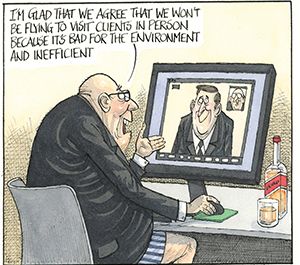

Travel restrictions and social distancing as a result of the coronavirus crisis transformed investment banking in 2020, introducing a more efficient, more flexible way of working. Asia-Pacific was the first region to go into the crisis and in some ways is the furthest through it. As health concerns begin to ease, does the region’s experience suggest that changes will stick?

![]()

Early last year, shortly after banks in the Asia Pacific first began telling staff to work from home, the Asia CEO of one global bank took a call from a junior banker with an unusual question around the implications of the bank’s remote working policy.

The banker went on to ask whether the firm could start paying his rent since, he argued, it now qualified as his main place of work under the Hong Kong securities regulator’s rules.

That request was politely declined, but the onset of the coronavirus pandemic threw up many more difficult questions as bankers swapped boardrooms for kitchen tables and business-class flights for Zoom calls.

It also triggered a feast of capital markets deals that made 2020 the best year on record for investment banking fees, according to Refinitiv data.

Asia, the first region to be hit by the Covid-19 pandemic, set the template for remote working and online dealmaking in 2020. It has also been more successful than other regions at containing the virus, allowing some countries to ease restrictions and give the world a glimpse at what the future might look like once the pandemic is under control.

And now, after a hugely successful 12 months, bankers in the region see little reason to go back to the pre-Covid way of doing business.

“The world is not going back to where it was previously. We will move towards a hybrid work model involving a mixture of working remotely and working from the office,” said Chandra Mallika, Deutsche Bank’s Asia Pacific chief operating officer.

“We’re currently going through a planning exercise looking at what this will mean for each role depending on its requirements and also the local regulations but what is clear at least is that things have changed for good.”

Status quo

The response across Asia-Pacific’s financial centres was broadly consistent. All but the most essential staff were asked to work from home, with some critical functions moved to back-up sites on socially distanced floors.

After an initial scramble for laptops and spare monitors, most bankers have been taken aback by the ease of the transition.

“At one point, we had 95% of the workforce at home almost with no disruption to services for our customers,” said Farhan Faruqui, group executive for international banking at Australia and New Zealand Banking Group. “If you had asked me two years ago whether that could have been done, I would have been sceptical.”

Twelve months later, many are in no rush to bring staff back to the office. In Hong Kong, where the government is chasing a target of zero infections, some are still advising staff to stay away or limiting office capacity.

The success of remote working has prompted a rethink of expensive office costs.

Standard Chartered has told staff across the world that they can work from home or adopt a hybrid office-and-home set-up indefinitely if their job allows it. The bank is also trialling a partnership with International Workplace to offer a third option of using serviced co-working spaces and meeting rooms in 3,500 locations.

Most market participants expect that other banks will follow suit.

“It partly depends on the function and I think for back office functions, it is more likely that banks will provide more flexibility than for front office sales and trading roles, where the regulatory requirements are greater,” said Mark Austen, CEO of trade body ASIFMA. “Even for sales and trading though it is likely that banks will grant some flexibility as it’s been proven that it can work.”

China’s experience, however, suggests banks are likely to return to work as usual once the pandemic is no longer a threat. Offices in Beijing and Shanghai are busy again, with around 90% of staff back in their primary location.

Investment banking

Unlike traders and private bankers, who were not previously set up to work from home because of regulatory requirements around documenting client orders, heavy travelling investment bankers were already accustomed to life outside the office. With video calling and smartphones, the shift to virtual client interactions has proven far less disruptive than initially feared.

Indeed, if the data is anything to go by, the pandemic has had no adverse impact on deal-making activity whatsoever. Overall investment banking fees in the region last year totalled US$28.44bn, comfortably surpassing the previous year’s US$23.13bn record, Refinitiv data show.

