US$18bn of equipment ABS supply this year on improving economic fundamentals and the sector's delinquencies and defaults staying muted amid the pandemic.

Equipment finance companies priced a total of US$12.4bn in the ABS market in 2020, down from US$17.2bn the year before, Refinitiv data showed.

"We expect that the many issuers will remain active, but the issuance pace will (be) slow as equipment investment still needs to recover from the recession back to the pre-pandemic levels," JP Morgan analysts said in a report in January.