Europe’s largest investment banks are losing ground in derivatives trading to US and UK banks this year in a surprise Brexit twist resulting from a financial regulatory standoff between Brussels and London.

BNP Paribas, Deutsche Bank and Societe Generale are among the banks to register notable market share declines in trading of interest-rate swaps and credit-default swap indices this quarter, according to sources familiar with the matter, as a result of no longer having access to UK-based derivatives trading venues from the start of 2021. That has cut them off from a large chunk of UK institutional investors – as well as other banks – that still trade billions of dollars worth of derivatives on these platforms every day.

The struggles for European Union banks – which the European Commission appeared to acknowledge tacitly in a previously unreported January letter to these firms – are the latest sign of how Brexit is shaking up financial markets following an exodus of derivatives trading activity from London this year.

It also lays bare how the current standoff is inflicting damage on both sides of the negotiations, mainly to the benefit of large US investment banks and their home market.

“This is putting European banks in particular at a competitive disadvantage as they can’t trade with UK clients unless they move to a swap execution facility or have a UK subsidiary,” said Michael Turner, head of competitor analytics at Coalition Greenwich.

“It’s early days and they’re clearly hoping it will get sorted out, but right now it doesn’t look great and it will impact first-quarter trading results.”

London was, until recently at least, the main global hub for derivatives trading. But the failure of the UK and the EU to reach an agreement over so-called mutual equivalence for financial regulation – despite their rules being virtually identical – has convulsed the market.

EU-based firms haven’t been able to transact on UK derivatives trading venues since January 1, and vice versa. Instead, EU and UK-based firms can only trade on local venues or in countries with which equivalence agreements have been struck, such as the US.

Trillions of dollars worth of derivatives trading has consequently left the City of London for US swap execution facilities this year, while a smaller portion has moved to the EU. But the standoff has also hurt some of the EU’s national champions through preventing these banks from taking a share of the significant amount of activity that remains in the UK.

There is no public data on precisely how much derivatives activity lies out of reach of EU banks on UK venues at present, but cross-referencing figures from post-trade firm MarkitSERV and the Bank for International Settlements produces a crude estimate of around US$220bn of daily trading volumes in interest-rate derivatives. A significant portion of the multi-trillion dollar CDS index market still resides in London too, traders say. All of that is now off-limits to the likes of BNPP, Deutsche and SG.

Cut off

Regulators on both sides of the English Channel require foreign banks to establish fully capitalised subsidiaries in their jurisdictions if they want to connect to local trading venues. Those – like BNPP, Deutsche and SG – that operate branches, not subsidiaries, in the UK are now cut off from UK derivatives venues.

“If you’re operating a cross-border branch structure you used to have access to the whole market. Now, EU banks with London branches (and UK banks with EU branches) have a problem: they’ve lost access to part of the market,” said Kirston Winters, managing director at MarkitSERV.

By contrast, most major UK banks have established EU subsidiaries. That means Barclays, for instance, can plug into EU trading venues. US banks like Goldman Sachs and JP Morgan, meanwhile, can trade in both jurisdictions and are picking up market share in derivatives trading as a result, sources say.

“We have half a hand tied behind our backs vis-a-vis some of the US banks when trading with some” UK clients, said a senior trader at an EU bank. “We’re lobbying the relevant authorities, but at the moment that is our disadvantage – and also for clients.”

All highly standardised swaps that banks and institutional investors are required to transact on regulated trading platforms – that is, all activity falling under the so-called "derivatives trading obligation" – has been affected. That accounted for roughly 50%–60% of all interest-rate swap trading volumes for euros, US dollars and sterling in January, according to MarkitSERV. The DTO also covers the vast majority of the CDS index market.

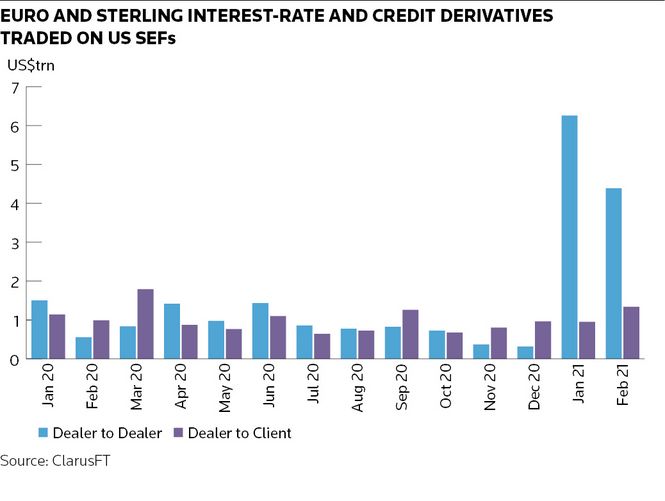

The post-Brexit deadlock has shifted much activity to the US, where both US and EU banks can compete. Nearly US$13trn in euro and sterling-denominated interest-rate swaps and CDS traded on US swap execution facilities in the first two months of the year, according to research and analytics firm ClarusFT, up from US$4.2trn over the same period the previous year.

“Brexit has shown that people are not scared to trade on SEFs,” said Chris Barnes, a consultant at ClarusFT. “SEFs have benefited as a result of Brexit.”

But interbank activity has driven the majority of that movement, ClarusFT data show. Meanwhile, euro and sterling interest-rate swap client volumes are up 18% in the first two months of the year on SEFs at US$1.9trn following a sharp uptick in February, while equivalent CDS volumes are down 22% at US$407m.

Traders say some global asset managers have moved activity to the US, but note there are still a number of UK-based hedge funds and institutional investors – including pension funds and insurance companies – that have been reluctant to shift, leaving them out of reach of EU banks.

UK venues still accounted for 11% of euro interest-rate swap volumes in January, according to MarkitSERV, 21% of sterling swaps and 6% of dollar swaps.

“Given the choice, UK clients might not want to submit themselves to the jurisdiction of US regulators by trading on SEF if they don’t have to,” said Winters.

Level playing field

Tilman Lueder, head of the securities markets unit at the European Commission, sent a letter to EU banks dated January 20 asking about derivatives trading activity including market shares in various instruments, a breakdown of counterparties by region and concerns that banks had. In one section, the letter asked why EU banks hadn’t used their position of influence in euro CDS markets to encourage other dealers to trade these instruments on EU venues.

EC sources acknowledged there have been significant shifts of business since January 1, with possible impacts for various market players. The Commission is monitoring derivatives markets closely and will assess whether anything needs to be done based on factual evidence, the sources said.

“There’s a good understanding that the current situation isn’t great for EU banks [given the lack of a] level playing field,” said one senior banker, adding that the “US has definitely gained in this situation.”

Few are expecting an imminent agreement on equivalence, not least because of concerns that any swaps activity the EU has gained this year would quickly revert to London. Nor do EU banks appear to be in any rush to establish fully capitalised UK subsidiaries that would allow them to connect to UK venues.

“The balance here is to find a solution that allows [EU] banks in their current legal entity structure to be relevant internationally or outside of the [EU] without necessarily asking all of their clients to move over to the US, whilst making sure that there is a decent amount of volumes and activity on the EU market infrastructure," the senior banker said.