Quick to adapt

In rapidly changing conditions, one bank picked the right deals and harnessed Asia’s growing demand for socially responsible investments to fund Covid recovery efforts. For its response to unprecedented challenges, HSBC is IFR Asia’s Bond House of the Year.

Asia’s primary bond markets started 2020 on a tear, before issuance ground to a halt in mid-March as global markets plunged because of the novel coronavirus pandemic.

In late March and April, Asian high-grade issuers took their first steps into a fragile market – one where new issue concessions were essential. As confidence grew, high-yield issuance returned and new deals pushed out to longer tenors, but it took a skilled arranger to balance the needs of issuers and investors.

HSBC, which in 2020 created a strategic solutions group to advise clients more effectively on things like ratings and ESG considerations, was quick to respond to changing market conditions.

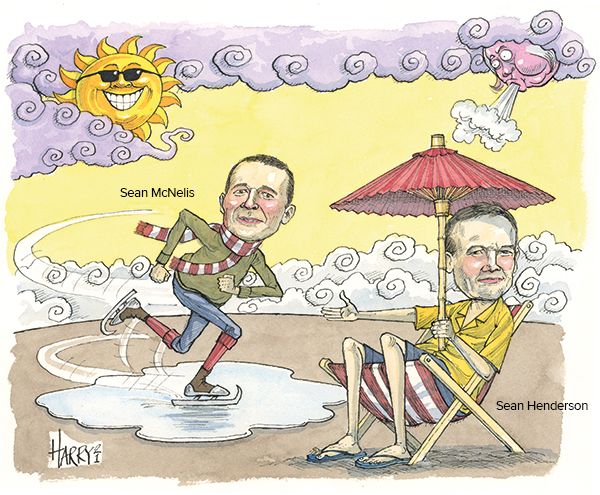

“When we are the lead international bank, we are an advice-giver,” said Sean McNelis, global co-head of debt capital markets for HSBC, who also leads Asia Pacific debt capital markets alongside Sean Henderson. “We want to be the closest to the issuer, not just a passenger.”

The Republic of Indonesia’s US$4.3bn multi-tranche offering in early April helped reopen the Asian market in the wake of the mid-March sell-off, and set the scene for the key themes of the year.

The deal included Indonesia’s first 50-year tranche and explicitly listed the country’s coronavirus response among the use of proceeds. That ESG theme would become a feature of many of HSBC’s deals, including Asia’s first Covid-19 response covered bond for Korea Housing Finance Corp in June. In August, HSBC was sole green structuring adviser on Hong Kong metro operator MTR’s US$1bn offering, the largest green tranche from an Asian corporate issuer.

HSBC also helped bring other Asian issuers into longer tenors. Chinese tech giant Tencent Holdings and Malaysian oil company Petronas printed their first 40-year bonds – the latter as part of a US$6bn deal which was the largest ever offshore deal from South-East Asia – while Singapore’s Temasek Holdings sold its first 50-year tranche.

All three of these issuers printed in 144A/Reg S format, as the liquid US investor bas took on more importance to major Asian investment-grade issuers.

The Reg S-only market remained the backbone of Asian issuance, of course, and HSBC was a joint global coordinator when China National Travel Services reopened the market for Chinese issuers on April 16. It held the same role when battery maker Contemporary Amperex Technology printed the largest Reg S debut from China’s private sector, with a US$1.5bn dual-tranche deal in September.

As investor confidence grew, Hong Kong property company Hysan Development, having sold its first subordinated perpetual bond in February, came back in August with its first fixed-for-life perp, reopening the market for these instruments.

In September, HSBC led Australian shopping centre owner Scentre Group’s debut dollar hybrid, and then in December helped Airport Authority Hong Kong sell a US$1.5bn dual-tranche perpetual offering that repriced the senior-to-perp spread in the region and printed at the lowest coupon so far for an Asian dollar perp.

HSBC continued to show its strengths in bank capital, bringing Thailand’s first Additional Tier 1 offering from TMB Bank, as well as Bank BTN’s US$300m Tier 2 offering, Indonesia’s first offshore issuance of Basel III capital. It advised China Development Bank Leasing on the first offshore Tier 2 issue from any Chinese non-bank financial institution, and helped pan-Asian insurer AIA Group to decide on a 20-year bullet structure to comply with Hong Kong’s forthcoming insurance capital rules.

In November 2020, HSBC led the Chinese sovereign to the euro currency market, followed by a covered bond from Singapore’s United Overseas Bank, with both trades printing at negative yields for the first time.

HSBC was at the forefront of the growing use of liability management, whether for high-grade state-owned issuers like Pertamina and PTTEP, Chinese high-yield property developers, or even the government of Mongolia.

In high-yield, HSBC led a flurry of Chinese property trades and featured on deals from less popular sectors, such as a US$450m Yankee for Australian mining services group Perenti Global.

HSBC ended the awards period with US$32.7bn from 255 deals in Asia ex-Japan, for a 7.6% market share.

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com