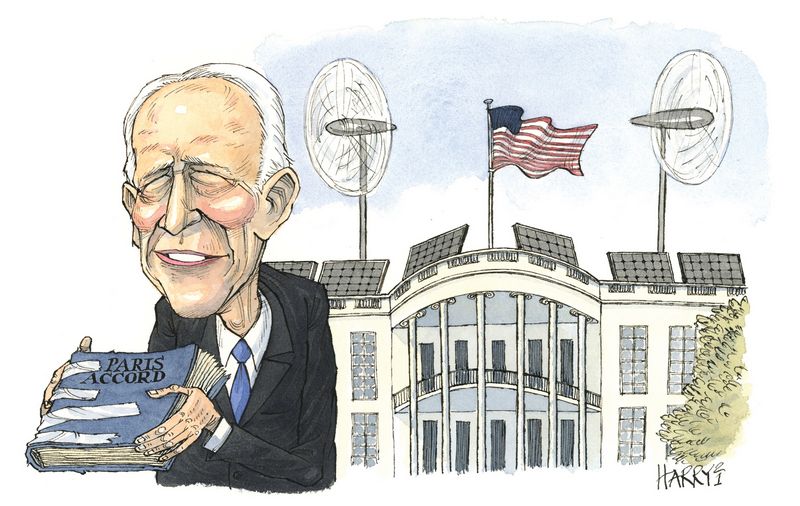

Despite the best efforts of the Trump administration and a less-than-supportive regulatory climate, the ESG financing market in the US still managed to move forward in 2020. US ESG financing lags behind much of the rest of the world (Europe in particular) but a greener administration in the US will add momentum to efforts to harness financial markets to address climate change and other social ills.

![]()

2020 was a breakout year for environmental, social and governance financings globally.

Five years on from the Paris Agreement and driven by the increasingly obvious effects of climate change, demands for social justice and the misery of the coronavirus pandemic, the financial industry got serious about ESG, which moved from being a niche interest on the sidelines of the markets to front and centre.

Advancement in ESG financings has been most pronounced in Europe where bottom-up development, driven by a responsibly-aware investor base, was matched by a policy-driven, top-down approach.

“The gravitational centre for ESG financial markets has been Europe,” said Jacob Michaelsen, head of sustainable finance advisory at Nordea Markets. “The European Union has been leading the discussion around ESG and has been developing practical advice to support the growth of green and sustainable financing.”

That kind of regulatory support has not been replicated in the US where, during former president Donald Trump’s term in office, the White House pursued an anti-ESG agenda, rolling back rules and standards introduced to reduce emissions and address environmental problems.

“Over the last four years, developments in Europe and the UK have been progressing at a really fast pace,” said Heather Slavkin Corzo, head of US policy at the PRI, a UN-supported network of investors that works to promote sustainable investment. “The US needs to catch up.”

President Cnut

A lack of encouragement in the White House has not stemmed the tide of US interest in ESG, however, with large parts of the economy and the financial markets embracing the issue.

“The US is not that far behind the curve,” said Chris Wigley, an independent ESG fixed income portfolio manager. “States and corporates have continued issuing green and social bonds and investors have been buying them.”

The numbers paint a mixed picture but overall support the view that, despite the best efforts of Trump, momentum behind ESG financing remains strong.

According to Refinitiv data, the US share of green bond issuance has kept pace with global issuance – it was US$22.9bn in 2019 (12.5% of the global total of US$183.6bn) and US$28.4bn in 2020 (12.6% of US$225.6bn). US social bond issuance actually fell as a share of global issuance – US$1.2bn in 2019 (8.6% of US$13.9bn) and US$9.4bn in 2020 (5.7% of US$166.1bn) – although those totals were skewed by the huge social bond issuance from the EU. US sustainable bond issuance, on the other hand, increased massively as a share of the global market – from just US$2.5bn (7.3% of US$34.2bn) in 2019 to US$72.6bn (56.3% of US$128.9bn).

In the loan market, ESG loans for US borrowers grew at more or less the same rate as ESG lending globally. US ESG lending totalled US$16.3bn in 2019 (9.7% of the global total of US$167.4bn), while in 2020 US ESG loans were US$17.9bn (9.9% of US$181.7bn).

“The US market is home to the world’s biggest green bond issuer, Fannie Mae, and there is an active municipal bond market,” said Matthew Kuchtyak, an AVP-analyst at Moody's who specialises in ESG issues. “The market may be more concentrated in terms of issuer type than in Europe but diversity is growing.”

