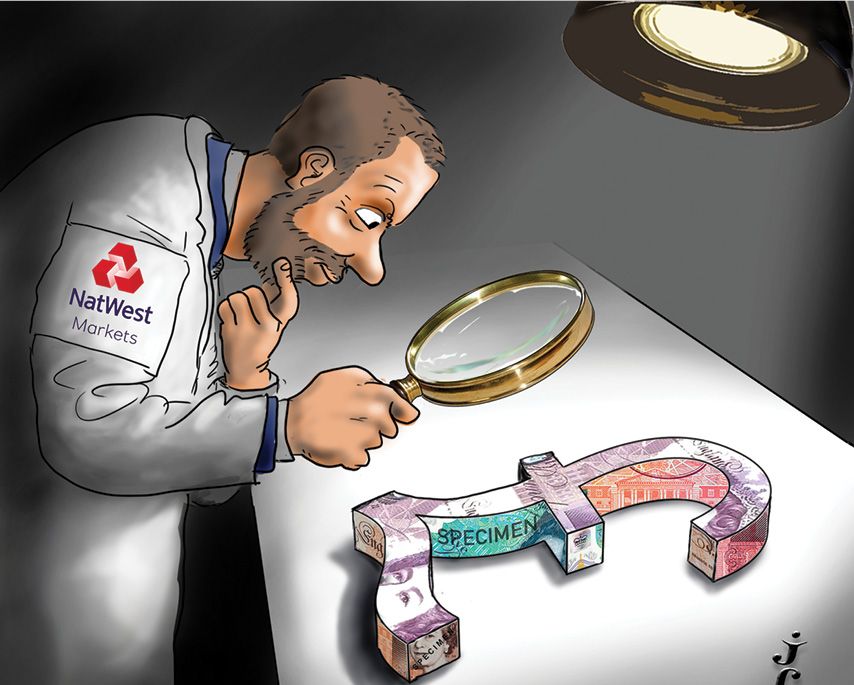

Attention to detail

There was a risk challenges thrown up by the pandemic could undermine the sterling bond market. But NatWest Markets called on its in-depth and long-standing knowledge of the sector to ensure this was not the case, with its careful shepherding leading to a successful conclusion. NatWest Markets is IFR’s Sterling Bond House of the Year.

In terms of magnitude, the sterling bond market might not rival its US dollar or euro peers. That does not come without compensation, however, with its smaller scale offering opportunity for diverse themes that can become muddled and opaque in the hectic activity elsewhere.

This is not lost on James Mariott, head of FI and SSA DCM advisory at NatWest Markets. “I think the most noteworthy development of the year was the level of leadership we were able to show across all key aspects,” he said. “What differentiates us is our attention to detail, not to mention the huge care taken.”

The transition from a Libor-based floating-rate market to one comfortable with the widescale adoption of Sonia has been a work in progress over a few years, and it continued to evolve over the course of 2020.

NWM worked closely with the Bank of England’s risk-free working group, assorted sub-groups, asset managers and issuers to ease the move towards more innovative conventions (for example, the shift methodology and the transition of Libor-referencing subordinated debt to the ISDA five-year median spread adjustment).

The fruits of this work could be seen in lead roles in EBRD’s first Sonia shift transaction, consent solicitations for covered bonds from Nationwide and Skipton building societies – the former also encompassing RMBS – and the transition of AT1 securities issued by Santander UK.

In the liability management arena, NWM looked to address capital inefficiency and lack of flexibility in callable instruments. These included a tender offer for a Virgin Money Tier 2 prior to the five-year anniversary alongside a new T2 issue; a deal for Yorkshire Building Society that replaced T2 with senior non-preferred debt; and a Coventry Building Society AT1 tender offer and new issue. There was also an 11-tranche exercise across sterling and euro covered bonds for Nationwide.

On the corporate side, the bank was consent solicitation agent for the likes of Manchester and Gatwick airports and Meadowhall shopping centre, ensuring the issuers had greater flexibility to weather the Covid-19 crisis.

Going green

While the ESG juggernaut has been slower to get rolling in the sterling markets than in euros, it is a theme that has taken on greater importance. With this in mind, NWM organised networking days, hosted roundtables and participated in conferences, as well as arranging specific ESG roadshows.

“There is demand for green assets,” said Kerr Finlayson, head of the frequent borrowers group syndicate. “We work with investors in the long term, so when we do offer advice it’s backed by solid evidence.”

And the return on the effort was clear to see. On the more established SSA side, there was AIIB’s sustainable development bond – its inaugural sterling transaction. Perhaps even more notable was the debut from the International Development Agency, the part of the World Bank whose mission is to eradicate extreme poverty in a sustainable manner. More than a year’s work culminated in the largest inaugural supranational offering, at £1.5bn.

In the nascent corporate ESG sector, there were also a string of firsts and records, notably from Southern Water, Clarion, Burberry and NPG. And in the broader market, NWB demonstrated that sterling was no longer a “nice to have” but could offer genuine opportunity.

“Sterling is a sophisticated market that is not just a diversification but a strategic funding tool,” said Chris Agathangelou, head of flow credit syndicate, pointing to Rabobank kicking off the year with its debut sterling senior non-preferred deal, although he could also have mentioned the likes of Commerzbank, NAB, PBB, Intesa Sanpaolo and Danske Bank.

“There is a drive towards a genuine liquidity market from an arbitrage market. It used to be a bit like the Swiss market, where you might get £250m, but the sizes are much larger now.”

From a raft of corporates such as SSE’s hybrid refinancing and M&S’s debut as a fallen angel, through the FIG arena with the likes of Phoenix’s sub market reopener, to the public sector and liquidity raising at home and abroad, NWM played a central role.

It may or may not be at the top of the various asset class league tables, depending on how they are cut – although it is there or thereabouts in them all – but that is not the whole point.

“It’s about more than just volume,” said head of capital markets, Jonathan Peberdy. “Our core objective is to get our customers the best possible result.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com