In many respects, Covid-19 has made capital raising a much more efficient process. Moving roadshows online has cut the typical marketing period for an Asian IPO in the US from a week or 10 days to just three or four days. Without the need to travel, senior bankers have also been able to handle more deals at once.

Across the industry, virtual roadshows, which began with Hong Kong IPOs from China Bright Culture and InnoCare Pharma in March last year, have fast become the norm and were used on an array of high-profile deals last year, including China’s US$6bn sovereign bond in October – its first to target US 144A investors since 2004 – and Ant Group’s US$37bn IPO, which was yanked at the last minute by regulators.

The pandemic has given birth to some innovative solutions. Goldman Sachs, for example, has used drone technology to help with due diligence on industrial sites, while one banker in India told IFR that a manufacturing company uploaded a video of its factories to YouTube to allow bankers to inspect them.

Back to the future

There is still a preference for face-to-face contact, however, especially when vetting new opportunities. And as such that is likely to return when possible.

“It’s true that for an M&A deal or IPO, due diligence will be challenging,” said Sumit Indwar, partner at Linklaters. “The regulators will not want to accept any lower standard of diligence given the role they see the banks as playing in the primary markets.”

There are also signs that the online shift has made investors more hesitant about deploying capital on deals – despite the surge in activity in 2020. While 82% of investors said they would be willing to commit capital to an IPO without meeting management face-to-face, according to a survey from investment bank Berenberg, many of them admitted it would impact the size of their orders.

“You may have a majority of deal roadshows done virtually but I would expect some meetings to be held as face-to-face meetings with larger investors,” said Niccolo Manno, head of ECM syndicate in Asia-Pacific at JP Morgan. “Naturally, it is more difficult to ask large fundamental investors to commit big order sizes in a deal if their only meeting with management is via videoconference.”

The most common complaint about virtual working arrangements is the challenge of cultivating new relationships.

In Asia, the top houses consolidated their market share in 2020 as travel restrictions handed an advantage to the biggest firms with staff on the ground across the region. In the uber-competitive market of Chinese investment banking, it was no surprise to see Hong Kong-based staff relocate to mainland China for months on end in order to be closer to their clients – another sign that face-to-face pitching is certain to resume once it is allowed.

“It is fair to say that it is harder to win new clients virtually, as personal interactions and building relationships are key elements in our business,” said Johnson Chui, head of Asia-Pacific ECM at Credit Suisse. “Having said that, we are able to tap into our broad on-the-ground footprint across the region and leverage our teams in each location to meet existing and new clients locally.”

Compliance risks

The region’s regulators, unusually, have won plaudits from bankers for the speed with which they responded to the crisis and the flexibility that they have granted banks.

The Securities and Futures Commission of Hong Kong, for example, said in March that non-licensed individuals based overseas could execute trades on behalf of Hong Kong clients, under certain circumstances.

While banks would like to make some of the more flexible practices permanent, there is some concern that regulators may take a tougher stance.

The Monetary Authority of Singapore in November warned banks to review their cybersecurity controls, citing fears that hacks will increase if remote working becomes permanent.

“I haven’t heard of the SFC coming out with any major enforcement action, but I wouldn’t necessarily take too much comfort from that,” said Matthew O’Callaghan, partner at law firm Freshfields. “As we have seen recently with some of the actions taken by the SFC against banks over their role as IPO sponsors, it can take a while for these matters to work their way through the system.”

Overall, though, the efficiency gains made in 2020 are simply too good to ignore.

“A lot of the focus until now has been on allowing flexibility temporarily but there is a growing movement to allow for this to become permanent,” said one senior banker in Hong Kong. “There may be some stricter requirements, for example, around due diligence if it is to continue to be done virtually, but I expect most of the changes to remain once the pandemic is over.

“You can’t put the genie back in the bottle.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com