Deals were, on the whole, larger in the US, too. Average deal sizes for green bonds in 2020 in the US, for example, were US$568m versus the global average of US$346.5m.

Renewable investors

Increasing levels of ESG issuance in the US have been matched by interest in responsible investments.

“US investors appreciate that ESG is financially relevant and can lead to outperformance in the long term,” said Slavkin Corzo.

That appreciation is reflected in improved flows into asset managers following an ESG strategy, with numbers undoubtedly helped by the outperformance of ESG funds in 2020.

According to the Forum for Sustainable and Responsible Investment, total US-domiciled assets under management using sustainable investing strategies grew from US$12trn at the start of 2018 to US$17.1trn at the start of 2020, an increase of 42%. That represents one-third of the US$51.4trn in total US assets under professional management.

“Assets under management with ESG or negative screening strategies continues to grow,” said Kuchtyak. “There’s still a lot of room for fund growth but the direction of travel is established.”

Shot in the arm

The acceleration towards greater engagement in ESG markets within the US, and its wider contribution to the global effort, has been enhanced by the election of a new administration that has made much of its plan to make “a historic investment in clean energy and environmental justice, and play its role in rallying the rest of the world to meet the threat of climate change”.

The last years of Trump’s presidency have shown that ESG markets can grow despite a lack of backing at the top level and there is broad acknowledgement that markets will continue to expand irrespective of who is in the Oval Office. There is little doubt, however, that a president who puts such issues near the top of the agenda can accelerate the change to a more sustainable economy and financial sector.

“The Biden win is a net positive for ESG markets,” said Tim Leary, senior portfolio manager at BlueBay Asset Management. “There’s a lot that he could do to stimulate the change, but whatever Washington does it needs to be bipartisan and long-lasting to have the most impact.”

And a bipartisan approach to getting things done is important given how closely balanced power lies within the lower and upper houses of Congress.

“There is unlikely to be a radical adoption of green policies under the new administration to begin with as it would be difficult to get them through a divided Congress,” said Slavkin Corzo. “But there are still things that could be accomplished independently of Congress and it can certainly set the agenda.”

Biden made an immediate declaration of intent by signing, just hours after his inauguration, an executive order that will see the US rejoin the Paris Agreement, building on the green commitment already demonstrated by the appointment of former secretary of state John Kerry as climate envoy. Kerry, who helped negotiate the Paris accord before Trump rejected it, is pressing for accelerated action on climate change at home and globally.

The nomination of ex-Goldman Sachs banker Gary Gensler as chair of the Securities and Exchange Commission is also expected to increase ESG disclosure requirements and potentially reduce confusion with respect to ESG investing. Rules pushed through by the Department of Labor in October required fiduciaries for the many US pension plans governed by ERISA rules to always put economic interests ahead of other goals, bringing into question the use of ESG criteria in investment decisions.

“Rule-making directly reversed guidance issued by the Obama administration at the end of 2015,” said Slavkin Corzo. “It’s a bit of a political football, which has resulted in fiduciaries being reluctant to push ESG investments. The ERISA pensions market is almost entirely lacking in ESG.”

Nevertheless, with a focus on sustainability at senior political levels, there is a greater likelihood that progress will be made on establishing the necessary transparency around ESG investing that will ease anxieties about incorporating ESG into investment decisions.

“Improving transparency, reporting and accountability are so important to addressing investor concerns with regards to greenwashing. Without it, investors may struggle to compare the actual level of ESG risk between funds,” said Leary. “A better-informed investor will be able to make educated choices and that will eventually benefit those companies making robust disclosure.”

Increased engagement at the highest institutional level is already apparent, with the Federal Reserve referencing climate change for the first time in its 2020 Financial Stability Report. The Fed also asked to join the Network for Greening the Financial System, a forum supporting the exchange of ideas, research, and best practice on the development of environment and climate risk management for the financial sector.

There’s no question that the return of the US to the effort to fight climate change and to embrace ESG financing will be warmly welcomed by the rest of the world.

“Success in mobilising private finance to address climate change is greatly enhanced through global collaboration, and the harmonisation of standards, definitions and reporting requirements,” said Kuchtyak. “US participation in efforts such as the NGFS is critical, given the size and maturity of the US financial markets.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com