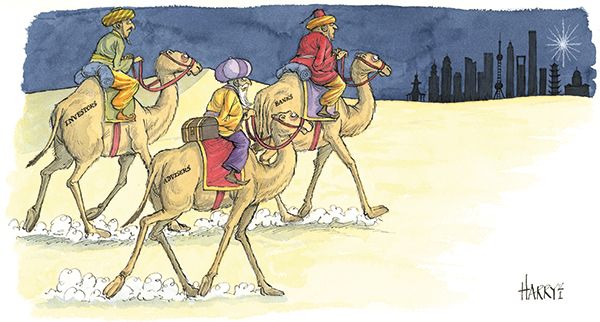

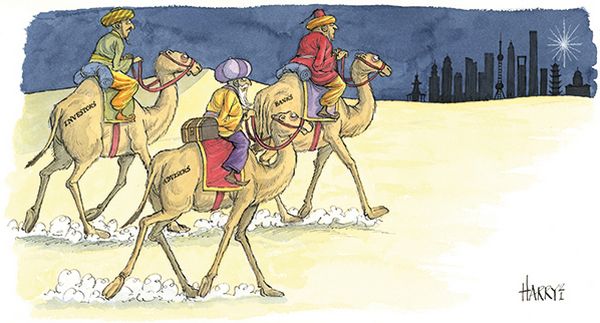

A Star is born

The Shanghai Star Market has been a shining success since its launch in 2019. Global investors and investment banks are paying close attention.

Shanghai’s Nasdaq-style board for new-economy listings beat all expectations in 2020, its first full year of operation, and is poised for further growth in 2021.

The Shanghai Stock Exchange Science and Technology Innovation Board, better known as the Shanghai Star board, finished 2020 with more than 200 listed companies commanding over Rmb3trn (US$463bn) in market capitalisation.

Expectations for the market were high, to be sure.

“The Star Market forms part of a broader strategy in the PRC to develop its equities market into one that is fitting for the second largest economy in the world,” said Terry Yang, a capital markets practice partner at international law firm Clifford Chance.

The reasons to celebrate its success are many. China’s main boards of Shanghai and Shenzhen have historically subjected companies to painfully slow regulatory approval processes, leaving hundreds of firms stuck in pre-listing limbo for years.

“The Star Market was launched to supplement the main boards,” said Gu Haibo, head of China equity capital markets at HSBC. “The average application review period for a Star board IPO is around seven months, which is slightly longer than in Hong Kong, but compared to the old days it is certainly an improvement. The whole process has been streamlined and expedited, which is good for issuers.”

In a big departure from stringent requirements around profitability, track record and ownership structures, the Star board introduced a more flexible, disclosure-based regime – far closer to international standards.

“Thanks to the adoption under the PRC New Securities Law of the registration-based IPO system first piloted on the Star Market, many market observers would consider this initiative a success,” said Clifford Chance’s Yang.

Among other innovations, the registration-based IPO system also removes the unwritten cap on valuations at 23 times historical earnings and allows pre-profit, red-chip and weighted voting rights companies to list in the A-share market for the first time.

The new rules have added real variety to the Chinese equity market, which has been traditionally dominated by old industries, often at least partially state-owned. The China Securities Regulatory Commission said in January 2019 it would favour listing applications from six industries, namely IT, high-end equipment, new materials, new energy, environmental protection and healthcare.

All six segments are now represented on the Star board, according to analysts at Credit Suisse. Among the stocks listed on the Star board as of end-November, IT companies took the largest share, accounting for 42% of the total number of companies, followed by healthcare with 22%.

“By their nature many new and innovative companies do not yet meet those [previously stringent] standards,” said HSBC’s Gu. “The companies that have listed include those that are not profitable yet, or those with weighted voting rights, for example. The diversity of these companies also achieves the purpose behind the Star board.”

The notable impact of the registration system has been on waiting periods. The first 197 IPOs on the Star board had an average waiting period of 228 days from application to listing, compared to the 382 days for the ChiNext board, 546 days for the SME board and 617 days for the main boards of SSE and SZSE, Credit Suisse noted.

The ChiNext timeframe has also shortened dramatically since it adopted a registration based-system in the second half of 2020. The average ChiNext IPO in the final quarter of 2020 was completed in just 110 days, down from 209 days in the previous six months and 322 days in 2019.

