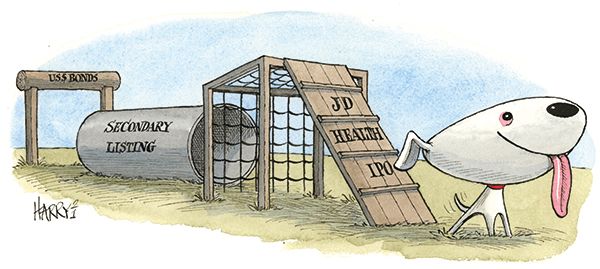

New tricks

In a breakout year for Chinese technology stocks, one company delivered a series of popular and well-executed capital market deals. For raising its profile and winning over new followers, JD.com is IFR Asia’s Issuer of the Year.

JD.com completed an impressive range of capital markets financings in 2020, broadening its reach with global equity and debt investors and capitalising on a global shift to new-economy stocks.

The Chinese e-commerce giant returned to the US dollar bond market in January, listed its shares in Hong Kong in June and floated its online healthcare business in December. It navigated a tough regulatory and political environment and repositioned itself as a full-service technology platform, boosting its market value by over 150% over the course of the year.

It also played a part in the response to the coronavirus crisis, using its delivery network to keep food and medical supplies running when China was forced into lockdown.

“It took 17 years for us to develop from a low-profile latecomer to an industry leader who has a positive influence on suppliers and helped stabilise prices and ensure the supply of daily necessities during the Covid-19 outbreak,” founder Richard Liu wrote in May, ahead of the group’s Hong Kong listing.

In a year when the Chinese technology sector came to the fore, JD.com used the capital markets to their full potential. Its funding strategy brought it closer to its customer base and raised its profile, leaving it well placed to unlock further value in 2021 and beyond.

January’s US$1bn SEC-registered bond offering underlined its appeal. Originally marketed as a 10-year bond, a 30-year tranche was added during bookbuilding on the back of investor enquiries. That was a far more successful outcome than its 2016 debut, when its five-year and 10-year offering struggled in early trading, in part because investors were unconvinced by its low investment-grade rating.

JD.com priced a US$700m 3.375% 10-year tranche at 99.68 to yield 3.413%, or Treasuries plus 160bp, well inside initial guidance of 195bp area. Orders exceeded US$4bn at final pricing from 201 accounts. The US$300m 4.125% 30-year tranche priced at 98.98 to yield 4.185%, with US$1.3bn in the book.

Bank of America and UBS were joint lead managers and bookrunners, with HSBC as joint lead manager.

JD.com’s resilience through the coronavirus outbreak highlighted its credit quality. Moody’s went on to upgrade the company to Baa1 from Baa2 on August 28, noting its “prudent approach towards investment and expanding funding channels”. S&P put its BBB rating on positive outlook a week later.

Happy homecoming

The strength of its business was again on show with JD.com’s HK$34.5bn (US$4.4bn) secondary listing in Hong Kong in June, six years after it went public on the Nasdaq.

The capital raising came in a deteriorating geopolitical environment, with US-China relations increasingly strained and calls growing for the delisting of all Chinese companies from the US stock markets in the wake of an accounting scandal at smart-retail business Luckin Coffee.

Rather than a defensive move, however, JD.com pitched the Hong Kong offering as part of its transformation from an online retailer to a technology-driven supply chain service provider, allocating the proceeds towards technology initiatives around inventory management, retail and logistics services that it can offer to third-party customers.

Investors clearly bought into the story. The US-listed ADRs gained 40% in the month leading up to the Hong Kong float, adding 15% between its listing hearing and pricing, and the institutional books closed 11.3 times covered. That allowed JD.com to price at HK$226 a share, a tight 3.9% discount to the previous day’s close on the Nasdaq even after its recent gains. Including the greenshoe, the new shares on offer represented a 5% stake.

The listing has been a resounding success for JD.com, its existing shareholders and those who bought in at the offer price. The Hong Kong stock opened 5.8% higher and never looked back, finishing the year at HK$342, up 51% from the listing price and second only to Zai Lab among the nine US-listed Chinese firms that completed a Hong Kong secondary listing in 2020.

As well as helping insulate the company from potential US moves against Chinese ADRs, JD.com’s listing also kicked off a remarkable run of popular Hong Kong offerings. At the time, it was the city’s largest float of the year, attracting a total of 396,096 investors in a retail tranche that was 179 times subscribed, setting the stage for even more popular listings later in the year.

Liquidity in the Hong Kong counter has also grown steadily, accounting for almost 25% of average daily trading volumes by the end of the year.

Bank of America, CLSA and UBS acted as sponsors. The three banks were also joint global coordinators and joint bookrunners with BOC International, CCB International, China Renaissance and Jefferies.

Healthy performance

JD.com again turned to the Hong Kong market to unlock more value later in the year with the HK$31bn (US$4.0bn) IPO of its healthcare unit.

Completed in early December, JD Health’s IPO was Hong Kong’s biggest new listing of the year and one of the city’s hottest debuts on record. The shares soared 56% on their trading debut on December 8 and more than doubled by the end of the year.

JD Health’s IPO valued it at US$29bn and was a blockbuster from the start. It had its pick of cornerstone investors, sealing lock-up agreements with six big-name investors, including GIC, Tiger Global and BlackRock, for a total of US$1.35bn.

A strong market backdrop saw books close early and made pricing at the top of the HK$62.80–$70.58 range a formality. The retail tranche was 422 times covered with orders from 846,200 retail investors. A total of 663 investors participated in the international tranche, which was 31 times covered.

The IPO was also a response to the Covid-19 pandemic. JD Health CEO Xin Lijun told reporters the pandemic had had a “revolutionary impact” on demand for online healthcare. The company’s platform hosts 100,000 online consultations a day and offers over 150,000 pharmaceutical products for delivery in as little as 30 minutes.

Bank of America, Haitong International and UBS were joint sponsors. China Renaissance acted as financial adviser and joint global coordinator. The other joint global coordinators were BOC International, CLSA, Goldman Sachs, Jefferies and ICBC International.

Not done yet

There is more to come.

JD.com filed for a Rmb20bn (US$3.1bn) Shanghai Star IPO of its financial unit Jingdong Digits Technology Holding (JD Digits) in September and is expected to move forward with the listing in 2021 after the impact of China’s new rules on digital finance become clear.

Another Hong Kong listing is on the way, too, with the spin-off of JD Logistics. The deal, which could raise about US$4bn at a valuation of around US$40bn, is expected to hit the market in the second quarter of 2021. Bank of America, Goldman Sachs and Haitong International are the sponsors.

JD.com built its own rapid delivery network from scratch and is opening it up to third-party customers. It span off the unit into a standalone entity in 2017 and raised US$2.5bn from a private financing round in 2018 at a valuation of about US$13.5bn, with Hillhouse Capital, Tencent Holdings and China Life Insurance among the investors.

JD.com’s successes in 2020 sum up the adaptability that has been a hallmark since its earliest days. Liu first turned to online sales in the aftermath of the Sars epidemic, launching electronics marketplace jdlaser.com in 2004. Sixteen years later, the coronavirus pandemic has again accelerated a shift in its business model – and transformed its profile in the capital markets.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com