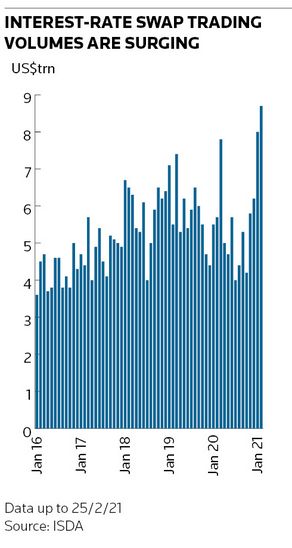

A wave of investors and companies hedging against rising interest rates is driving record trading volumes in derivatives markets, raising questions over whether this activity may also be fanning the flames of a sharp sell-off in government bonds.

Volumes in interest-rate swaps have reached US$8.8trn so far this month – already surpassing January’s monthly record of US$8trn, according to ISDA data up to February 25. That comes as a growing number of market participants position themselves for reflationary forces to build in the coming months as vaccinations programmes ramp up and Western governments look to ease pandemic-related lockdowns, while also increasing spending to revive their economies.

The 10-year Treasury yield has risen steeply by over half a percentage point to 1.48% this year to reflect this rosier outlook, pulling yields on developed government bonds to levels not seen in many cases since prior to the coronavirus pandemic.

Derivatives experts are divided over the extent to which companies that are particularly sensitive to interest-rate moves, such as US mortgage providers, are fuelling the bond sell-off through buying swaps to hedge their exposures. Either way, there are clear signs that investors are bracing themselves for a world of higher bond yields on the back of a brighter economic outlook and supportive central-bank policy.

“There are real concerns among clients about reflation,” said Jean-Francois Mastrangelo, global head of structuring at Societe Generale. “People are using derivatives to hedge and manage their duration. The prospect of more fiscal stimulus with the Democrats holding power in the US creates the conditions for inflation to come back."

"There’s less consensus in Europe, but governments have also increased spending plans over Covid and that’s encouraged some institutional investors to hedge,” he added.

Jabs and jobs

The reflation story traces its roots to last November, when Western vaccine developers first announced successful trial results, showing a potential route out of the pandemic. It was also around that time in the US that the Democrats won the presidency, held onto Congress and saw a path to wresting control of the Senate. That opened up the possibility of the newly-elected Biden administration passing another huge stimulus package – currently coming to US$1.9trn – to boost growth.

Ten-year Treasury yields have nearly doubled since then. Derivatives activity has also picked up sharply as more investors have shuffled their positions.

Interest-rate swap volumes in November and December topped US$12trn – more than double the amount traded in the same period a year earlier. US dollar swaps have taken up a larger than normal share of trading lately, representing 54% of all volumes in January compared with 45% in January 2020.

“When views around the macro environment change quickly, there’s a lot of trading. Some of it’s proactive hedging, some of it’s forced hedging and some of it’s speculative activity,” said Josh Younger, head of US derivatives strategy at JP Morgan.

“In this case there have been two big themes in US rates: one around the functioning of money markets; the other around the medium-term path of growth, inflation and monetary policy.”

Forced hedgers

Analysts are divided over how prominent a role this record derivatives activity is playing in driving bond yields higher. Back in previous bond sell-offs in 2003 and 2013, analysts believe activity from interest-rate sensitive market participants such as mortgage originators hedging their positions created a feedback loop that pushed bond yields up too.

Some are concerned a similar dynamic could be taking hold this time round. Rates strategists at Bank of America said in a note that recent drivers of the move in bond yields included “improving fundamentals” and “convexity hedging” (a reference to mortgage-related activity), highlighting a widening in the gap between bond yields and interest-rate swaps when rates jumped on February 16.

“Our mortgage team sees growing risks for hedging needs out of mortgage originators, which could exacerbate the rate rise,” they said.

Not everyone is convinced, though. JP Morgan’s Younger noted that Treasuries, not swaps, have been leading the way higher in rates, suggesting that these companies haven't played a prominent role in the bond yield rise.

“There’s very little evidence that forced mortgage hedgers are the primary driver of these moves,” he said.

Interest-rate sensitive entities such as the US government-sponsored enterprises (Fannie Mae, Freddie Mac, etc) and real estate investment trusts that have in the past engaged in this kind of hedging are much smaller than they once were, Younger said. Moreover, there are lots of reasons to believe that REITs along with banks – which can also drive this activity – were net short duration going into this move, he added, meaning they will need to rebalance less as rates rise.

“The question is do we reach a point where everybody has to rebalance? Perhaps it goes without saying, but if rates happen to rise another 100bp, then it’s a different story," Younger said.