Global attention

The Star Market has inevitably caught the attention of global banks looking to expand their China business, which already accounts for three quarters of investment banking fees generated in the whole Asia Pacific region, according to Refinitiv data.

Foreign players have yet to make their mark. Of the first 200 listings on the Star board, just two saw the participation of international underwriters, acting through their Chinese securities joint ventures. The struggle on the ECM front is representative of the longer-term challenges for international banks doing business in China, whether or not they have an established onshore securities JV or are starting out from scratch.

“The JVs have some deals in the pipeline, so their market share should increase, but will likely remain relatively low,” forecasts HSBC’s Gu.

That being said, HSBC, with its HSBC Qianhai JV, the first foreign controlled securities JV in China, is hoping to start leaving its mark.

“We have around 80 people in China on the IB side,” said Gu. “We have been actively looking at opportunities in the domestic market, including on the Star board. We are optimistic we will have something this year.”

Tang Zhenyi, China CEO at Credit Suisse, sees a role for global banks in advising overseas listed firms on their homecoming IPOs. The popular debut from chipmaker Semiconductor Manufacturing International Corporation last July was the first Star listing from a Hong Kong-traded company. Carmaker Geely has also applied for a Star float.

“We expect to see more overseas listed China companies returning to both the Hong Kong market and the A-share market, especially the Star Market,” Tang said. “This will certainly present considerable opportunities for foreign investment banks.”

Credit Suisse gained majority control of its local securities joint venture, Credit Suisse Founder Securities, last June.

Skin in the game

One sticking point for foreign banks is the sponsor investment requirements. In an effort to discourage overly aggressive valuations, the regulators require sponsors to buy 2%–5% of each IPO they bring to market, up to a cap of Rmb1bn, and hold the shares for at least two years.

“On the Star board, they have required sponsors to put skin in the game,” said Gu. “The intention is good, to ensure even greater diligence and focus on issuers and deals. But it can create extra challenges for banks, since if they invest there are additional regulations to comply with. You also need to have additional capital, which JVs in particular have to consider, given they often have a smaller capital base versus local banks and brokers.”

Some foreign banks have taken a creative approach, such as using their offshore qualified foreign institutional investor (QFII) quotas to buy into those Star Market IPOs. However, banks going down that route would need to be aware of the extra hoops they will need to jump through when attempting to repatriate that money offshore. One banker noted that the QFII strategy is unlikely to become the norm, as regulators have already informally expressed their preference for banks to use their onshore capital base for Star Market transactions.

The bounty of listings in Shanghai has also widened opportunities for global investors. While until the end of 2020 only those with qualified foreign investor quotas could directly hold Star-listed stocks, the Hong Kong stock exchange has added index-eligible Star stocks to the Shanghai-Hong Kong Stock Connect trading link, a rule that took effect on February 1.

At the time of writing, at least one US ETF provider, Krane Funds Advisors, was awaiting approval to launch a New York-listed fund tracking the SSE Star 50 index.

Closer ties between onshore and offshore markets are helping domestic equities markets take the leap.

“There is an increasingly developed structured products market providing exposure to PRC equities, which has received explicit support from Fang Xinghai, the vice chairman of the China Securities Regulatory Commission,” said Yang. “These developments increasingly blur the lines between listing onshore and listing offshore from an investor access perspective.”

Regulatory risk

One sore point in the otherwise sparkling narrative of the Star Market’s success was the last-minute cancellation of the listing of Ant Group, the financial affiliate of internet giant Alibaba Group Holding, just days before the stock was due to begin trading. Market participants acknowledge that such events show that there are still limits to the registration-based IPO regime in China, where regulations can change quickly.

“PRC regulations are still developing rapidly and are increasingly incorporating and aligning themselves with the norms of international financial markets,” said Yang. “This means that additional work is involved in understanding the dynamic nature of the PRC regulations, but the rewards are participation in one of the largest and fastest growing markets in the world.”

With technology stocks globally pushing record valuations, the Star board looks sure to build on its success in the rest of 2021. China’s accommodative monetary policy and rapid recovery from the Covid-19 crisis have also boosted expectations of strong economic growth.

“The macro backdrop should remain fairly positive,” said HSBC’s Gu. “For the Star Market, there are around 250 companies in the pipeline under review right now. With an average listing period of seven to eight months, many of them will be listing this year. So we expect the market to remain very active.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF, please email gloria.balbastro@lseg.com