Tackling the debt pile

Swelling budget deficits and rapidly increasing funding needs put public sector issuers at the heart of governments’ responses to the Covid-19 crisis in 2020, with the scale of the task seemingly unsurmountable. Yet Barclays stepped in to deliver funding at crucial times, making it IFR’s SSAR Bond House of the Year.

As the Covid-19 crisis began to spread worldwide and governments enforced strict lockdowns, it soon became clear that public sector borrowers would be the first in line to offer support.

The banks covering the SSAR market had to step up to the challenge. None excelled as much as Barclays, which delivered deal after deal for clients across the currency and maturity spectrums, reopening markets where pricing transparency and liquidity had all but disappeared, thereby helping to restore confidence.

“It was important for governments to succeed, they needed to be able to support their economies; had they not been able to deploy all this money so quickly, where would we be today? I can’t imagine where some of the riskier asset classes would have been had governments not been successful with their plans,” said Lee Cumbes, head of public sector debt for EMEA at Barclays.

The bank was quick to step in, leading record-breaking transactions for sovereign issuers, including an €8bn seven-year for Belgium and a €5bn seven-year for Portugal as they grappled with the fallout from the pandemic by focusing on shorter-dated tenors.

“This was a market where clients needed help given the volatility, they needed guidance and intelligence and they came to us. We have the presence, the breadth, the depth, we are everything to everyone,” said Cumbes.

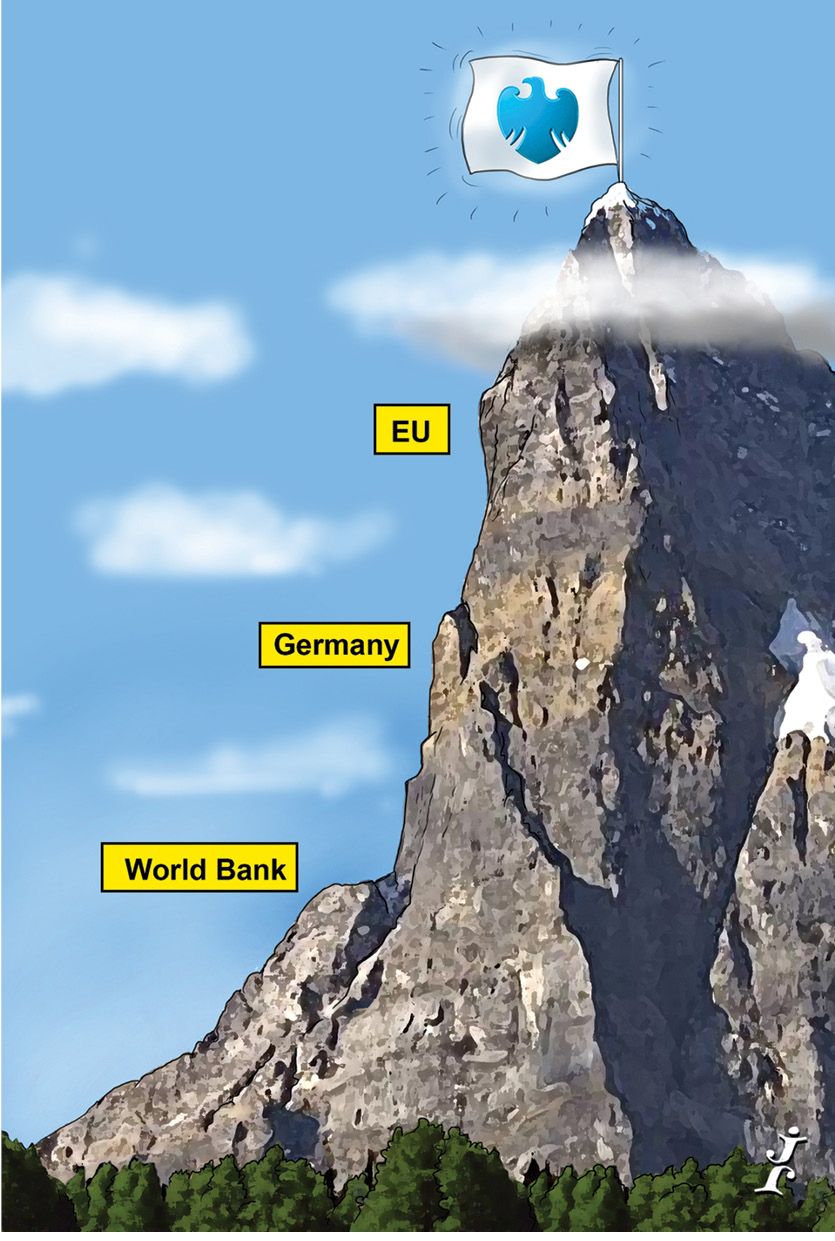

This focus landed the bank one of the most coveted mandates of the year, a bookrunner spot for the European Union’s debut €17bn 10-year and 20-year dual-tranche deal in October under the Support to mitigate Unemployment Risks in an Emergency (SURE) European Commission programme. Barclays was one of only two banks chosen to run two global investor calls ahead of the deal as well as the trade itself, which Cumbes described as a “perfect first step”.

The deal further bolstered Barclays’ already well-polished ESG credentials that saw the bank lead Germany’s €6.5bn 10-year debut green bond, the first deal to truly capture the so-called “greenium”, and a US$8bn five-year sustainable development bond for the World Bank that broke size and order books records.

This is only one of many examples of record-breaking deals that Barclays led, landing the bank the top spot in Refinitiv’s SSAR league table and an almost 2% gain in market share across all currencies.

“We expanded market capacity, redrawing what was seen as possible in capital markets,” Cumbes said. Spain’s €15bn 10-year in April that saw demand reach €97bn was a prime example.

“That was a substantial increase on what we had seen before,” said Cumbes. “Before that transaction there were some question marks around how they were going to manage but this was transformational.”

Like other euro SSA transactions in 2020, the deal benefited from the extraordinary liquidity support unleashed by central banks that helped underpin the market. But Barclays was also there in markets where central bank support was not as direct.

The bank held clients’ hands through some of the worst volatility ever seen, bringing a €2bn 10-year for the European Stability Mechanism at the end of February when price transparency had all but disappeared. In other markets, a US$1bn three-year for the IFC looked like it was not going to make it over the line.

“It was the first Covid-linked financing and therefore important to be able to deliver the deal,” Cumbes said. “We didn’t know at the time, but the US dollar swap market was breaking down.”

During execution, three-year swap spreads moved from 6.75bp to –6.25bp. The trade looked like landing at 20bp over Treasuries at one point but priced at 4.4bp over.

A trusted adviser, Barclays was awarded repeat mandates from marquee issuers such as the EIB and KfW but also ventured into the longer end of the market for clients such as Austria and Societe du Grand Paris. But to Barclays’ credit, it also won mandates from rarer issuers, bringing EDC’s euro debut in January through a €1bn five-year.

Its ability to take issuers across borders and tap into all the pools of liquidity available was also on show as it did three sterling deals in a row for Canada’s CPPIB while retaining key relationships such as the UK DMO, pricing a £9bn 30-year for the sovereign, which like its counterparts faced unprecedented funding challenges.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com